City Developments Limited - Recovery and assets monetisation underway

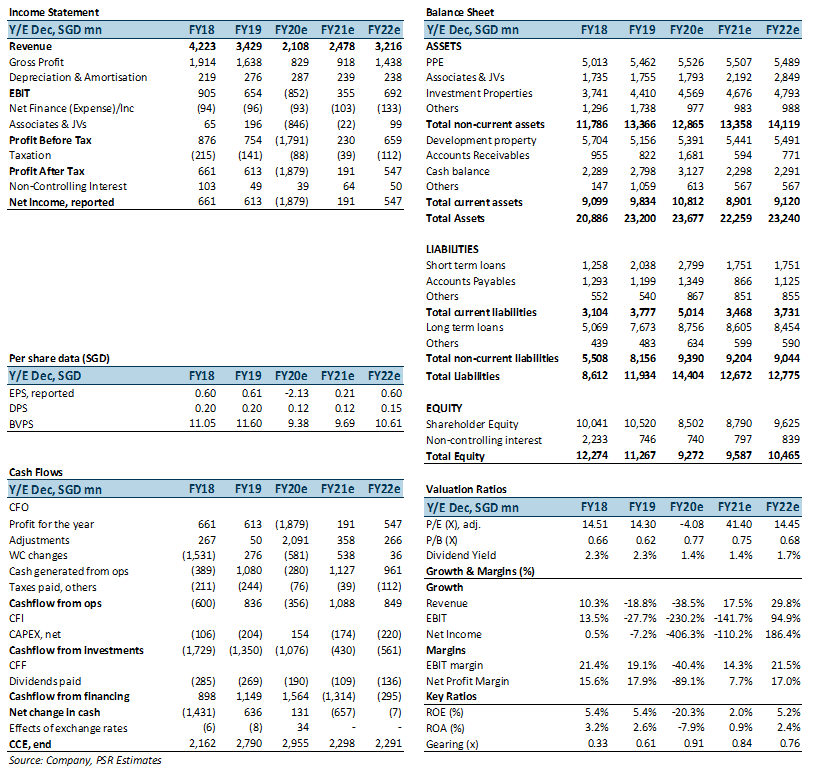

20 Sep 2021- Catching Singapore property upcycle with a strong development pipeline of 1,746 units, translating to FY22e/23e GDV of S$2.1b/S$1.0bn.

- Impending recovery of hospitality sector and monetisation of assets through potential SREIT listing to improve financial position.

