那些你不可不知的社交媒体巨头交易所交易基金(ETFs)

摘要

- 万维网 (WWW) 向 Web 2.0 的过渡,使内容创建普及化,导致了社交媒体的兴起。

- 社交媒体行业的竞争优势使其成为对各种规模的企业均具有吸引力的广告渠道。

- 随着用户增长放缓,以及并购增加,社交媒体行业正显示出步入成熟期的迹象。

- 为了应对用户增长放缓的影响,社交媒体公司必须想出不同的货币化策略,以补充其核心广告收入。

- 货币化策略可能会颠覆传统行业,并为投资者提供增长的机会。

- 投资者可通过股票代码 SOCL, 3072.HK, PNQI, FDN 和 2812.HK,获得社交媒体和互联网行业的敞口。

社交媒体商业模式的竞争优势

- 网络效应和潮流效应

- 个性化网络

- 专业和细分化

- 数据收集

- 动态定价

主要收入来源

- 广告收入仍然是社交媒体公司的主要收入来源

- 社交媒体行业的竞争优势为广告商创造了一个理想的环境,通过利用各种在线平台,可以实时向目标受众传播定制化的信息。

- 通过向各种规模的企业提供超针对性的广告算法以及其预算灵活性,社交媒体公司已从传统广告渠道手中掠夺了市场份额。

步入成熟后的持续增长

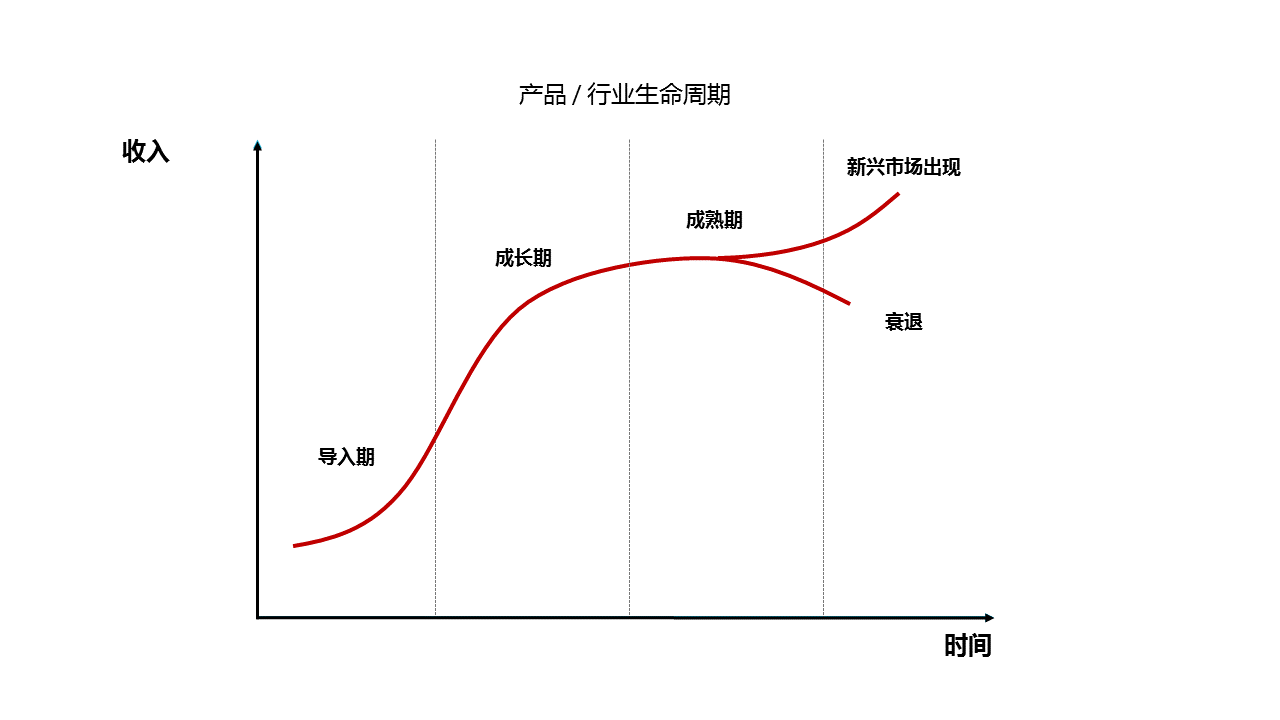

为了避免收入增长因社交媒体的广告支出增长下滑而下降,社交媒体公司必须不断创新,以改进其现有产品,并创造出新产品。这样可使公司进入行业生命周期的更新阶段,以重振其收入增长。

图6:产品 / 行业生命周期

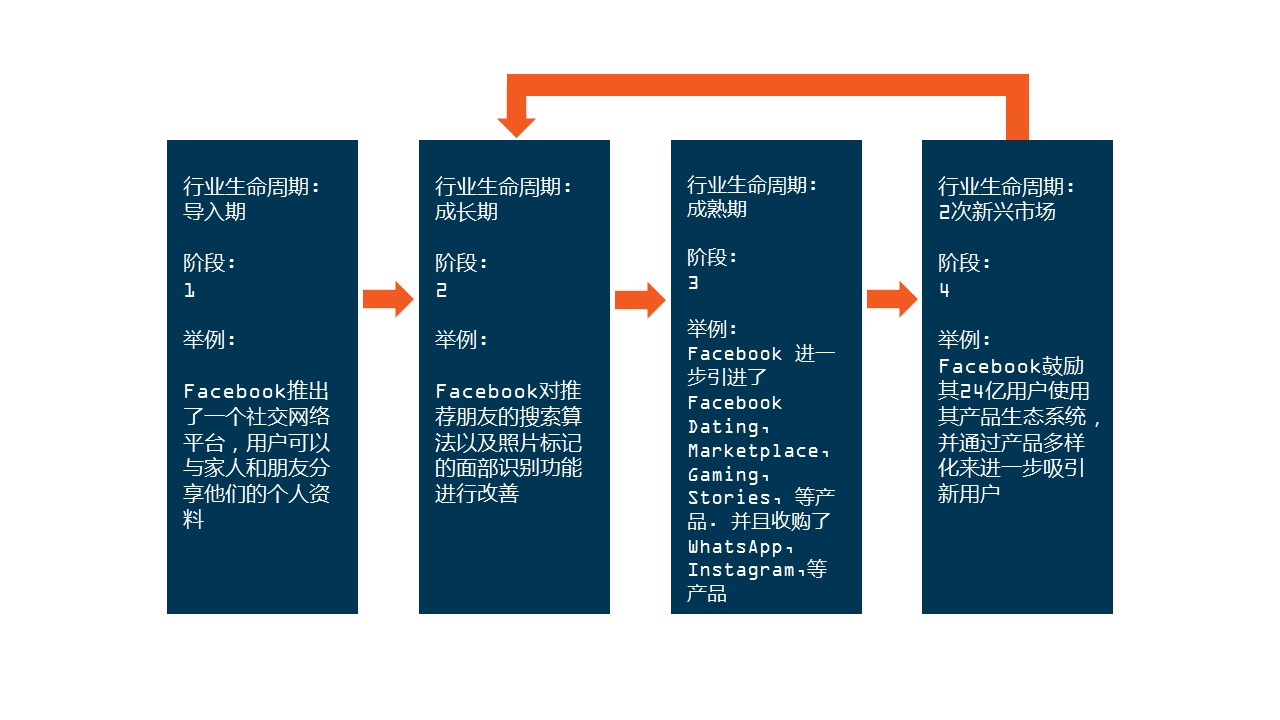

社交媒体公司有一个系统的蓝图来维持其可扩展的收入增长。增长公式如下:

