美国大选:对行业的影响 – 能源

简介

能源行业是由石油和天然气勘探(上游),运输和储存(中游)以及产品精炼(下游)等公司组成。大多数油气公司都是综合性的,涉及整个价值链。该行业还包括热能煤和铀,而其所占的比重不到1%。

基本面

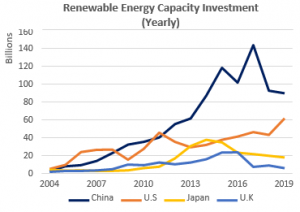

美元下跌对该行业普遍有利。然而,自2004年起,向清洁能源的长期转变一直在进行着。我们相信这趋势将一直延续下去。自2004年以来,美国的可再生能源产能投资一直以18.5%的复合年均增长率在增长。这是全球第二大增长,仅次于中国(见图1)。尽管在特朗普任期内,放松了对能源行业的监管,但可再生能源产能的投资每两年仍以15.6%的复合年均增长率在增长。这意味着,这一转变的势头是势不可挡的。

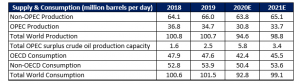

2020年末,对石油产能削减6.1%或可缓解供应过剩的局面,但可能不足以抵消因新冠肺炎导致的需求更大幅度的8.5%的降幅。因此,我们认为供应过剩的情况将会持续下去。根据EIA预测,截至2021年底,全球石油需求仍将比新冠疫情前的水平下降2.4%左右。同样,截至2021年(见图3),过剩产能可能仍比新冠前的水平高出36%。如果这种情况成为现实,那供过于求将延续至2021年以后,从而抑制油价。

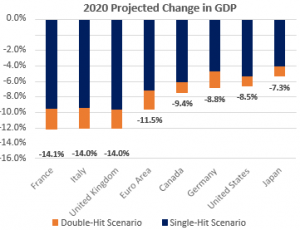

任何病毒的死灰复燃都可能引发新一轮的部分地区封锁,并延长旅游限制。疫情的第二波将毁坏经济复苏,并导致美国2020年末的GDP下降8.5%,而目前的降幅为7.3% (见图2)。这使能源行业的持续复苏更是充满悬念。

美国大选 – 政策概述

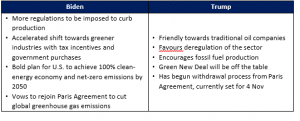

拜登和特朗普在环境政策和气候变化的问题上持相反的立场。

图5:预期两位总统候选人对该行业产生的潜在变化

Source: PSR

行业前景

特朗普连任可能对能源行业有利。在他当前的任期内,原油的月度开采、采石和产量在2019年底增幅接近45%,创下历史新高(见图4)。这在一定程度上,归疚于气候和环境政策的积极倒退。

如拜登胜出后,他很可能会恢复被特朗普取消的环境政策。恢复到特朗普出任总统之前的产能水平,将意味着从当前水平下降12.8%。由于价格在近期受到抑制,产量的进一步下降将对能源行业产生负面影响。

相反,拜登可能会加快对美国可再生能源产能的投资,寻求缩小与中国的差距,自2012年以来,中国在可再生能源产能投资方面一直超越了美国(见图1)。仅在四年内投资达到2万亿美元,就意味着比目前的投资水平增长了8.2%。我们也可预期,将有更多的企业采用清洁能源,因为这与政府的政策保持一致。

估值 / 相对强势:

截至2020年三季度末,能源板块的市盈率为0.99倍,低于其五年历史平均市盈率1.81倍的水平。短期来看,该板块继续落后于整体市场。在标准普尔500的能源股中,仅有8%处于其50日移动均线之上交易。这与在标准普尔500中占比77.9%,在50日移动均线上交易的股票相比,就显得相形见绌了。

建议:

如果拜登当选,我们看好其2万亿美元的气候计划中的清洁能源领域。我们相信,无论谁当选总统,向清洁能源的长期转变都将继续下去,只不过,如拜登当选将大大加快这一进程。如特朗普获胜,将有利于该板块的发展,而当前的估值似乎颇具吸引力。然而,基于长期的供应过剩,及病毒卷土重来的风险,我们对该行业仍保持谨慎的态度。

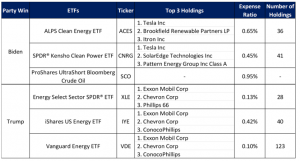

图6:投资者可能会关注的行业ETFs

Source: Morningstar, POEMS ETF Screener

图1:自2004年起,向清洁能源的转变一直在进行中。如拜登当选,可能会刺激对可再能源产能的进一步投资,从而有机会拉近美国与中国间的差距。

Source: BloombergNEF, PSR

图2:如病毒卷土重来或出现第二波疫情,可能会进一步损害经济复苏,并抑制全球石油需求。

Source: OECD Economic Outlook

图3:全球消费复苏和原油供应过剩可能会延续至2021年后。

Source: U.S. Energy Information Administration

图4:特朗普执政期间,月度工业生产(采矿,采石和原油生产) 增长接近45%。如拜登获胜,产量可能将下降12.8%,回到特朗普执政前的水平。

在其股票分拆后,Apple现在看起来更便宜和更实惠了,每股价格在100美元左右。 然而,历史不断重演,Apple在拆分后,其股价走低。其股价从9月2日的137.98美元的高点一路跌至103.1美元。此后,该股设法收复部分失地,并反弹至115美元左右。这使其成为9月的亚军。

Apple本应在9月份发布年度产品 – 新一代iPhone。9月中,该公司发布了新款的 Apple Watch 和iPad,并附带一些新功能和服务[7]。然而,由于芯片出货延迟,其新款iPhone已推迟到今年10月发布。

Source: Board of Governors of the Federal Reserve System (US), PSR

如果有想了解更多全球股市资讯,请关注微信公众号 “辉立资本新加坡” (SGPSPL)。同时提供在线免费开设股票账户,一个账户轻松交易全球股票和ETF

美股,港股,新加坡股,中国A股,越南股票,韩国股票,德国股票,马来西亚股票,泰国股票,印尼股票,菲律宾股票,日本股票,澳大利亚股票,台湾股票,加拿大股票,英国股票,法国股票,荷兰股票,葡萄牙股票,比利时股票,土耳其股票

如果本文是英文翻译版本,一切请以英文为准