股市资讯 | 阿里宣布将全面进军物联网领域 专家:今明两年美国经济基本面向好 史上最大IPO将会花落谁家?基金经理眼中未来的港股

美国股市

北京时间5日凌晨,美股周三反弹收高,科技股领涨。道指出现近800点宽幅震荡,最低曾下跌510点、最高上涨超过270点。有分析师认为,美股大幅反弹意味着投资者认为中美双方的关税措施只是意在讨价还价的谈判策略性行动。

美东时间4月4日16:00(北京时间4月5日04:00),道指涨230.94点,或0.96%,报24,264.30点;标普500指数涨30.24点,或1.16%,报2,644.69点;纳指涨100.83点,或1.45%,报7,042.11点。

尽管道指成份股波音股价走低令道指蒙受了大约40点的损失,但其他成份股表现强劲,帮助道指抹去了早间遭受的超过510点跌幅。道指成份股联合健康与IBM大幅上涨,推动道指走高。

荷美尔食品及沃尔格林长靴联盟等股票大涨,推动消费品板块上扬。

对中美贸易摩擦升级的担忧一度导致美股周三大幅低开。

全球基金经理:阿里巴巴成最爱的股票

中新网4月4日电 本周,英国知名财经媒体Financial News和美国道琼斯旗下专业的财经信息网站MarketWatch接连发文,惊叹阿里巴巴已经成为全球基金经理最爱的股票了。

两家媒体纷纷援引美国数据提供商eVestment的信息,称阿里巴巴已经成为中国大陆首支被世界大型机构投资者普遍持有的股票。eVestment数据显示,阿里巴巴股票在基金经理投资组合中的占比上涨迅速,在全球被普遍持有的股票排名中已经从2016年底的43位攀升至2017年底的第20位。

阿里巴巴在过去的2017年里股价近乎翻番,股票表现有目共睹,是去年成长迅速的行业中表现最佳的公司之一。尽管股票不停上涨,屡创新高,但在今年年初,阿里巴巴依然被很多知名媒体、专业研究机构持续坚定的看涨和反复推荐。资本市场持续对阿里巴巴和背后的中国经济的看好,已经成为美国社会的共识。

1月8日,美国新闻与世界报道对于2018年最值得投资的股票进行推荐时表示:即使已经180美元,阿里巴巴是最值得购买的股票之一。以现在的价格买入,就跟偷一样(便宜)。

2月,阿里巴巴发布了2018财年第三季度财报。惊人的业绩增长和在各个细分市场令人印象深刻的表现,以及有远见的战略布局,让著名的《福布斯》杂志为阿里点赞。也难怪全球的基金经理们按捺不住纷纷入手阿里股票。

华尔街从未掩饰过视对阿里巴巴的期待。在2017年11月底的统计的数据显示,在华尔街的215个大型基金中,有三分之一的基金买入阿里巴巴的股票,年化回报率达到了33%,远高于市场平均水平。

中美贸易战特斯拉受伤最严重

对于特斯拉来说,中国的买家只能进口购买特斯拉汽车。这就意味着如果中国坚持对美国拟征收的关税进行反击的话,这些中国的特斯拉买家将为所购车辆支付高达50%的关税。而目前,中国对进口车辆征收25%的关税。

“鉴于运输成本和各种税,进口车辆价格已经高于美国基本价格,而关税又进一步提高了价格,”约翰逊指出。比如,基础款的Model S 100D在美国售价为9.4万美元,同样的车辆目前在中国的售价为93.1万人民币(约14.8万美元)。关税大大提升了价格。

香港股市

4月4日早盘,恒指高开低走,走势不断反复,围绕开盘价震荡。午后港股跌幅进一步扩大,尾盘恒指越挫越深。截至收盘,恒指跌2.19%,报价29518.69点。腾讯控股跌2.88%,报397.6港元,失守400港元重要心理关口。

医药板块再次逆势上扬,为近期难得的板块亮点;上海医药(601607)(02607)收涨5.75%,绿叶制药(02186)涨6.79%,华润医药(03320)涨2.51%,药明生物(02269)涨6.27%,石药集团(01093)涨3.28%,国药控股(01099)涨5.58%,报44.45港元,盘中再创历史新高。国办发布《关于改革完善仿制药供应保障及使用政策的意见》提出,仿制药企业经认定为高新技术企业的,减按15%税率征收企业所得税。

科技股走势不佳,舜宇光学科技科技(02382)跌3.96%,瑞声科技(02018)跌5.87%,邱太科技(01478)跌2.34%,华虹半导体(01347)跌2.88%。

航空板块跌幅居前,已连续数日回调;截至收盘,中国南方航空(600029)股份(01055)跌5.49%,中国东方航空(600115)股份(00670)跌4.92%,中国国航(601111)(00753)跌3.41%。

中资银行继续萎靡,截至收盘,中国银行(03988)跌2.82%,工商银行(01398)跌3.52%,农业银行(01288)跌1.57%,招商银行(03968)跌4.28%。

哪些港股受中美贸易战影响最大?

