CityDev - Stock Analyst Research

| Target Price* | 6.87 |

| Recommendation | BUY› BUY |

| Market Cap* | - |

| Publication Date | 5 Mar 2024 |

*At the time of publication

City Developments Ltd - Record revenue driven by property development

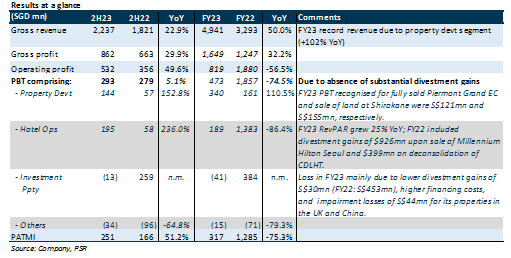

- FY23 PATMI of S$317.3mn (-75.3% YoY) missed our estimate by 15% due to higher-than-expected finance costs (+73% YoY). The YoY decline in PATMI was largely attributable to the absence of outsized divestment gains from the divestment of Millennium Hilton Seoul (S$926mn) in FY22.

- Excluding divestment gains and impairment losses, FY23 PATMI quadrupled YoY to S$188.6mn (FY22: S$47mn); PBT grew 90% YoY to S$352.7mn (FY22: S$186mn). This was mainly due to the contribution of Piermont Grand EC in its entirety in Jan-23 and the sale of land at Shirokane in Jul-23 under the property development segment.

- Maintain BUY with a lower TP of S$6.87 from S$8.22, a 45% discount to RNAV of S$12.50. We raise our FY24e PATMI estimate by 15%, factoring in higher contributions from hotel operations. We view CDL as a proxy for the Singapore residential market and hospitality recovery. Asset monetisation, unlocking value through AEIs and redevelopments, establishing a fund management franchise, and the continuous recovery in the hospitality portfolio are potential catalysts for CDL, which could help narrow the discount between CDL’s share price and RNAV.

The Positives

- Record revenue in FY23 boosted by property development segment (+102% YoY). This was due to the fully sold Piermont Grand EC, which obtained TOP in Jan 23, and the sale of land at Shirokane in July 23. In FY23, the group and its joint venture associates sold 730 units with a total sales value of S$1.5bn (FY22: 1,487 units with a total sales value of S$2.9bn). Sales were largely driven by The Myst and Tembusu Grand, which sold 60% of its 638 and 51% of its 408 units to date respectively. The launch of Lumina Grand EC in Jan 24 was well received, with 55% sold to date. The group plans to launch two projects in 2H24 – Union Square Residences (366 units) and Champions Way (348 units). It is still monitoring market conditions to determine the appropriate time to launch Newport Residences, which has no ABSD deadline.

- Hospitality segment continues to improve. FY23 portfolio RevPAR rose 25.3% YoY to S$168.7, exceeding pre-COVID FY19 levels by 22%, fuelled by higher room rates (+10%) and occupancy (+9ppts). FY23 GOP margin improved 3.7ppts to 34.5% led by Asia markets. The group’s strategic expansion of its hotel portfolio continued in FY23 as it acquired three hotels with a total of 1080 rooms and opened another three hotels with a total of 916 rooms.

The Negatives

- Average cost of debt rose from 2.4% in FY22 to 4.3% in FY23, resulting in a 73% jump in finance costs. Net gearing on fair value on investment properties rose to 61% (FY22: 51%). As only 45% of debt is on a fixed rate, CDL will benefit significantly from any interest rate cuts.

About the author

Darren Chan

Research Analyst

PSR

Darren has over three years of experience on the buy-side as a fund manager. During his time as fund manager, he has managed multiple funds and mandates including dividend income, growth, customised, Singapore focused and regionally focused funds. He graduated from the University of London with a First-Class Honours degree in Banking and Finance.

About the author

Darren Chan

Research Analyst

PSR

Darren has over three years of experience on the buy-side as a fund manager. During his time as fund manager, he has managed multiple funds and mandates including dividend income, growth, customised, Singapore focused and regionally focused funds. He graduated from the University of London with a First-Class Honours degree in Banking and Finance.

Trade of the Day - NVIDIA Corporation (NASDAQ: NVDA)

Trade of the Day - NVIDIA Corporation (NASDAQ: NVDA) Trade of the Day - Applied Materials, Inc. (NASDAQ: AMAT)

Trade of the Day - Applied Materials, Inc. (NASDAQ: AMAT) CapitaLand Ascott Trust - Occupancy to improve with ADRs stabilising

CapitaLand Ascott Trust - Occupancy to improve with ADRs stabilising NikkoAM-StraitsTrading Asia ex Japan REIT ETF - Resilient dividends despite rate hikes

NikkoAM-StraitsTrading Asia ex Japan REIT ETF - Resilient dividends despite rate hikes