AOT TH SDR - Stock Analyst Research

| Target Price* | - |

| Recommendation | REDUCE› REDUCE |

| Market Cap* | - |

| Publication Date | 5 Jun 2023 |

*At the time of publication

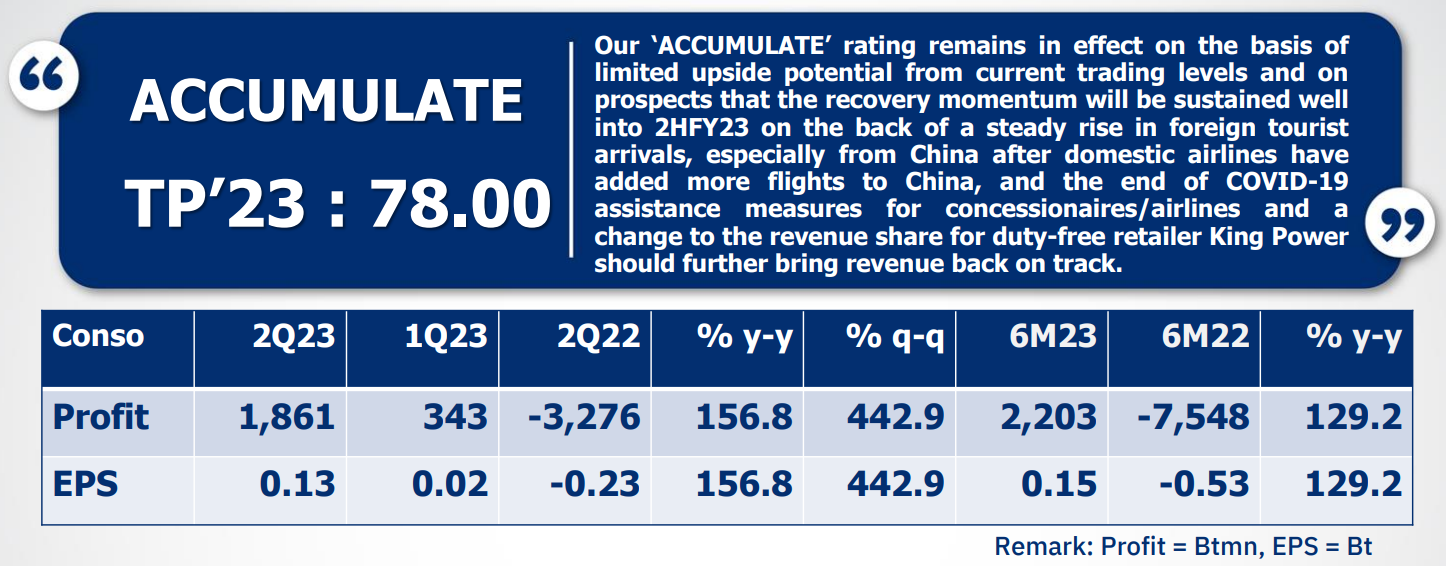

Airport Authority of Thailand (AOT) - 2QFY23 profit above forecasts

-2QFY23 profit above forecasts: AOT beat forecasts with a spectacular rise of 156.8% y-y in 2QFY23 to Bt1,861mn on revenue beat and lower-than-expected costs. The quarterly profit came in 23.7% higher than our estimate. For the period, sales and service revenue skyrocketed 264% y-y to Bt11,001mn as the number of passengers and flights surged 195.5% and 79.8% y-y to 26.45mn and 164,000 respectively after the COVID-19 pandemic eased, and concession revenue grew on the back of rising passenger numbers. Total expenses ticked up 20% y-y due to the increasing number of passengers and the rises in utilities expenses, outsourcing expenses fueled by an increase in advance passenger processing system payments to the service provider, and other expenses. SG&A expenses shot up 34.4% y-y owing to a rise in accrued bonus expenses and increased staff levels at subsidiaries.

-Recovery momentum set to continue into 2HFY23: The recovery momentum is likely to be sustained well into 2HFY23, propelled by a steady rise in tourist numbers. Foreign tourist arrivals to the country continued to increase in Apr to 2.11mn from 0.29mn in the same year-ago period. Further adding more fuel to the recovery is a likely pickup in Chinese tourist numbers after 0.33mn Chinese tourists visited the country in Apr compared to 1HTD when 0.64mn Chinese arrivals were recorded after airlines have added more flights to China. The end of COVID-19 assistance measures for concessionaires/airlines since Mar 31 and a change to the revenue share for duty-free retailer King Power should further bring revenue back on track.

About the author

Phillip Research Team (Thailand)

About the author

Trade of the Day - Microsoft Corp (NASDAQ: MSFT)

Trade of the Day - Microsoft Corp (NASDAQ: MSFT) Apr 15th - Things to Know Before the Opening Bell

Apr 15th - Things to Know Before the Opening Bell Singapore REITs Monthly – Waiting for interest rate cuts

Singapore REITs Monthly – Waiting for interest rate cuts Apr 12th - Things to Know Before the Opening Bell

Apr 12th - Things to Know Before the Opening Bell