Amazon.com Inc. - Cost pressures surpassing healthy demand

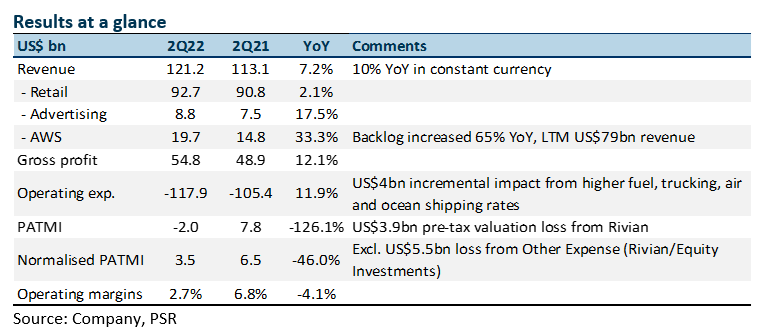

5 Aug 2022- 2Q22 revenue beat expectations, but earnings missed modestly. 1H22 revenue at 45% of our FY22e forecasts, while normalised PATMI came in at 38%, excluding a pre-tax valuation loss of US$3.9bn from Rivian Automotive.

- Faced with US$4bn incremental cost from external factors: higher fuel prices, trucking, air and ocean freight rates. Higher energy costs to hurt margins, with 4% FX headwinds in 3Q22.

- We believe that earnings will remain suppressed due to increasing inflationary costs in the near term; our FY22e assumptions remain unchanged. We downgrade to NEUTRAL with an unchanged target price of US$133.00 based on DCF with a WACC of 6.4% and terminal growth of 5.0%.

The Positive

+ Revenue beat top-end of guidance. Amazon recorded revenues of US$121.2bn for 2Q22, slightly above the top-end of its guidance, representing a 7% YoY growth (10% YoY in constant currency), despite surpassing Prime Day event in June 2021 and larger-than-expected FX headwinds. Revenue growth was driven mainly by AWS (33% YoY), with retail and advertising also performing slightly better than expected. Amazon also said that it continued to see an increase in consumer demand for its services.

+ Good progress in adjusting staffing levels, improving fulfilment efficiency. Amazon was able to work through some of its incremental costs, reducing it by US$2bn QoQ to US$4bn in 2Q22 – in line with expectations. Most of these costs included higher fuel, trucking, air and ocean shipping costs. Staffing levels were also more in line with 2Q22 demand, with overstaffing resolved by the end of the quarter. Amazon is also seeing better optimization within its fulfilment network – improving in-stock levels and increasing delivery speeds.

The Negatives

– Higher costs continue to hurt margins in 3Q22. Amazon guided operating margins to be in the range of 0.0% to 2.8%, with the expectation that pressure from high inflationary levels – higher energy costs, will continue to pull down the company’s margins moving into 3Q22. A strengthening US dollar is expected to be a 4% revenue headwind. Operating margins were at 2.7% for 2Q22, down from 6.8% in 2Q21.

– US$3.9bn pre-tax valuation loss from Rivian Automotive. Amazon followed up 1Q22 with another quarter of net losses, posting US$2bn in net loss for 2Q22. The biggest drag on this was a US$3.9bn pre-tax valuation loss from Rivian, and losses in its equity investments. Removing these losses, the company would have had a normalized PATMI of US$3.5bn.

Outlook

Revenue guidance was positive, with Amazon expecting growth of 13%-17% due to Prime Day being in 3Q22 compared with 2Q21, even with an estimated 4% of FX headwinds. Operating margins were similar to 1Q22 guidance, at 0.0%-2.8%, weighed down by continued costs due to inflationary pressures and increasing investments in AWS and additional content for Prime members.

Amazon continues to focus on investing in AWS (~50% of CAPEX for FY22e), with plans on increasing headcount and infrastructure in 24 new geographies to better position itself, and at the same time working on building out a pipeline for AWS bookings – remaining life of current bookings is around 4 years. The company seems to have worked through its over-staffing issues from the last quarter and continues to improve the efficiency of its fulfilment services – increasing delivery density and package deliveries per hour.

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY) Trade of the Day - Singapore Airlines (SGX: C6L)

Trade of the Day - Singapore Airlines (SGX: C6L) Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)

Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83) Trade of the Day - Microsoft Corp (NASDAQ: MSFT)

Trade of the Day - Microsoft Corp (NASDAQ: MSFT)