新加坡研报 | 泰国酿酒

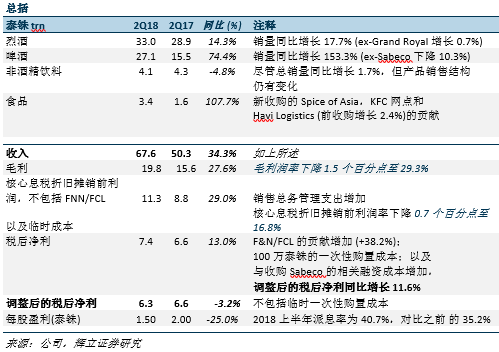

2018上半年的收入/核心息税折旧摊销前利润达到我们全年预期的55%/50% ;财务成本和有效税率高于预期,导致盈利错失。

近期收购带来的强劲业绩,无法抵消泰国啤酒市场持续疲软的影响。

自2018年1月26日起,为老年基金开征2%的新消费税。

拟下调中期派息每股为0.15泰铢 (2017上半年:0.20 泰铢)

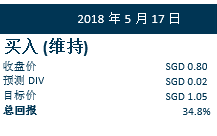

维持买入评级,目标价不变,分类加总估值法-衍生目标价为新元1.05

积极方面

(b) 啤酒:Sabeco 的盈利厚增。它为集团2018上半年的净利贡献了16.1亿泰铢或者增长13.7% 。

(c) 食品:SOA, QSA 和Havi Logistics 为集团2018上半年净利润贡献了1.113亿泰铢或者增长34.1% 。

流动性改善,流动比率环比从0.88倍上升至1.82倍。从为收购提供资金的过桥贷款中获得的500亿泰铢,在2018年3月转换为长期债务。管理层打算进一步将其短期债务再融资至长期债务。

消极方面

现有的酒精饮料部门因受到长期需求疲软和开征新消费税的双重打击,而感到失望。从2018年1月26日开始生效,所有的酒精饮料被依法额外征收2%的消费税,用以资助老年基金。

(a) 烈酒:2018上半年的销量同比下滑了5.1% ,再加上投入成本和销售总务管理支出的增加,致使2018上半年的净利润率同比下降2.7个百分点至16.6%。

(b) 啤酒:国内啤酒需求的持续疲软,销售总务管理支出增加以及新消费税的开征,拖累了盈利。6个百分点被削除2018上半年的净利后,增长仅为1.1%。

2018上半年,现有啤酒业务的销量同比下降8.3%,同时,行业成交量也下降了6.7%。然而,我们对其在泰国啤酒市场占据38%的稳定市场份额,感到满意。

前景

短期会有压力,但受益于2018 FIFA 世界杯的提振。

尽管从一个低基点起步,酒精饮料的贸易消费量仍未扭转。尽管泰国经济走强还不够广泛,但高昂的家庭债务已侵蚀了消费者的购买力。泰国对酒精饮料的需求疲软可能会持续较长一段时期。尽管如此,我们认为FIFA 世界杯很可能将促进啤酒的销量,不仅在泰国,在越南也是如此。

另一方面,与2018年二季度相比,我们预计毛利率将不会进一步恶化。集团已于2018年4月底就征收额外消费税,调整了烈酒价格,鉴于激烈的竞争,近期内可能会避免提高啤酒的价格。管理层还指出,在过去12个月来自糖浆价格的压力应该会在2018下半年有所缓解。

然而,因为广告和促销活动恢复至哀悼期之前的水平(2016年10月前),销售总务管理支出应会保持在较高水平。

维持买入评级,分类加总估值法-衍生目标价为新元1.05

随着2018年二季度的短期贷款向长期贷款的转换更加清晰,我们调整了更高的财务费用,因此,2018财年末调整后的税后净利,与之前的预测相比,现修正为-3.9%。

潜在重新评级的催化剂:

Sabeco 获得更高的经济利益。

利润的扩张与消费税同步上升。

非酒精饮料的快速复苏 (集团的目标是到2020年实现盈亏平衡)。

通过与Yum Thailand, Grand Royal Group, Sabeco, 和Havi Logistics 的合作,释放潜在协同效应的价值。

其他更新

收购Havi Logistics 75%的股份,以加强集团在泰国的分销业务。

Havi Logistics (泰国) 公司在泰国经营食品服务物流业务,并拥有冷链物流和多温度食品分销技术方面的专业知识。

这将扩大集团的物流业务组合,通过与ThaiBev物流的协同作用提高运营效率,并在未来增强其食品业务扩张的平台。

此次收购于2018年2月28日完成。此后,Havi Logistics 分别为集团的收入和净利润贡献了1610万泰铢和80万泰铢。

2.4亿泰铢的现金代价意味着收购市盈率为11.1倍。

关键字:新加坡股票研报,新加坡股,新加坡研报,新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合,新加坡证券交易所(SGX),泰国酿酒