Salesforce Inc - Focused on margin expansion

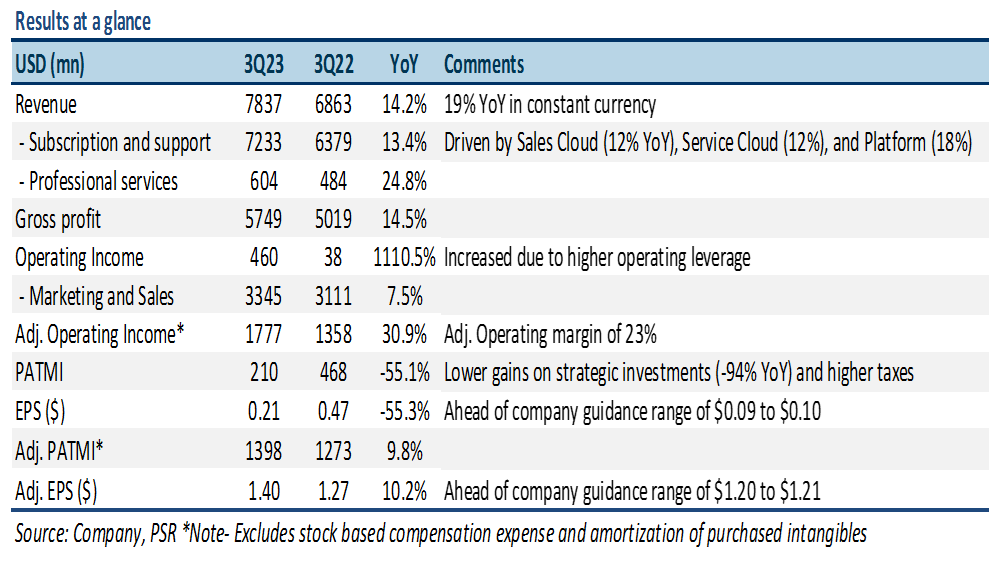

2 Dec 2022- 3Q23 results were in line with expectations. 9M23 revenue/adjusted PATMI was at 74%/75% of our FY23e forecasts. Revenue grew 19% YoY in constant currency driven by continued demand strength for its Customer 360 platform and new customer wins.

- operating margin was a record high 23% driven by lower marketing and sales expenses, including measured hiring. Future contracted revenue or remaining performance obligations (RPO) grew by 10% YoY to US$40bn.

- We maintain a BUY recommendation with a lower DCF target price of US$205 (WACC 7%, g 4%), down from US$213. Our FY23e revenue is nudged lower 1% due to a slower macro environment and incremental FX headwinds; while we have increased our adjusted PATMI by 3% due to lower expenses. Salesforce enjoys tailwinds from digital transformation trends as companies seek to have a single view of their customer data.

The Positives

+ Strength in core products drives growth. Salesforce recorded revenue of US$7.8bn for 3Q23, slightly above the top-end of its guidance, representing a 14% YoY growth (19% YoY in constant currency). The core segments continued to gain momentum in the quarter with Sales Cloud revenue growing 12% YoY to US$1.7bn and Service Cloud also growing 12% YoY as it neared the US$2bn revenue mark. Slack revenue grew 46% YoY to about US$402mn. Remaining performance obligations (RPO), which represent future revenue under contract, grew by 10% YoY to US$40bn. The current portion of RPO (cRPO), which the company expects to be recognized in the next 12 months, increased by 11% YoY to US$20.9bn. This was driven by the strength of its Customer 360 platform, new customer wins (Bank of America and Dell), and multi-cloud adoption.

+ Record-high operating margin. In 3Q23, Salesforce reported adj. operating margin of 23% compared with 20% in 3Q22. This was mainly driven by continued focus on operational discipline, driving cost controls through measured hiring and reductions in sales-related travel and entertainment expenses.

The Negative

– FX continues to be a headwind. Salesforce’s revenue was negatively impacted due to the strengthening of the dollar against several key foreign currencies, including the Euro, British pound, and Japanese yen. In 3Q23, FX headwind to revenue was US$300mn (143% of PATMI), higher than the company’s guidance of US$250mn. Salesforce projects US$250mn headwind from FX in 4Q23e.

Outlook

For 4Q23e, Salesforce expects total revenue to be in the range of US$7.93bn to US$8.03bn, representing growth of 8% to 10% YoY. Management also guided GAAP EPS/adj. EPS to be in the range of US$0.23 to US$0.25 and US$1.35 to US$1.37, respectively. The current portion of RPO (cRPO) is expected to grow by 7% in 4Q23e, which implies cRPO of US$23.5bn. This suggests further deterioration in the quarter amid intense customer scrutiny of deals in the US and major European markets. Salesforce acknowledged tougher demand backdrop with elongated sales cycles and deal size compression.

While Salesforce didn’t provide preliminary guidance for FY24e, it did mention that investors should anticipate margin expansion driven by higher operating leverage, including measured hiring and lower travel and entertainment expenses. The company reiterated its target of returning 30% to 40% of free cash flow annually to shareholders on average. Salesforce repurchased US$1.7bn of its stock in 3Q23 out of its authorized US$10bn buyback program.

Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY) Trade of the Day - Singapore Airlines (SGX: C6L)

Trade of the Day - Singapore Airlines (SGX: C6L) Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)

Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83) Trade of the Day - Microsoft Corp (NASDAQ: MSFT)

Trade of the Day - Microsoft Corp (NASDAQ: MSFT)