Salesforce Inc - Good growth metrics; Announces US$10bn buyback

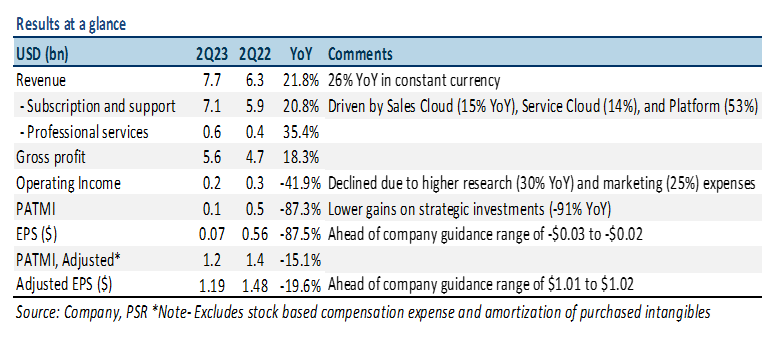

31 Aug 2022- 2Q23 results were in line with expectations. 1H23 revenue/adjusted PATMI was at 48%/45% of our FY23e forecasts. Total revenue grew 22% YoY to US$7.7bn driven by continued demand for its Customer 360 offerings and new customer wins.

- Future contracted revenue or remaining performance obligations (RPO) grew by 15% YoY to US$41.6bn. Multi-cloud adoption maintained traction as the number of customers purchasing five or more of Salesforce’s cloud products grew by double digits.

- We maintain a BUY recommendation with a lowered DCF target price of US$213.00 (prev. US$253.00), with an increased WACC of 6.6% and a terminal growth rate of 4.0%. We nudge lower our FY23e revenue/adjusted PATMI by 2%/1% due to FX headwinds and cautious IT spending environment. Despite the macro impact, Salesforce enjoys longer term tailwinds from cloud-based digital transformation trends as companies look to form a more holistic views of their customers.

The Positives

+ Revenue beat top-end of guidance. Salesforce recorded revenue of US$7.7bn for 2Q23, slightly above the top-end of its guidance, representing a 22% YoY growth (26% YoY in constant currency). Revenue growth was driven mainly by Sales (15% YoY) and Service (14% YoY) cloud segments and accounted for 49% of total revenue during the quarter. Platform, which includes collaboration tool Slack, rose 53% YoY to US$1.5bn – the highest YoY revenue increase in 2Q23. Slack contributed US$376mn to 2Q23 revenue (25% of Platform), above the company’s estimate of US$360mn. The number of paid customers on Slack spending over US$100K annually surged by more than 40% YoY in 2Q23.

+ In-line metrics supporting growth. Remaining performance obligations (RPO), which represent future revenue that is under contract but hasn’t been recognized, grew by 15% YoY to US$41.6bn. The current portion of RPO (cRPO), which the company expects to be recognized in the next 12 months, increased by 15% YoY to US$21.5bn. This is mainly because of continued demand for its Customer 360 offerings and new customer wins. Multi-cloud adoption maintained traction as the number of customers purchasing five or more of Salesforce’s cloud products grew by double digits. Also, the attrition rate remained at record lows of about 7.5%.

+ Authorizes first ever US$10bn stock buyback. Salesforce announced a share repurchase program for up to US$10bn to offset dilution from stock-based compensation. Management also stated that it plans to maintain a healthy balance sheet to help fund any future M&A and ongoing investments in organic innovation.

The Negatives

– Higher-than-expected FX headwinds. FX had a negative impact of US$250mn on 2Q23 revenues (368% of PATMI), higher than the company’s guidance of US$200mn. Currency is now expected to negatively impact FY23e revenue growth by US$800mn, up from the US$600mn projected previously.

Outlook

For FY23e, Salesforce reduced its revenue guidance to US$30.9bn to US$31.0bn (prev US$31.7bn to US$31.8bn), representing growth of about 17% YoY. The downward revision was mainly because of unfavorable foreign currency exchange rates and cautious buying behavior resulting in a lengthened sales cycle, increased deal scrutiny, and deal compression. The updated guidance includes US$1.5bn of revenue contribution from Slack business. However, Salesforce maintained its adjusted operating margin forecast of 20.4% driven by higher operating leverage (measured hiring and lower travel and entertainment expenses). Salesforce also slightly reduced its adjusted EPS guidance range to US$4.71 to US$4.73 (prev US$4.74 to US$4.76) but reiterated its GAAP EPS range of US$0.38 to US$0.40.

For 3Q23e, Salesforce expects adjusted EPS to be in the range of US$1.20 to US$1.21 on total revenue of US$7.825bn at the midpoint of guidance. The company also expects cRPO growth of about 12% YoY.

Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY) Trade of the Day - Singapore Airlines (SGX: C6L)

Trade of the Day - Singapore Airlines (SGX: C6L) Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)

Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83) Trade of the Day - Microsoft Corp (NASDAQ: MSFT)

Trade of the Day - Microsoft Corp (NASDAQ: MSFT)