Amazon Inc. - Longer term remains attractive

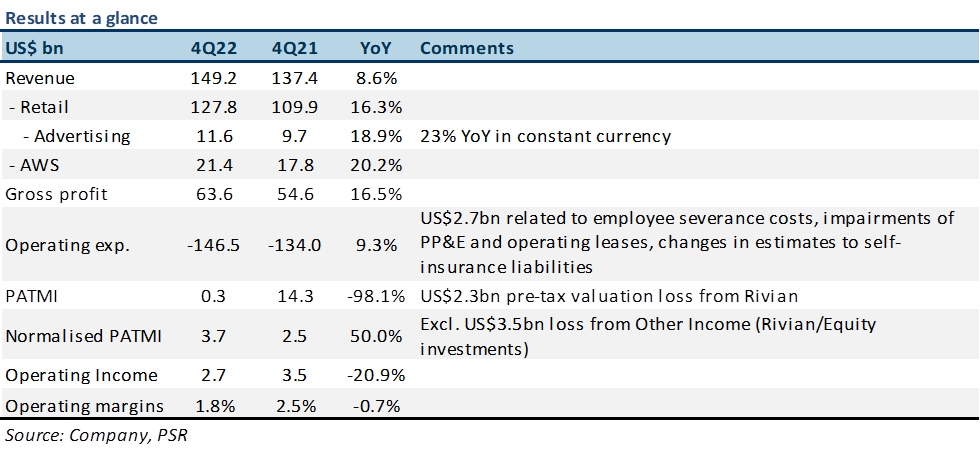

9 Feb 2023- Revenue was in line with expectations at 101% of our FY22 forecast; while earnings were a slight miss with normalized PATMI at 96%, excluding a pre-tax valuation loss of US$12.7bn from Rivian Automotive, due to higher-than-expected operating expenses.

- 4Q22 revenue grew 8.6% YoY, beating top-end company guidance with advertising continuing to buck the industry’s declining trend. AWS remains the fastest growing segment but growth is expected to decelerate to mid-teens in 1Q23.

- We upgrade to ACCUMULATE with a raised DCF target price of US$117.00 (prev. US$108.00) using a WACC of 6.4% and terminal growth rate of 5%. We expect near-term challenges for revenue growth as consumers are more selective in their discretionary spending and AWS customers opt for lower-cost products. However, we expect growth to reaccelerate in FY24e, particularly for AWS as Amazon increases its client base and customers scale up their computing demand as macro improves.

The Positives

+ Revenue beats guidance. 4Q22 revenue grew 8.6% YoY (12% in constant currency) to US$149.2bn, slightly above the top end of US$148bn company guidance. Retail sales were boosted by Prime Early Access Sales in October and Thanksgiving-Cyber Monday holiday weekend sales outperformance. Prime saw record new sign-ups during Rings of Power launch window. AWS remains the fastest growing segment, up 20% YoY, and was the sole contributor to the overall operating income of US$2.7bn.

+ Advertising continues bucking industry trends. Advertising grew 19% YoY to US$11.6bn (7.7% of total 4Q22 revenue) while competitors continue to see advertising revenue decline. Amazon continued to see inflow of advertising demand from sellers, vendors, and brands during the competitive holiday season, even as sellers were being frugal with their marketing budgets in the current macroeconomic environment.

The Negative

– 1Q23 AWS growth expected to decelerate. AWS YoY growth for January 2023 was in the mid-teens as enterprises continue their efforts in optimizing their spending by opting for lower-cost products. Management expects these optimization efforts to be the key headwind for AWS over the next few quarters. However, Amazon indicated that its new customer pipeline remains robust as many are putting plans in place to migrate to the cloud and commit to AWS for the long term.

About the author

Maximilian Koeswoyo

Research Analyst

PSR

Maximilian mainly covers the US technology sector. In his strive to be a globalized citizen and get continuous exposure to the fundamentals of companies from various industries, he graduated from Singapore Management University holding a Bachelor’s degree in Business Management.

About the author

Maximilian Koeswoyo

Research Analyst

PSR

Maximilian mainly covers the US technology sector. In his strive to be a globalized citizen and get continuous exposure to the fundamentals of companies from various industries, he graduated from Singapore Management University holding a Bachelor’s degree in Business Management.

NikkoAM-StraitsTrading Asia ex Japan REIT ETF - Resilient dividends despite rate hikes

NikkoAM-StraitsTrading Asia ex Japan REIT ETF - Resilient dividends despite rate hikes Netflix Inc. - Pricing power on display

Netflix Inc. - Pricing power on display Keppel DC REIT - DXC settlement offers partial relief from uncollected rents

Keppel DC REIT - DXC settlement offers partial relief from uncollected rents Apr 19th - Things to Know Before the Opening Bell

Apr 19th - Things to Know Before the Opening Bell