贸易战主要影响的领域方面: 1)从签署备忘录来看首当其冲是针对中国计划加征 25%附加关税的行业,尤其是航空航天、信息及通信技术、机械领域; 2)贸易占比较高的行业也会受到影响。从当前的中美贸易行业结构来看,中国对美国的出口产品主要是机械设备仪器(根据分类主要是家电、电子等类别,占出口总量 48%) 以及杂项制品(12%)、纺织品(10%)、金属制品(7%)等。美国对中国出口的产品则主要集中在机械设备仪器(30%,主要是资本品)、运输设备(20%)、化工产品(10%)、塑料及橡胶制品(5%)等; 3)从积极的方面来看,未来中国可能为应对中美贸易战加大对一些领域的开放,包括汽车、医药医疗、金融、养老、传媒产品等。

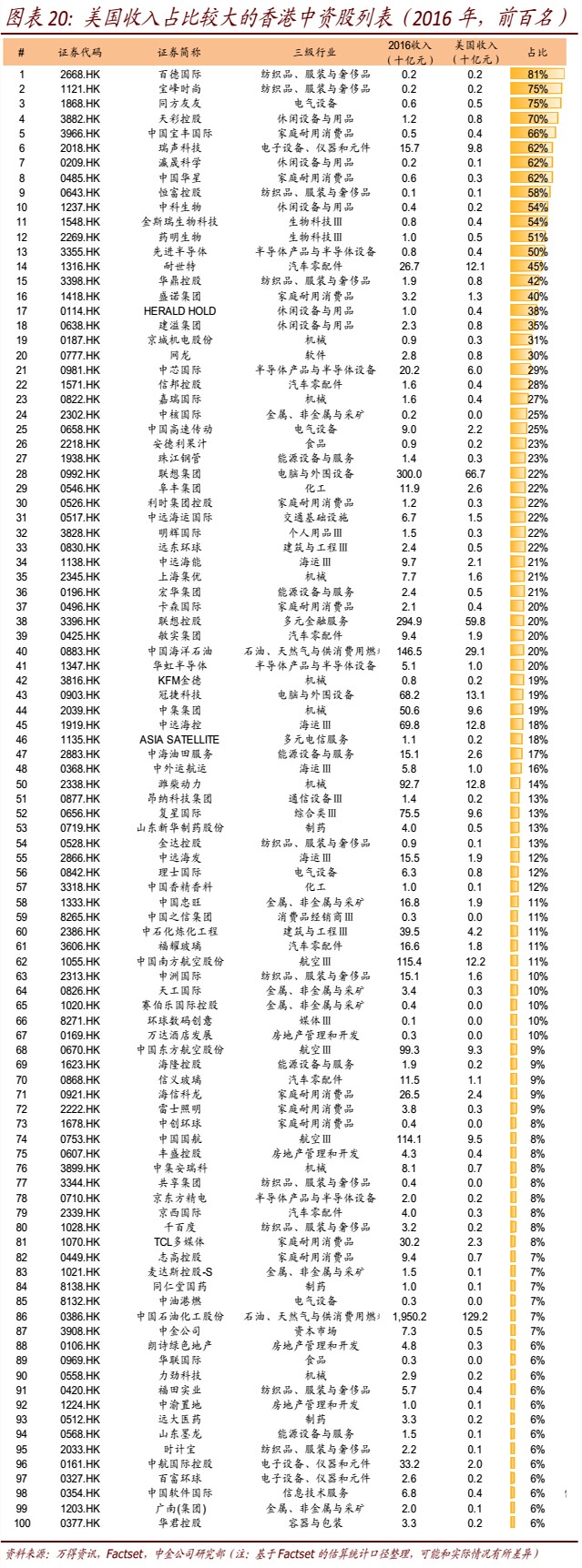

1. 按占比排名 美国收入占比较大的香港中资股 (2016年,前50名)

资料来源:万得咨询,Factset,中金公司研究部(注:基于Factset的估算统计口径整理,可能和实际情况有所差异)

