CapitaLand Investment Limited – Growth supported by RevPAU recovery

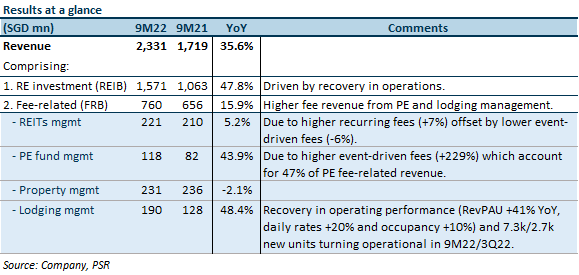

8 Nov 2022- 9M22 revenue of S$2,331mn (+36% YoY) was above our estimates, forming 88% of our forecast.

- RE investment revenue grew 48% YoY, driven by an occupancy recovery in their core markets, Singapore and India. Fee-related revenue was up 16% YoY, lifted by PE fund management (+44%) and lodging management (+48%) as RevPAU recovered to 92% of pre-pandemic 3Q22 levels.

- Maintain ACCUMULATE with an unchanged SOTP TP of S$4.12. We raise FY22e earnings by 8% as we increase RE investment revenue estimates for FY22e. The pick-up in travel and lifting of lockdowns in China will be immediate catalysts for CLI.

Note: In the 3Q22 update, only revenue and funds under management details were provided

The Positives

+ Fund management fee-related revenue (+16% YoY) formed 15% of revenue. PE fees (+44%) were boosted by higher transaction-related fees, which formed 47% of PE fees, while recurring PE fees dipped slight and fell 5% YoY. CLI’s listed funds posted +7% and -6% growth in recurring and transaction-related fees respectively. The latter was the result of a high base in 9M21, as transactions picked up after the pandemic year in 2020. Recurring fees made up 74% of 9M22 fee-related revenue.

+ Lodging segment recovering steadily. Lodging management fees rose 48% on recovering operating performance as well as 8.2k/7.3k new units turning operational in FY21/9M22. RevPAU grew 41% as average daily rates grew 20% and portfolio occupancy increased 10%. Recovery was seen across all CLI’s key markets, except China, with the strongest RevPAU recovery in Europe (+139%) and Singapore (+66%). The group also signed 7.3k keys in 9M22, ~89% of the number of keys signed in FY21, taking the number of keys signed to 155k. CLI is on track (~97%) to meet its 2023 target of signing 160k keys.

+ Real estate investment business (REIB) grew 48% YoY, on the back of reopening in most of CLI’s markets, except for China. Significant easing of community safe management measures since Mar 22 has improved business and consumer sentiment and increased activities. Leasing activity in India has similarly picked up with physical occupancy at business parks improving to ~39% from <5% in FY21.

The Negatives

– China retail lagging recovery. Due to China’s zero COVID-19 policy, China has not fully reopened since the start of the pandemic. While tenant sales in Singapore have recovered 29.4% YoY for 9M22, tenant sales in China declined 13.3%. Similarly, shopper traffic in China has declined 20.8% in China compared to an increase of 21.5% in Singapore. Occupancy at Chinese malls has dipped to 92% (2Q22: 92%), compared to the 97% retail occupancy for

Singapore.

– Macro-economic and geopolitical headwinds slowing fund generation and acquisition momentum. Inflation, rising interest rates and the Russia-Ukraine conflict have resulted in more circumspect behaviour and higher required returns for capital investors, limiting the assets eligible to seed funds. While USD-denominated capital has taken a wait-and-see approach towards RMB investments, CLI’s RMB fund management license allows it to tap local capital. However, continued lockdowns and tightened restrictions in China have impeded business discussions and may delay planned transactions.

Outlook

CLI’s real estate investment and lodging management business should continue to recover on the back of further easing of travel and mobility restrictions. After having divested S$2.4bn YTD, CLI is on track to hit its annual divestment target of S$3bn. However, its 10% FUM growth target may be at risk given the current macro-economic and geopolitical headwinds which have resulted in more circumspect behaviour among capital investors. Prolonged lockdowns in Shanghai and Beijing may also delay planned transactions.

Maintain ACCUMULATE with unchanged SOTP TP of S$4.12

We maintain our ACCUMULATE recommendation with an unchanged SOTP target price of S$4.12. We raise FY22e earnings by 8% as we increase RE investment revenue estimates for FY22e. Our SOTP derived TP of S$4.12 represents an upside of 9.5% and a P/E of 16.1x. The pick-up in travel and lifting of lockdowns in China will be immediate catalysts for CLI.

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

Netflix Inc. - Pricing power on display

Netflix Inc. - Pricing power on display Keppel DC REIT - DXC settlement offers partial relief from uncollected rents

Keppel DC REIT - DXC settlement offers partial relief from uncollected rents Apr 19th - Things to Know Before the Opening Bell

Apr 19th - Things to Know Before the Opening Bell Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY)