Apple Inc. - Proving its resilience

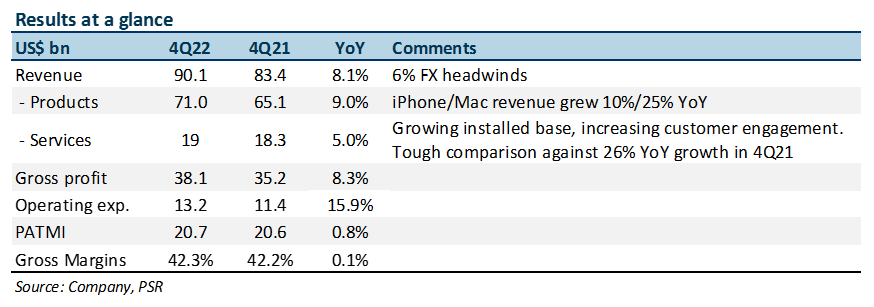

4 Nov 2022- Revenue and PATMI in line at 100% of our FY22 forecasts. Resilient hardware revenue with 9% YoY growth in 4Q22 amid negative industry sentiment.

- Revenue growth deceleration and increasing FX headwinds guidance for 1Q23.

- Maintain BUY with a lowered target price of US$190.00 (prev. US$198.00). Valuations based on DCF with a WACC of 6.5% and terminal growth rate of 3%. We believe Apple will benefit from the increased average selling price (ASP) of its iPhone while volume growth is expected to face headwinds from both the lower demand compared to FY22 and potential supply constraints from the continued lockdowns in China.

The Positives

+ Hardware product revenue remained resilient. iPhone recorded 10% YoY revenue growth to US$42.6bn, while Mac grew 25% to US$11.5bn, a new quarterly record, despite industry-wide warnings of a potential decline in smartphone and PC demand. The strong Mac performance was attributed to the ability to capture sales from backorders on M2 MacBook Air that suffered supply constraints following its launch in 3Q22. Both product categories set quarterly record for upgraders, with the iPhone growing switchers by double digits. Nearly 50% of Mac buyers during the quarter were new to the devices.

+ Growth in international markets despite strengthening US dollar. Aside from Japan, revenue across all geographies outside the US experienced YoY growth during the quarter with Europe increasing 10% and the Rest of Asia Pacific segment growing 23%, despite facing headwinds during the conversion of local currencies to the US dollar. Apple credited the strong performance in several large emerging markets, with India setting a new revenue record and strong double-digit growth in Thailand, Vietnam, Indonesia, and Mexico.

The Negatives

– Guided for QoQ revenue growth deceleration. Management guided for a slower revenue growth in 1Q23 compared to 4Q22’s growth of 8%, mainly due to the 10% of expected FX headwinds. Moreover, Mac sales are expected to decline substantially YoY, mainly because of the tough comparison with 4Q21 where it benefited from the launch of the newly redesigned M1 MacBook Pro and grew 25%. Services is expected to grow but hindered by the macroeconomic environment that increases FX headwinds and decreases spending on digital advertising as well as games on the App Store, although Apple has indicated that the advertising business does not contribute a large portion of the overall revenue.

About the author

Maximilian Koeswoyo

Research Analyst

PSR

Maximilian mainly covers the US technology sector. In his strive to be a globalized citizen and get continuous exposure to the fundamentals of companies from various industries, he graduated from Singapore Management University holding a Bachelor’s degree in Business Management.

About the author

Maximilian Koeswoyo

Research Analyst

PSR

Maximilian mainly covers the US technology sector. In his strive to be a globalized citizen and get continuous exposure to the fundamentals of companies from various industries, he graduated from Singapore Management University holding a Bachelor’s degree in Business Management.

Apr 19th - Things to Know Before the Opening Bell

Apr 19th - Things to Know Before the Opening Bell Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY) Trade of the Day - Singapore Airlines (SGX: C6L)

Trade of the Day - Singapore Airlines (SGX: C6L) Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)

Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)