股市资讯 | 1:10, 小米IPO认购好于预期。富士康美工厂动土,特朗普“罕见”到场!

美股

截至北京时间6月29日凌晨,美股周四收高,银行与科技股领涨。投资者仍在权衡国际贸易关系方面的不确定性因素及美国经济数据。

截止收盘,道指涨98.46点,或0.41%,报24,216.05点;标普500指数涨16.68点,或0.62%,报2,716.31点;纳指涨58.6点,或0.79%,报7,503.68点。

宏观基本面:

美第一季度GDP增幅下修为2%,上周首次申请失业救济人数升至22.7万。

焦点股关注:

波音(BA)成为表现最好的道指成份股。标普500指数的11大组成板块中,金融、科技与电讯板块涨幅领先。亚马逊(AMZN)股价收高2.47%,据报道该公司将收购一家线上药品零售商。

银行板块普遍攀升,JP摩根大通(JPM)、高盛(GS)、花旗(C)、摩根士丹利(MS)以及美国银行(BAC)等大型银行股涨幅均超过1%。在周四之前,银行板块已经连续13个交易日下跌。

港股

北京时间6月28日,美国三大股指周三全面收跌,纳指跌幅超1.5%;原油价格受地缘政治以及美国库存数据下降影响,再度飙升;6月28日,人民币兑美元中间价调贬391个基点,报6.5960,连续七日调贬,再创逾一年半以来最低。昨日早盘,恒指高开高走,午后一度大跌超0.5%,尾盘重回升势。

截至收盘,恒生指数高涨0.5%,报28497.32点;国企指数跌0.1%,报10868.45点;红筹指数涨0.09%,报4255.15。大市成交1172.51亿港元。

沪港通资金流向方面,沪股通净流入22.99亿,港股通(沪)净流出2.02亿。

深港通资金流向方面,深股通净流出13.43亿,港股通(深)净流出1.1亿。

宏观基本面:

香港特区特别行政会议批准征收一手房空置税。控制房价。

焦点股关注:

1. 重磅股走势回暖,友邦保险(01299)涨2.87%,腾讯控股(00700)涨0.42%,港交所涨0.87%,汇丰控股(0005)涨0.55%。

2. 内房股再度走低,龙湖地产(00960)大跌超7%,中国恒大(03333)跌4.56%,碧桂园(02007)跌2.67%。政策规范房企海外融资也进一步利空地产。发改委昨日宣布,要规范房地产企业境外发债资金投向,房地产企业境外发债主要用于偿还到期债务,避免产生债务违约,限制房地产企业外债资金投资境内外房地产项目、补充运营资金等。

3. 美国威胁其他国家在11月4日之前,停止从伊朗进口石油,否则会面临制裁。再加上,美国能源部最新公布数据显示,截至6月22日当周,原油库存大幅减少989.1万桶,远多于预期减少300万桶。。三桶油大涨,其中,中海油(00883)涨3.85%,领涨蓝筹;中石油涨2.45%,中石化涨1.9%。

4. 资讯科技股走好,美图(01357)涨6.71%,比亚迪电子(00285)涨2.64%,富智康集团(02038)涨4.42%,瑞声科技(02018)涨2.27%。

5. 人民币兑美元中间价调贬391个基点,报6.5960,连续七日调贬,再创逾一年半以来最低。航空股继续受挫,东方航空跌5.74%,南方航空(01055)跌4.26%,中国国航(00753)跌0.67%。

小米:公开认购超10倍 ,成全球最大散户规模IPO

小米公开认购数据昨日公布,好于预期。

截止昨日十二点,共有超10万投资者参与小米的散户认购,认购总额超10.3亿股。根据港股市场中央结算中心的时间因素,这一数据暂未包括散户今日半天提交的认购数。《香港经济日报》称,以小米公开认购部分集资5%或约24亿元计,散户认购资金仍达240亿元。小米预计于明日定价,下月9日挂牌。

中国A股

北京时间6月28日,昨日沪深两市再度低开,沪指盘初快速下探,最低摸及2790.40点,续创两年新低,随后受券商股提振小幅翻红,午后大盘再度跳水,一度跌超1%。

截止收盘,沪指报2786.90点,跌幅0.93%,深成指报9071.73点,跌幅1.06%。截止今天沪指大跌9.97%,创下2016年1月份熔断大跌后最大的单月跌幅。