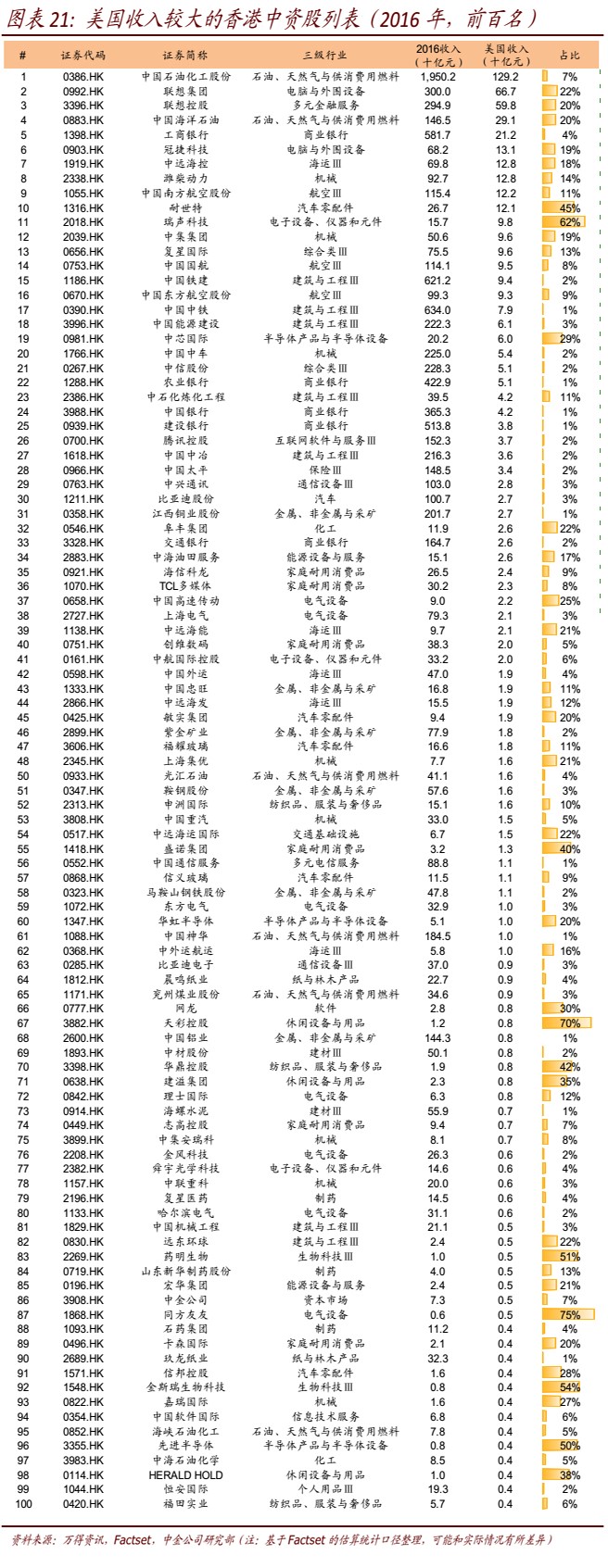

2. 按收入排名 美国收入占比较大的香港中资股(2016年,前50名)

资料来源:万得咨询,Factset,中金公司研究部(注:基于Factset的估算统计口径整理,可能和实际情况有所差异)

中国股市

4月4日沪深两市高开,沪指早盘维持高位震荡态势,而创业板早盘即显弱势,午后三大股指纷纷走跌,其中沪指高位回落,尾盘翻绿,深成指与创业板则持续下挫,尾盘跌幅扩大。两市成交量较上一交易日相比有所缩小。

截至收盘,沪指报3131.11点,跌5.52点,跌幅0.18%,成交1935亿元;深成指报10684.56点,跌69.73点,跌幅0.65%,成交2758亿元;创业板报1836.81点,跌35.66点,跌幅1.90%,成交1001亿元。

盘面上,种植业、白酒、医药、农产品、军工等概念板块涨幅居前;国产软件、工业互联网、人工智能、网络安全等概念板块跌幅居前。

个股方面,景峰医药、敦煌种业、石化机械、湖南盐业、深深宝A、高斯贝尔等涨幅居前;永泰能源、万家乐、德新交运、坚瑞沃能、群兴玩具等跌幅居前。

关键词:股票,香港股市,港股,恒指,香港IPO,交易港股,美股,中国A股,股市资讯, 美国上市, 阿里巴巴股票,行业板块,银行股,特斯拉,暗盘,上市,美国IPO, 医药板块,中美贸易战,特斯拉,中金数据,基金

来源:东方财富网,新浪财经,同花顺,21世纪经济报道,彭博,华尔街见闻,辉立证券