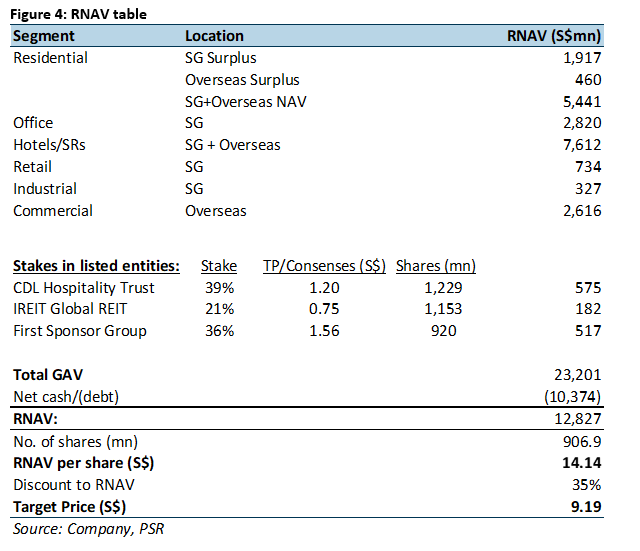

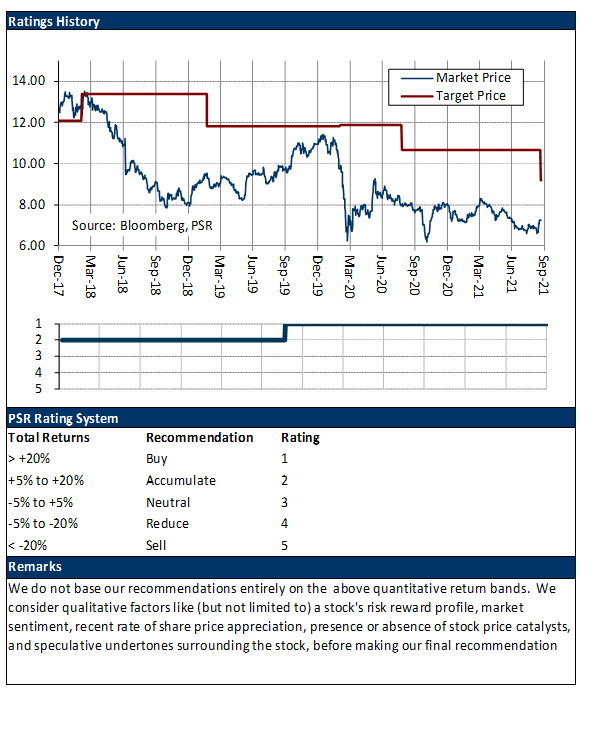

- Re-initiate with BUY and RNAV-derived TP S$9.19 (35% discount). CDL is trading at an attractive 49% discount to our RNAV/share of S$14.14.

Investment Thesis

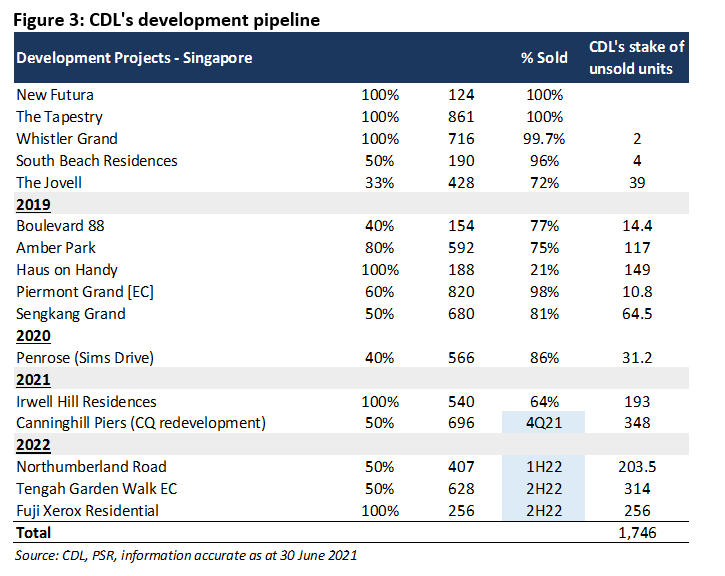

- Catching Singapore property upcycle with a strong development pipeline. CDL picked up two plots of land YTD – the Northumberland Road GLS and the Tengah Gardens EC site. Residential units from its redevelopment projects, Canninghill Piers (Liang Court) and Fuji Xerox, brings CDL’s unlaunched pipeline to 1,121 units, which will be launch over the next two years. Based on our forecasts, these two redevelopment projects should yield CDL respectable margins above 30%. Including the unsold units from earlier launches, we estimate that CDL has 1,746 units to be monetised, translating to FY22e/23e GDV of S$2.1b/S$1.0bn.

- Impending recovery of hospitality sector. CDL’s hotel segment contributed S$192/178mn or 16.2%/15.8% of EBITDA in 2018/19. COVID-19 severely impacted the hospitality portfolio in FY20. Portfolio occupancy fell from 74% to 39%, resulting in a 64.5% nosedive in RevPAR. Revenue for the segment is expected to recovery gradually, in tandem with the sector. CDL’s cost containment initiatives to reduce duplication of roles and digitalisation efforts to lower manning cost should help improve margins, hastening its return to profitability. Keeping our forecast conservate, we projected 20% revenue CAGR for FY21e-FY25e. We expect the segment to turn NPI positive by 2024, before recovering to pre-pandemic levels in 2025.

- Listing of UK Commercial REIT to improve balance sheet. CDL applied for the initial public offering of UK commercial SREIT in June 2021. We understand that that CDL will co-sponsor the SREIT. Assuming a 20-25% stake for CDL, the injection of 125 Old Broad Street and Aldgate House into a 38%-geared S$3.5bn SREIT portfolio could unlock S$526-633mn for the group.

