研报 | 辉立新加坡策略:为经济复苏继续投资

2019年4月9日

STI 在2019年一季度上涨4.7%。它所有的收益都在1月份刷新纪录。在接下来的两个月里,表现平平。REITs (图1) 和周期股 (图2) 领涨,而银行股则受阻 (图3)。2019年将以两个政策风险拉开帷幕;美联储的立场强硬,中美贸易紧张局势不断升级。 当这两种风险开始消退时,STI 出现反弹。当美联储强调需要对货币政策有耐心时,加息的风险降低了。特朗普总统发表令人鼓舞的言论称,贸易谈判进展顺利,为反弹增添了动力。拖累股市的是全球经济增长放缓。全球采购经理人指数接近3年的低点,而固定收益市场通过收益率曲线反转反映出衰退状况。

前景 :我们仍然看好股市。我们的前提是全球经济增长再次出现好转。首先,金融状况有所缓解。在美联储释放出鸽派立场的信号后,全球利率已暴跌至两年低点 (图8)。其次,中国政府显然在提供财政支持。它出台了减税,放宽了金融环境,以及加速投资等政策。我们认为这些政策利好方面存在着滞后性。第三,出现了一些经济活动复苏的早期迹象。全球采购经理人指数已开始企稳 (图4)。我们认为,股市反弹的下一个推动力将是某些形式的中美贸易协定,预计将于5月初达成。没有人预计这种修昔底德陷阱能在短期内避免,但一项贸易决议应能消除关税进一步升级的风险。

STI 目标:我们将STI 目标从3400提高到3600。这使市场估值固定在14倍,接近其10年来的平均估值。政府政策已转向更加支持股市。利率已放缓,我们预计经济增长将会带来积极的惊喜。

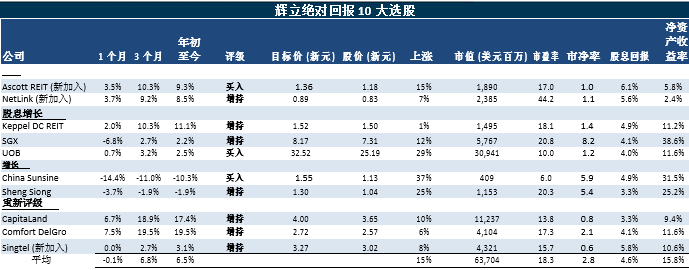

建议:辉立绝对回报10大选股投资组合在2019年一季度上涨了7.1%。我们的收益率和重新评级建议表现良好。成长股和金融股的表现令人失望。然而,我们的投资组合中仍持有大华银行和新交所。这两只股票都应受益于经济状况和资本市场的复苏。腾飞房产信托和凯德商务产业信托已达到我们的目标价位,因此我们将出售他们,并购入:(i) NetLink Trust, 将从130万经常性客户中获得稳定的收益,以此作为投资组合的基础;(ii) Ascott REIT(雅诗阁房产投资信托),鉴于其诱人的股息以及可用于收购的8.8亿新元的债务空间。在持续的生产和成本令人失望的情况下,我们剔除了Geo Energy,并以Singtel 取代它进入投资组合。我们认为,第四大移动运营商TPG全面推出的延迟,将影响Singtel在新加坡获得吸引力的能力。运营商们正在建立利润池和规模。他们是包括Singtel在内的现有运营商的批发客户。此外,我们预计,随着手机价格已开始再次攀升,Singtel 在印尼的最大合伙人的利润将出现回升。

2019 年业绩回顾 – 辉立绝对回报10大选股

辉立绝对回报10大选股投资组合在2019年一季度增长了7.1%。我们的表现比STI 高出2.4% (图11)。我们的收益率和重新评级建议表现良好。随着利率预期急剧暴跌 (图9),在投资者寻求收益中,REITs 出现反弹。一些高于市场估值的交易也提振了人们对商业地产的信心。以110亿新元收购了星桥腾飞资产组合后,凯德置地的股价上涨。

然而,我们投资组合中的成长股和金融股的表现令人失望。尽管如此,我们的投资组合仍然持有着大华银行和新交所。这两家公司都将受益于经济状况和资本市场的复苏。腾飞房产投资信托和凯德商务产业信托已达到我们的目标价位。我们将购入以下产品替代它们:

(i) NetLink Trust,将从130万经常客户中获得稳定收益,作为其投资组合基础;

(ii) Ascott REIT,诱人的股息以及用于收购的8.8亿新元的债务空间。

我们打算出售Geo Energy。其生产和成本持续令人失望。将购入以下产品作为替代:

(iii) Singtel. 我们认为,第四大移动运营商TPG全面推出的延迟,将影响其在新加坡获得吸引力的能力。运营商们正在建立利润池和规模。他们是包括Singtel在内的现有运营商的批发客户。此外,我们预计,Singtel 在印尼最大合伙人的利润将出现回升,因为手机价格已开始再次攀升。

尽管中国尚舜的业绩令人失望,但我们将继续保留该公司在我们的投资组合中。估值较低,市盈率为5倍,我们预计产量增长和稳定的利润率将支撑该公司的盈利。同时,升菘集团将通过其创纪录的门店扩张,为投资组合提供收益增长。鉴于新加坡的工资上涨和总就业的复苏,消费者支出也应有所改善。

本文为英文翻译版本,仅供参考,一切请以英文版本为准。如果有想了解更多全球股市资讯,请关注微信公众共 “辉立资本新加坡” (SGPSPL)。同时提供在线免费开设股票账户,一个账户轻松交易美股,港股,新加坡股

关键字:新加坡股票研报,新加坡股,新加坡研报,新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合