研报 | 2019美国银行业展望:市场过于悲观

投资概要

我们对美国银行业提出增持的建议。估值处于25年来的低点。

近期收益率曲线趋平可能已经触底,并且不会预示着明年出现经济衰退。

融资成本的步伐将加快,但会被更快的贷款重新定价和充足的银行资金供应所抵消。

资产质量保持良好,受小企业商业和工业 (C&I) 贷款推动了贷款增长。

美国2019年银行业展望

收益率曲线的翻转是一个很好的预兆….. 10-2 年期美国国债收益率差 (2s10s) 目前处于自2007年6月以来的最低水平。收益率曲线翻转不会导致衰退,但它一直是经济衰退的一个不可思议的先行指标。在二战后的最后9 次衰退中,收益率反转已预测了7次。从历史上看,收益率曲线反转与经济衰退之间的时滞差异是很大的。1990年美国经济衰退为期13个月,2000年的互联网泡沫破灭为期8个月,以及全球金融危机(GFC) 为期16个月。平均而言,衰退是在收益率曲线反转15个月以后开始的。鉴于收益率曲线尚未反转,明年出现衰退的可能性不大。

…..但明年不太可能。短期利率主要受联邦政策利率的影响,而长期利率则是美国国债市场供求的一个因素。我们认为,当前收益率曲线趋平已经见顶。美联储正在从资产负债表上削减5000亿美元。这将为美债消除较多的垄断买家。在供应方面,由于税收改革带来较大的财政赤字,将导致美债的发行量增加。此外,多年来,美债与其他主要储备货币 (德国,日本和瑞士) 之间的收益率差在扩大,达到18年来的最高水平。这种央行的干预一直是海外国家对美债需求的一个主要驱动因素。

值得注意的是,没有确凿的数据表明,收益率曲线的反转将导致银行业绩的螺旋式下滑。大型银行的收益差与其业绩之间的相关性很低。银行业的股价在收益差不断缩小的时期继续飙升。

存款成本将以较快的速度增长,但将被更快的贷款重新定价和较低的存款需求所抵消。早在2016年初,储户的存款利率为零,而他们几乎不会转换银行。然而,储户在消化连续9次加息后,他们对利率变得愈发敏感。他们更有可能将存款转换成收益率更高的产品。30天商业票据 (30DCP) 利率的增幅是上一次加息的两倍。自2017年一季度以来,大型银行的平均存款成本上升了9个百分点。根据标准普尔发布的2018年美国银行市场报告显示,银行将联邦基金利率上调的25%转嫁给了储户,而2016年初这一比例还不到5%。然而,在2008年全球金融危机后,银行积累了大量的存款。大型银行的贷存比率仍维持在63%的低水平,而银行贷存比率的行业标准则约为80-90%。加上最近的税制改革,对存款的需求减少了,因为银行有多余的资本来发放新的贷款。因此,虽然存款利率按计划会有所上升,但随着贷款按月重新定价,存款按年重新定价,两者的重新定价差距不太可能缩小。

汽车和抵押贷款回升,而小企业的资本支出将推动 C&I 贷款增长。由于10年期美国国债收益率与抵押贷款和汽车贷款的利率密切相关,明年国债收益率的温和上涨将转化为更高的融资利率,并使新车和房主的负担能力降低。然而,低失业率,实际工资上涨和消费者信心上升等宏观经济因素,可能会推动2019年的抵押贷款和贷款发放的增长。在 C&I 贷款方面,小企业将推动 C&I 贷款的增长,因为他们仍然对经济保持乐观。根据 NFIB 商业乐观指数,2019年小企业的扩张前景同比增长 7.4%,而有未来资本支出计划的小企业比例同比增长 11.5%。

整体资产质量保持健康。继2010年签署的多德-弗兰克法案之后,银行的资产质量稳步提升。不良贷款率从2010年的7.5%稳步下降至2018年三季度的1.58%,而坏账率稳定在较低水平。在市场前景不明朗的情况下,明年美国银行业可能会继续减少高风险贷款。事实上,银行一直在收紧信贷。根据纽约联邦储备银行的消费者预期信贷准入调查显示,被贷款方关闭账户的受访者比例是自2013年启动该调查以来的最高水平。10月份,接受调查的消费者中,有7.2% 的人报告说,在过去12个月里,他们的账户被非自愿关闭,高于去年的5.7%,和2016年的4.2%。信用卡的拒付率为21.2%,远高于2017年10月的15.7%。

与其他行业相比,银行业目前的价值被低估,而且价格低廉。美国银行业的市盈率(P/E) 和市净率 (P/B) 目前均低于其1个标准差,分别为2013和2016年以来的最低水平。它目前的市盈率和市净率在所有行业中都是最低的。尽管2018年的每股收益可观,但除了工业和原材料之外,金融股的市盈率和市净率目前是在最低的水平之一。因此,我们认为,美国银行业目前处于超卖状态,预计未来一年将继续走高。

建议

我们对美国银行业给出增持的建议,并将其纳入2019年重点关注的行业之一。收益率曲线趋平是近期美国银行股票抛售的主要原因之一。然而,我们认为,随着收益率曲线下降趋势在明年逆转,市场回调将是短暂的。融资成本,适度的贷款增长以及良好的资产质量,将有助于美国的银行实现稳定的每股收益增长。随着银行从最近的下跌中恢复健康,监管机构批准的大规模资本回报计划应该会给投资者带来安慰。估值很有吸引力,目前处于25年来的低点。

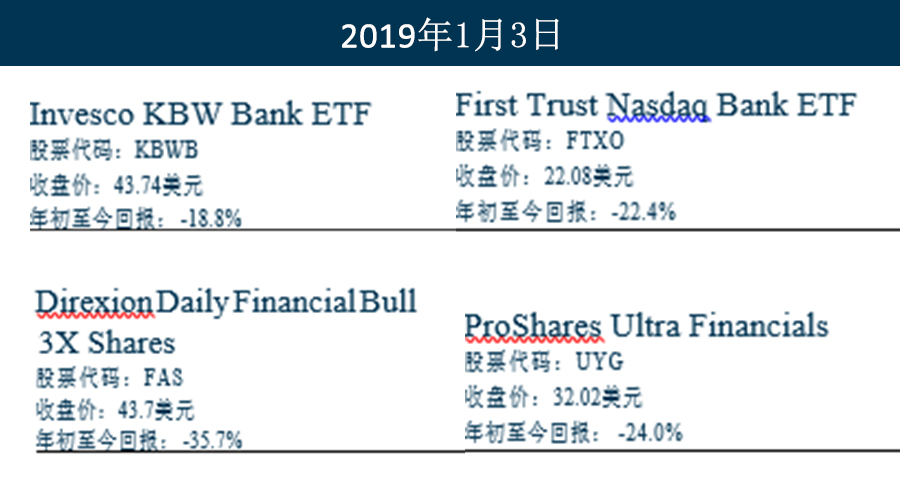

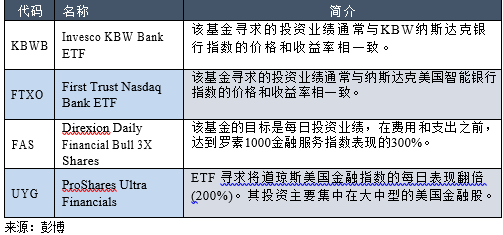

一些对美国银行板块相关的ETFs 包括:

关键字:新加坡股票研报,新加坡股,新加坡研报,新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合