Outlook

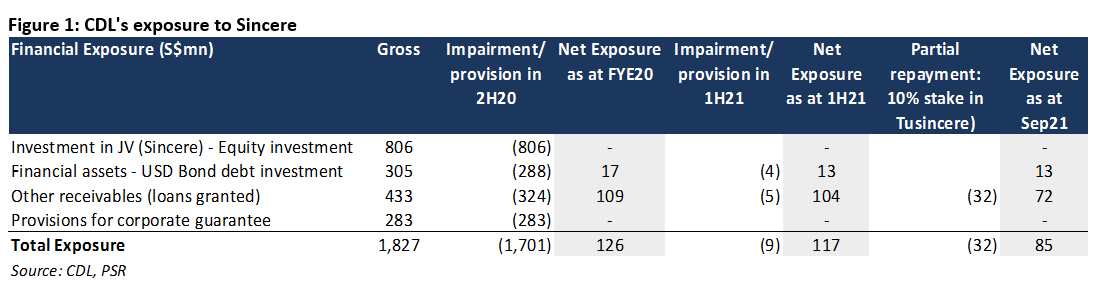

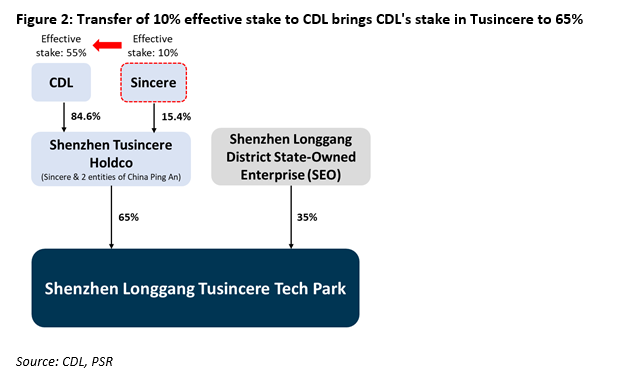

Closing the chapter on Sincere. CDL provided a S$1.7bn write down on its exposure to Sincere in 2H20, fully impairing its equity stake in Sincere. The sale of the equity stake in Sincere for US$1, which was announced on 10 September 2021, is CDL’s final attempt to turn the page on this chapter. In the announcement, CDL also reported the transfer of Sincere’s 10% effective stake in Shenzhen Longgang Tusincere Tech Park to the group, as partial repayment of loans extended to Sincere. This further reduces CDL’s exposure to Sincere to approximately S$85mn, while increasing CDL’s stake in Tusincere to 65% (Figure 1 and 2). CDL acquired its initial 55% stake in Feb21. As of 20 February 2021, 2224,933 sqm or 54% of the saleable area of Phase1-3 have been pre-sold, translating to sales proceeds of RMB7.2bn (c.S$1,477mn). Construction of Phase 4, the self-held office block, has not commenced.

Re-initiate with BUY and RNAV TP of S$9.19

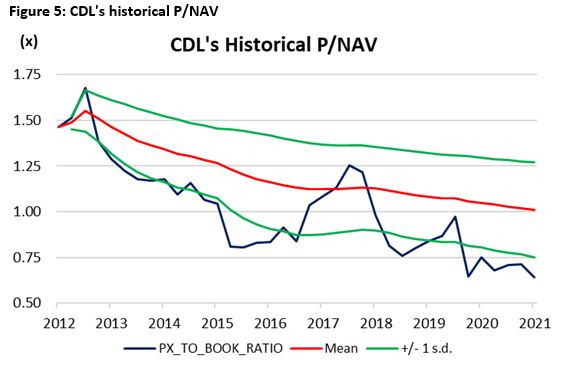

CDL is trading at an attractive 49% discount to our RNAV/share of S$14.14. Asset monetisation and faster-than-expected recovery in hospitality portfolio are potential catalyst for CDL while recent AEIs and redevelopments should strengthen income stream and portfolio.

Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY) Trade of the Day - Singapore Airlines (SGX: C6L)

Trade of the Day - Singapore Airlines (SGX: C6L) Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)

Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83) Trade of the Day - Microsoft Corp (NASDAQ: MSFT)

Trade of the Day - Microsoft Corp (NASDAQ: MSFT)