BRC Asia - Stock Analyst Research

| Target Price* | 1.99 |

| Recommendation | ACCUMULATE› ACCUMULATE |

| Market Cap* | - |

| Publication Date | 13 Feb 2024 |

*At the time of publication

BRC Asia - Margins gained from higher volume

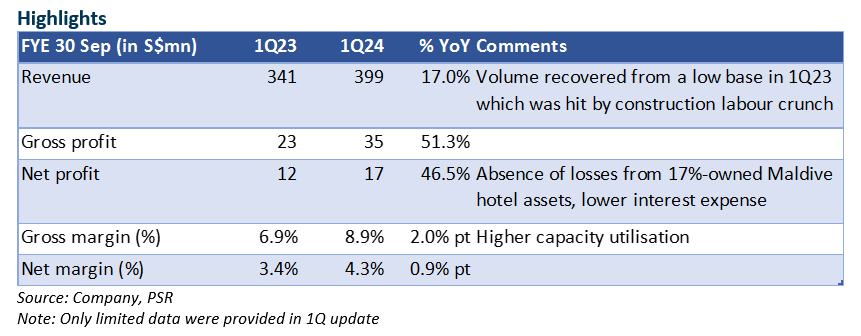

- 1Q24 net profit came in at 20% of our FY24e estimates. This is typically the lull quarter for construction output. Revenue jumped 17% YoY due to low volume in the year earlier, as the labor crunch affected activities and order deliveries. We estimate higher volume was partly offset by a 17% lower ASP for steel rebars. Net profit gained from the absence of associate losses, and lower interest expense as net gearing improved to 0.46x (Dec 22: 0.65x).

- We maintain our net profit estimates for FY24e, though there is a possible upside from a S$14mn divestment gain of the Maldives hotel assets. We estimate that the sale could also lift dividends by about S$0.05/share, which have not been factored into our numbers.

- Downgrade to ACCUMULATE (prev. BUY) due to the recent share price gain. Our TP remains unchanged at $1.99. BRC’s strong ROE of 18.6% in FY24e reflects market leadership that enables it to enjoy economies of scale. The tailwinds for FY24e are stronger construction output and the bottoming of steel prices.

The Positives

+ 1Q24 net profit surged by 46.5% YoY, on the back of volume recovery from a low base in the year earlier, the absence of losses from the 17%-owned Maldives hotel assets, and lower interest expenses. We estimate that steel prices were about 17% lower YoY.

+ Gross margin was 2.0% points higher YoY, which reflects a higher utilisation rate at its fabrication plant and possibly lower freight costs.

+ Net debt at end-Dec 23 of S$207mn was flat versus S$196mn at end-Sep 23, despite the jump in sales, suggesting still healthy working capital and no collection stress. Lower steel prices also free up trade financing needs. Net gearing as at end-Dec was 0.46x.

The Negative

– nil

About the author

Peggy Mak

Research Manager

PSR

Peggy has been a sell-side equity analyst for 22 years and a fund manager for 15 years.

About the author

Peggy Mak

Research Manager

PSR

Peggy has been a sell-side equity analyst for 22 years and a fund manager for 15 years.

Trade of the Day - NVIDIA Corporation (NASDAQ: NVDA)

Trade of the Day - NVIDIA Corporation (NASDAQ: NVDA) Trade of the Day - Applied Materials, Inc. (NASDAQ: AMAT)

Trade of the Day - Applied Materials, Inc. (NASDAQ: AMAT) CapitaLand Ascott Trust - Occupancy to improve with ADRs stabilising

CapitaLand Ascott Trust - Occupancy to improve with ADRs stabilising NikkoAM-StraitsTrading Asia ex Japan REIT ETF - Resilient dividends despite rate hikes

NikkoAM-StraitsTrading Asia ex Japan REIT ETF - Resilient dividends despite rate hikes