Amazon.com Inc - Absorbing higher costs

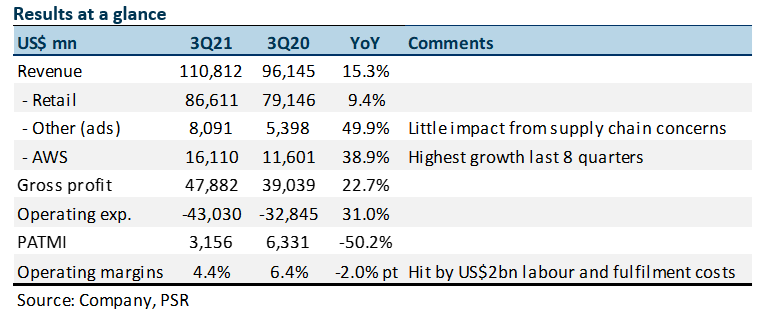

2 Nov 2021- 9M21 revenue and gross profits were in line at 70%/72% of our FY21 forecast. Operating margins down 2% points to 4.4% on higher labour and fulfilment costs.

- Amazon’s cloud and advertising businesses continue to show register healthy growth of 39% and 50% YoY respectively.

- Maintain BUY with revised target price of US$4,157.00, down from US$4,329.00. Our valuations are based on DCF with a WACC of 6.2% and terminal growth of 5%. We revise our FY21e PATMI down 10% on higher guidance of labour and fulfilment costs for 4Q21e.

The Positives

+ Healthy growth for Amazon Web Services (AWS) and advertising. AWS, Amazon’s cloud computing business, revenue jumped 39% YoY to US$16.1bn in 3Q21, strongest growth in the last 8 quarters. Industries whose spend was suppressed by the pandemic, are recovering and accelerating their use of the cloud. Amazon’s advertising revenue (other), grew 50% YoY to US$8.1bn, on track to reach our FY21e target. Supply chain pressures have not impacted advertisement demand.

The Negatives

– Operating margins fell 2% points YoY to 4.4%. On the e-commerce front, Amazon is absorbing higher costs from rising wages and productivity losses from labour shortages, higher steel prices and trucking/container capacity costs. These increased 3Q21 operating expenses by US$2bn (2% of revenue), leading to operating expenses spiking 2x faster than revenue. These costs are guided to approach US$4bn through the 4Q21 holiday season as Amazon ramps up staffing by 150,000 and opens access to new ports and container capacity.

Outlook

As Amazon prioritise its customers’ experience, higher costs will be incurred to ensure fast delivery times and available stock during the holiday season. Higher costs are expected to dampen growth for the next quarter. We also worry the higher cost may linger into the following quarters as the US labour shortage may persist and higher wages take a permanent nature.

Maintain BUY with revised TP of US$4,157.00, down from US$4,329.00.

Our valuations are based on DCF with a WACC of 6.2% and terminal growth of 5%. We revise our FY21e PATMI down 10% on higher than expected labour and fulfilment costs for 4Q21

Apr 19th - Things to Know Before the Opening Bell

Apr 19th - Things to Know Before the Opening Bell Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY) Trade of the Day - Singapore Airlines (SGX: C6L)

Trade of the Day - Singapore Airlines (SGX: C6L) Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)

Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)