股票研报 | 昇松集团(Sheng Siong):新门店将支持增长

投资概要

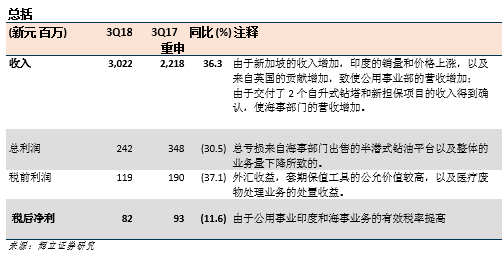

2018年四季度的收入和盈利符合我们的预期。2018年四季度,由于政府拨款减少230万新元,使税后净利的整体表现受损。

毛利润很可观,但同店销售的萎缩,拖累了部分营收。

预计2018财年,随着零售空间增长23%之后,公司将迎来强劲的收入增长势头。

我们的预测维持不变。当我们将目标价滚存到2019财年末的估值时,我们将上调目标价至新元1.30 (先前目标价为新元1.13) 或者25倍市盈率。维持增持评级。

积极方面

毛利率仍保持健康。2018年四季度的毛利率为27.1%。这低于2017年四季度27.5%的高点。利润率得益于更高的新鲜产品组合。

录得门店开张。2018年,SSG 新增10 家门店。这是有史以来的最高水平。由于当局减少了门店的发布,2019年新增门店的情况不太明朗。

消极方面

同店销售令人担忧。2018年四季度,SSG 同店销售额下降2.7%。这是两年多以来最大的收缩。

还需要更长时间才能实现收支平衡。新门店要实现盈亏平衡还将需要更长的时间。来自周边超市的竞争正在加剧。

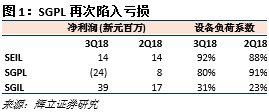

海事部门继续拖累集团的业绩:胜科海事 (SMM) 报告净亏损为2980万新元。净订单量继续下降 (2018三季度为64亿新元,对比2017财年(重申)为84亿新元)。工作量将保持在低水平,而利润率将被压缩。运营亏损预计还将持续几个季度。

前景

我们预计明年的收入增长将有三大驱动因素:

1) 2018年新增10 家门店开业 (店铺面积增加23%至496,200 平方英尺);

2) 减少了受2017年关闭两家大型门店的基础效应及拖累的影响 (即Verge 和Woodlands);

3) 门店每英尺的收入增加 (2018年每平方英尺增加3.4%,至1,971新元)。

我们预测,下行风险将是受同店销售的拖累,这将取决于经济景况和竞争状况。

投资行动

维持增持评级,目标价为新元1.30 (先前目标价为新元1.13)。我们的目标价是基于25倍市盈率的预测。该公司正扩展门店,增加市场份额,提高利润率,并享有25%净资产收益率的业务,净现金平衡表为8700万新元。

关键字:新加坡股票研报,新加坡股,新加坡研报,新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合