Amazon.com Inc - Normalising sales growth

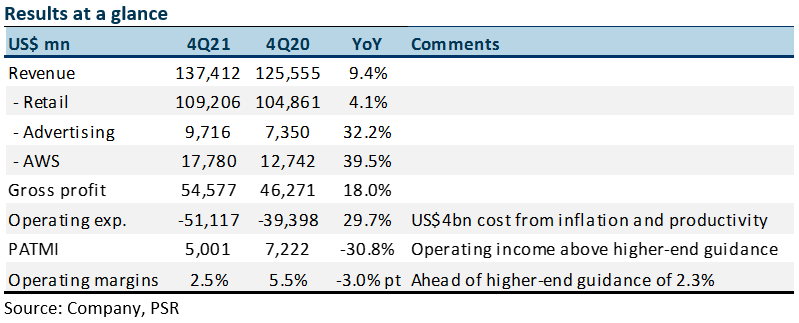

9 Feb 2022- FY21 results were in line with revenue and PATMI at 99% and 102% of our FY21 forecasts respectively, excluding a pre-tax valuation gain of US$11.8bn from the initial public offering (IPO) of Rivian.

- Amazon Web Services (AWS) 4Q21 revenue growth accelerated to 40% YoY, above consensus of 35% and our FY21 forecast of 33%. AWS is Amazon’s key growth driver, contributing 75% of FY21 operating income.

- New Amazon Prime membership price increases of 17% in 1Q22 should largely translate to bottom line and add about 10% to FY22e profit before taxes.

- The challenge from the tight US labour market is easing. However, guidance for net sales for 1Q22 was 3-6% weaker than consensus, signalling moderating demand. Amazon’s fulfilment network is no longer running at 100% capacity. As a result, we cut FY22e revenue by 3% and reduce operating margins from 8% to 6% due to still elevated wage and fulfilment costs, which lowers our FY22e PATMI by 31%. The swing factor is in margins from easing supply constraints. Maintain BUY with a lower target price of US$4079.00 based on DCF with a WACC of 6.2% and terminal growth of 5.0%.

The Positives

+ Operating margins above expectations. Despite additional US$4bn in costs from wage increases, higher transport costs and lost productivity due to Omicron, 4Q21 operating margin of 2.5% was better than guidance of 2.3% and consensus estimates of 1.8%. This was due to less than expected increase in staffing of 140,000 vs guidance of 150,000 for 4Q21. The tight labour challenges will improve in 1Q22.

+ AWS growth accelerated. AWS revenue growth accelerated to 40% YoY, above consensus of 35% and our FY21 forecast of 33%, and the 7th consecutive quarter of increasing growth. AWS is Amazon’s key growth driver, contributing 75% of FY21 operating income. Advertising services, the second key growth driver, grew 55% YoY beating our FY21 forecast of 53%.

+ Huge valuation gain from Rivian. Amazon enjoyed a pre-tax valuation gain of US$11.8bn from common stock investment in Rivian Automotive Inc, which completed an IPO in November 2021.

+ Price increases for US Amazon Prime memberships. Prime membership prices in the US will be increased from US$12.99 to US$14.99 monthly or from US$119 to US$139 annually. This represents a 17% increase. The additional US$3bn in fees should largely translate to the bottom line, which adds a 10% to FY22e profit before taxes. There are about 149mn Amazon Prime members in the US. There was little churn in previous price increases.

The Negatives

– Ecommerce growth moderated. 4Q21 ecommerce sales grew 4% YoY to US$109bn, slower than consensus estimates of 5%. Amazon’s fulfilment network is no longer running at 100% capacity, signalling moderating demand. This has led to US$1bn negative impact on operating income from lower fixed cost leverage. However, CAPEX in fulfilment centres, which represents 30% of CAPEX, is expected to moderate moving forward.

Outlook

E-commerce growth is normalising after a pandemic-induced surge. Guidance for 1Q22 net sales of US$112bn to US$117bn was 3-6% weaker than consensus of US$120bn. In addition, capex is expected to remain elevated in FY22 as Amazon continues to ramp up AWS infrastructure and transportation capacity. However, despite the weaker sales guidance, FY22 will benefit from easier comparables in FY21 vs the previous comparables in FY20. The swing factor in 1Q22 guidance is margins, likely due to the potential moderation of elevated fulfilment and labour costs as supply constraints ease.

Apr 19th - Things to Know Before the Opening Bell

Apr 19th - Things to Know Before the Opening Bell Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY) Trade of the Day - Singapore Airlines (SGX: C6L)

Trade of the Day - Singapore Airlines (SGX: C6L) Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)

Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)