CapitaLand Mall Trust - Uphill from here

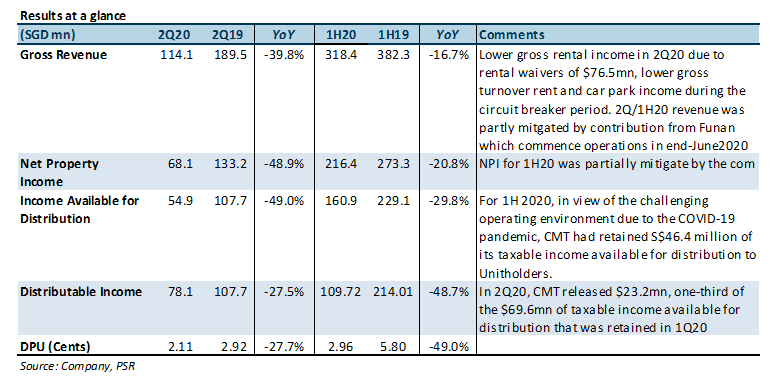

24 Jul 2020- 1H20 DPU of 2.96cents was -49% YoY and included one-third ($23.2mn) of the distributable income retained in 1Q20.

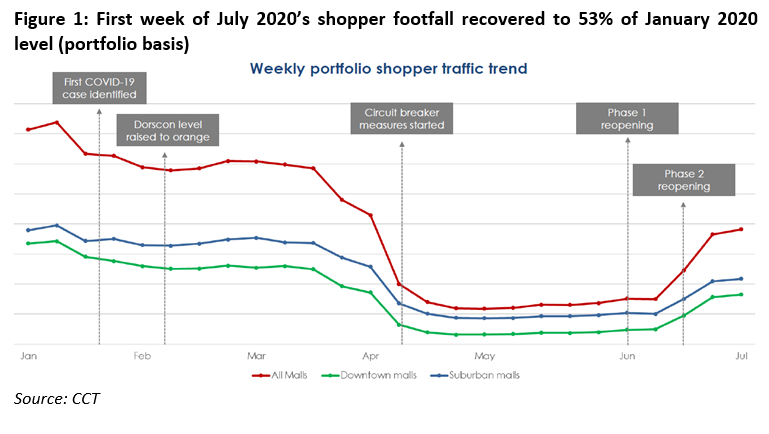

- The worst is over, barring a second wave of the virus. Footfall has recovered to 53% of January levels. 1H20 tenant sales fell -15.4% YoY, better than expected, while portfolio occupancy remained high at 97.7%, clocking +0.1% rental reversions for 2Q20.

- Maintain BUY with an unchanged TP of $2.33. We are keeping our estimates unchanged as we have previously incorporated c.$80mn of out-of-pocket (OOP) rental rebates, above the $76.5mn OOP rebates guidance for 1H20.

The Positives

+ Tenant sales fell by a smaller magnitude (-15.4%) compared to footfall (-40.6%). This was due to the strong performance by Supermarkets (+18.6%) and pent-up demand for Books & Stationery (+0.7%). CapitaLand also launched e-commerce platform (eCapitaMall) and online food ordering platform (Capita3Eats) on 1 June 2020 which was able to help tenants capture some sales, adding to tenant sales.

+ Eked out +0.1% rental reversions in 2Q20 (1Q20: 1.6%). Reversions were a mixed, with with downtown and suburban malls clocking both positive and negative rental reversions. There were non-renewals of c.2% of NLA in the quarter. 7.6% of leases by GRI remains for the FY20. Occupancy remained high at 97.7%, although it has come down from 99.3% as at 31 December 2020. We are expecting a softer leasing environment for the 2H20.

The Negatives

– Amount of rental rebates increased from $114mn to $154.5mn. The amount of rental relief committed as at 30 June 2020 was $154.4.5mn which comprised rental waivers from landlord, property tax rebates and cash grant (to be reimbursed by the government) and rental relief to qualifying SME tenants (based on CMT’s estimation of 60% SME tenants). This was $40.5mn higher than the $114mn (including property tax rebates) committed in April 2020, but largely attributed to the cash grant for SMEs from the government which are on a pass-through basis. Pending clarification from the authorities on definition and prescription of SMEs under the “New Rental Relief Framework for SMEs” (COVID-19 Bill), CMT may have to increase the amount of rental support given.

– Portfolio valuations fell 2.5% (including RCS 2.7%). Valuations were lower by -0.6% (Junction 8) to -4.8% (Clark Quay). The valuations were largely driven by lower market rents and rental growth rates due to economic uncertainties and COVID-19. There was no change in capitalisation rate assumptions.

Outlook

95% of CMT’s tenants are operating and shopper footfall has recovered to 53% of January 2020 levels as of the first week of July (1H20: 40.6%, Figure 1). Footfall at suburban malls was c.58% of January levels, with stronger suburban mall registering up to 80% of normalised footfall. Footfall at downtown malls ranged between 40-55%, averaging 49%.

Tenant relief package

In addition to the rental rebates of $154.5mn, CMT has also waived turnover rent and allowed tenants to release one month security deposits to offset rents. On average, CMT collects 3 to 5 months of security deposit from tenants. The release of 1 month’s security leaves 2 to 4 months of security deposits as a safety net.

Leases with higher risk-sharing

Maintaining occupancy remains a high priority. Apart from granting rental deferments, CMT allowed lease restructuring as a more holistic solution for tenants in this uncertainty environment. Going forward, we can expect the more leases with risk sharing. While structuring leases with higher risk-sharing, CMT will aim to keep occupancy cost between c.18%, consistent with historical occupancy cost. The management shared that they will be prepared to offer leases with more risk-sharing in the initial years for selected new-to-market brands (e.g. 1st year – pure GTO rents, 2nd and 3rd year some fixed rent tagged to certain level of sales).

CMT employed this strategy with Funan, which has a comparatively higher number of tenants on lease structures with a larger GTO component. In the long run, higher risk-sharing may increase the demand for retail space as the lower fixed rents makes it more economically viable for new-to-market brands to give the brick-and-mortar model a go – 30% of Funan’s tenant are new-to-market brands.

Maintain BUY with an unchanged TP of $2.33.

Maintain BUY with an unchanged TP of $2.33. We are keeping our estimates unchanged as we have previously incorporated c.$80mn of out-of-pocket (OOP) rental rebates, above the $76.5mn OOP rebates guidance for 1H20. Our FY20e/20e DPU presents a FY20e DPU yield of 5.8%/6.3%.

Apr 25th - Things to Know Before the Opening Bell

Apr 25th - Things to Know Before the Opening Bell JPMorgan Chase & Co - NII continues to rise, guidance maintained

JPMorgan Chase & Co - NII continues to rise, guidance maintained Trade of the Day - NVIDIA Corporation (NASDAQ: NVDA)

Trade of the Day - NVIDIA Corporation (NASDAQ: NVDA) Trade of the Day - Applied Materials, Inc. (NASDAQ: AMAT)

Trade of the Day - Applied Materials, Inc. (NASDAQ: AMAT)