新加坡股票研报 | 新加坡证券交易所(SGX)- 谢谢你的波动

投资概要

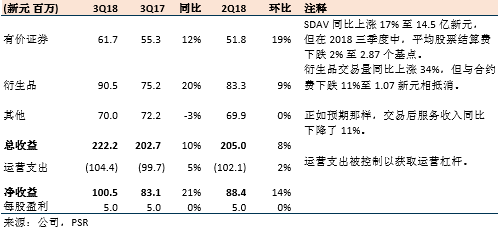

2018年三季度的税后净利比我们的预测超出11%。2.22亿新元的收入是上市 以来的最高收益。证券方面的收益超出我们的预期。

衍生品业务推动了收入增长,销量同比增长了34%。外汇衍生品的交易量飙升了89%。

新交所将于2018年6月推出新的印度股票衍生品,与所谓的“公开参考价格”挂钩。

维持买入评级。我们上调目标价至新元9.20 (先前为新元8.89),与我们2018财年末的盈利增长4%相符。

积极方面

衍生品的增长动力。衍生品收益同比增长20%,这是由于交易量飙升了34%所致。然而,由于产品组合的变化,每份合约的平均费用同比下降11%至1.07新元。交易量的增加主要是来自于中国A50,日经225 和外汇期货产品。

运营杠杆保持不变。营收环比增长接近1700万新元,并且差不多70%(或是1200万新元) 流入净利润。尽管收入有所增加,但新交所设法使运营费用保持相对稳定。

预期的上市数量会增加。新交所提到2018财年的股票上市可能会超过2017财年。这意味着到2018财年四季度,至少还有5宗IPO。年初至今,筹集的资金增加了6倍。

消极方面

没有与印度交易所达成决议。回想在2018年2月,印度交易所宣布他们将停止对其指数授权或者向外汇交易提供数据。这将影响新交所漂亮50产品的连续性。新交所近期表示,将于2018年6月推出新的印度股票衍生品。我们不清楚这些新产品将如何“无缝交易”并被市场参与者所接受。此外,如果这类产品能引起印度交易所的反应,也会引起人们的担忧。src=”/wp-content/uploads/gmd-mig/2018/04/121212.jpg” alt=”121212″ width=”471″ height=”181″ />

投资活动

我们维持买入评级建议。波动性的回归,新产品的不断涌现和运营杠杆将对盈利增长起到支撑作用。鉴于35%的净资产收益率,4%的股票派息率以及盈利的增长势头,估值是非常有吸引力的。

关键字:新加坡股票研报,新加坡股,新加坡研报,吉宝数据中心(Keppel DC REIT),新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合,新加坡证券交易所(SGX)