CapitaLand Mall Trust - Veterans in retail may emerge stronger

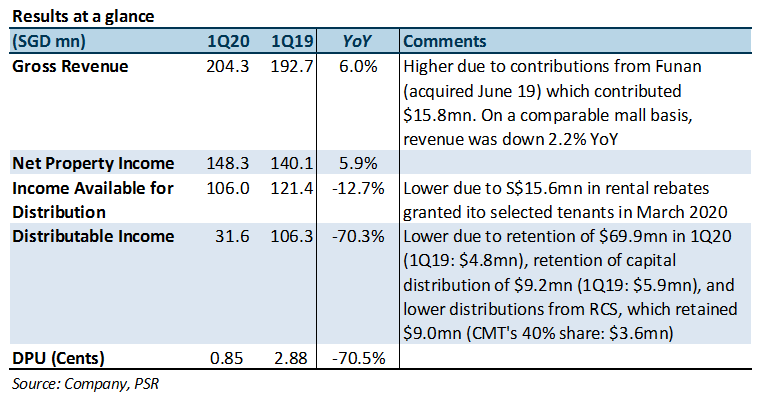

6 May 2020- 1Q20 revenue was in line with our forecast, DPU of 0.85 cents was 70.5% lower YoY due to retention of distributions.

- Tenant sales down 7.5%, full impact of circuit breaker will be felt in 2Q20.

- $114mn in tenant reliefs translates to 100% rebate for April and May for retail tenants. 2 to 4 months of security deposits remain.

- We lower our forecast to reflect the rental rebates and weaker retail outlook. The rental rebates will lower FY20e DPU by2%. FY20e DPU is cut from 12.51 cents to 10.78 cents representing a DPU yield of 5.9%. We upgrade our call to BUY on attractive valuations – P/NAV at 0.87x is attractive compared to the 1.09x to 1.29x range CMT has been trading at in the last 3 years.

The Positives

+ One-third of FY20’s lease expiries renewed in 1Q20 with average reversion of 1.6%. Out of the 21.3% of leases (by GRI) expiring in FY20, 11.9% of leases by GRI remains for the year. While the positive rental reversion achieved in 1Q20 is not indicative of future reversions which are expected to be mildly negative, the comparatively low expiries remaining for FY20 is a mild consolation. A higher 28.5% of leases will expire in FY21. The management is prioritising occupancy rates and will exercise creativity and flexibility in their leasing strategy.

The Negatives

– 1Q20 tenant sales down 7.5% YoY. Tenant sales for the top 5 trade categories which contribute >70% of gross rental income fell 6.5%. The only trade category which experienced positive tenant sales were the Supermarket (+13.1%) and Books & Stationery (+0%).

– Pre-terminations at Clark Quay in the low-single digits, by NLA. Pre-terminations from a mixed basket of trade categories. Reasons for pre-termination varied, some due to headquarter issues, and others were terminating a few months in advance.

Outlook

Full impact of the circuit breaker (7 April to 1 June 2020) will be felt in 2Q20. Only c.25% of portfolio tenants were operating in April. Footfall in April during the circuit breaker was 40% lower as compared to in January 2020.

Tenant relief package

CMT has committed to $114mn (inclusive of property tax rebates) of tenant relief, which translates to 100% rental rebates for April and May for almost all retail tenants, and allowed tenants to use 1 month of security deposit to offset rents in March. On average, CMT collects 3 to 5 months of security deposit from tenants. The release of 1 month’s security leaves 2 to 4 months of security deposits as a safety net.

Leases with higher risk-sharing

Potentially more leases with higher profit-sharing and lower fixed components will be seen in the future. The COVID-19 situation has highlighted the vulnerable positions retail tenants are in, with their thin margins as well as the market’s expectation for landlords to have “more skin in the game”. In the near-term, CMT will exercise flexibility in their leasing strategy, which may mean shorter lease terms with higher risk-sharing.

The management commented that they are prepared to take on more risk-sharing and we have seen CMT employ this strategy with Funan, which has a comparatively higher number of tenants on lease structures with a larger GTO component. In the long run, higher risk-sharing may increase the demand for retail space as the lower fixed rents makes it more economically viable for new-to-market brands to give the brick-and-mortar model a go – 30% of Funan’s tenant are new-to-market brands.

Upgrade to BUY with lower TP of S$2.22 (prev. $2.70).

We lower our forecasts to reflect the rental rebates and weaker retail outlook. Our cost of equity assumption is raised by 105bps to 7.25%. The rental rebates will lower FY20e DPU by 14.2% – FY20e DPU is cut from 12.51cents to 10.78cents representing a DPU yield of 5.9%.

We upgrade our call to BUY on attractive valuations – P/NAV at 0.87x is attractive compared to the 1.09x to 1.29x range CMT has been trading at in the last 3 year.

Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY) Trade of the Day - Singapore Airlines (SGX: C6L)

Trade of the Day - Singapore Airlines (SGX: C6L) Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)

Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83) Trade of the Day - Microsoft Corp (NASDAQ: MSFT)

Trade of the Day - Microsoft Corp (NASDAQ: MSFT)