- 创建一个能够吸引大量用户的核心产品

- 持续改进和优化核心产品,以提高用户增长率,使用率和留存率。

- 根据用户体验和使用数据来创建新产品,以增强和补充现有核心产品以及/或者通过收购其他公司以实现新业务的多元化。

- 鼓励现有用户体验公司产品和服务的生态系统,并通过产品多样化来吸引新用户。

图7展示了整个正向反馈循环的流程

图7:脸书生命周期的正向反馈循环

通过鼓励增加对公司不同产品和服务的使用,社交媒体公司能够使其收入流多样化,并提高每用户平均收入 (ARPU) ,以抵消用户增长放缓的影响。新产品和新服务的加入也为广告商提供了新的广告渠道,让他们能够碰触到目标受众,并以不同的形式来展示其内容。

事实证明,通过微故事形式提供视频片段和照片幻灯片,在社交媒体用户中相当受欢迎。这个理念起源于 2013 年的 Snapchat (NYSE: SNAP) ,以迎合向互动或视觉内容的转变。Facebook 设法将同样的概念融入到其产品套件中,以缓解年轻用户向竞争对手平台的流失。

今天,故事广告形式对 Facebook 来说是一个具有吸引力的增长机会 – 每天有超过 5 亿的活跃用户在Facebook 故事系列上发布内容,300 万广告商通过 Instagram, Facebook 和 Messenger 使用故事广告接触其客户。

交易所交易基金 (ETFs)

各式各样的主题交易所交易基金 (ETFs) ,允许投资者获得社交媒体和互联网行业的敞口。投资者可以采取前瞻性的投资方式,利用不同的社交媒体必须提供的货币化策略的增长机会。以下是一些提供社交媒体和互联网敞口的ETFs 例子。

| 交易所交易基金(ETF) | Global X Social Media ETF | Nikko AM Global Internet ETF | Invesco NASDAQ Internet ETF | First Trust Dow Jones Internet ETF | Samsung CSI China Dragon Internet ETF |

|---|---|---|---|---|---|

| 代码 | SOCL | 3072 | PNQI | FDN | 2812 |

| 交易所 | 纳斯达克(NASDAQ) | 香港交易所(HKEx) | 纳斯达克(NASDAQ) | 纽约证券交易所(NYSE Arca) | 香港交易所(HKEx) |

| 资产管理规模(AUM) | USD 134.91 million | USD 22.27 million | USD 552.90 million | USD 8.11 billion | HKD 147.31 million |

| 净费用比率 | 0.65% | 0.88% | 0.62% | 0.52% | 1.80% |

| 持股数 | 42 | 31 | 82 | 42 | 30 |

| 前三大控股 | –腾讯控股有限公司(HKEx:0700) –Facebook Inc (NASDAQ:FB) – Naver Corp(KRX:035420) |

–阿里巴巴集团控股有限公司(NYSE:BABA) –腾讯控股有限公司(HKEx:0700) – Alphabet Inc Class A (NASDAQ:GOOGL) |

– Netflix Inc(NASDAQ:NFLX) – Alphabet Inc Class C(NASDAQ:GOOG) – Facebook Inc(NASDAQ:FB) |

–亚马逊公司(纳斯达克:AMZN) – Facebook Inc(NASDAQ:FB) –思科系统(NASDAQ:CSCO) |

– 腾讯控股有限公司(HKEx:0700) – 阿里巴巴集团控股有限公司(NYSE:BABA) – 美团点评 (HKEx:3690) |

本文为英文翻译版本,仅供参考,一切请以英文版本为准。如果有想了解更多全球股市资讯,请关注微信公众共 “辉立资本新加坡” (SGPSPL)。同时提供在线免费开设股票账户,一个账户轻松交易美股,港股,新加坡股,中国A股,越南股票,韩国股票,德国股票,马来西亚股票,泰国股票,印尼股票,菲律宾股票,日本股票,澳大利亚股票,台湾股票,加拿大股票,英国股票,法国股票,荷兰股票,葡萄牙股票,比利时股票,土耳其股票