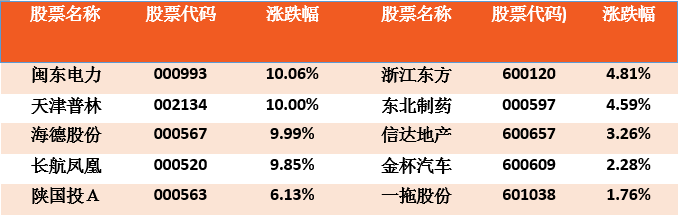

从盘面上,仅少数板块飘红,公交、券商、石油、高送转板块涨幅居前,养殖业、物流、军工、银行、家电等板块跌幅居前。

热点板块:

1. 白酒股昨日行情低迷,顺鑫农业(000860)盘中跌超9%,泸州老窖(000568)、舍得酒业(600702)、老白干酒(600559)、古井贡酒(000596)、伊力特(600197)、迎驾贡酒(603198)、五粮液(000858)、水井坊(600779)等跌幅居前。

2. 券商股表现亮眼,方正证券(601901)盘中触涨停,南京证券(601990)、中国银河(601881)、国信证券(002736)、西部证券(002673)、华泰证券(601688)、西南证券(600369)等均有表现。

宏观基本面:

中国央行将进行800亿元7天期逆回购,今日净回笼1000亿元;今日有600亿元7天、500亿元14天、700亿元28天逆回购到期。

中国商务部:中方不赞成以国家安全为由收紧外国投资条件

商务部发言人高峰:我们注意到白宫北京时间昨天晚上公布的有关声明,将密切关注美国《外国投资风险审查现代化法案》的立法进展情况,并且将评估对中国企业的潜在影响。中方不赞成以国家安全为由收紧外国投资条件。

汤森路透数据显示,中国企业今年迄今仅斥资16亿美元收购美国资产,较上年同期锐减近八成。反观中国购买欧洲资产规模则较上年激增39%至451亿美元。

富士康:美国建厂,川普出席道贺,补贴奖励巨大

美东当地时间2018年6月28日,美国威斯康星州芒特普莱森特,美国总统特朗普亲赴威斯康星州,与鸿海董事长郭台铭共同出席富士康工厂的动工典礼,并发表侧重创造就业的主题演讲。

富士康承诺将在威斯康星州建造巨型工厂﹐并创造13,000个工作岗位,平均年薪达5.4万美元的优质就业机会。

富士康超级工程计划在州长沃克大力支持下,通过投资奖励、确定选址、规划水电等繁琐程序不到一年完成。美国《华尔街日报》称,为吸引富士康价值100亿美元的投资,威斯康星和地方政府已在最初承诺的30亿美元基础上再额外增加10亿美元补贴。当地的《密尔瓦基哨兵日报》称 ,在哈雷摩托宣布将生产线移往海外引发争议后,能吸引富士康这样雄厚的外资落实投资,可以成为特朗普上任以来最为重大的经济政绩。

周四,富士康的这座工厂将在威斯康星州东南部举行动工仪式﹐美国总统特朗普将出席;这距离该公司在白宫的一个仪式上宣布该交易已过去了近一年时间﹐当时白宫举行这个仪式旨在表明特朗普将制造业工作带回美国的努力取得了成功。

《今日美国报》指出,富士康获得许多威斯康星税收优惠,包括预估高达30亿美元的制造业营利税,此外还有月7.64亿美元的设厂公共开支补贴以及约1亿美元的相关联通道路兴建费用。到2032年,当地纳税人将支付富士康园区建设和设备所需费用的13%,以及员工工资的17%。美国就业研究机构专家估算,富士康在美国每创造一个就业岗位,就会得到超过20万美元的就业补贴,比美国过去典型的奖励投资要高出数倍。支持者表示,富士康会改变该州的经济模式,带动当地产业向高科技领域转型升级。

此前,富士康股票工业富联(601138)上市4个涨停就停止上涨,接下来连续4交易日个暴跌,离发行价只有一个跌停板的距离,数天市值蒸发了上千亿元。昨日工业富联股票小微上涨,涨0.34%报17.95元。北京时间6月29日凌晨,富士康发布公告,拟披露中报。关注富士康的最新动向,请关注辉立资本新加坡(SGPSPL)。

来源:东方财富网,新浪财经,同花顺,21世纪经济报道,彭博,华尔街见闻,辉立证券