DBS Group Holdings Ltd - Higher net interest margin lift profits

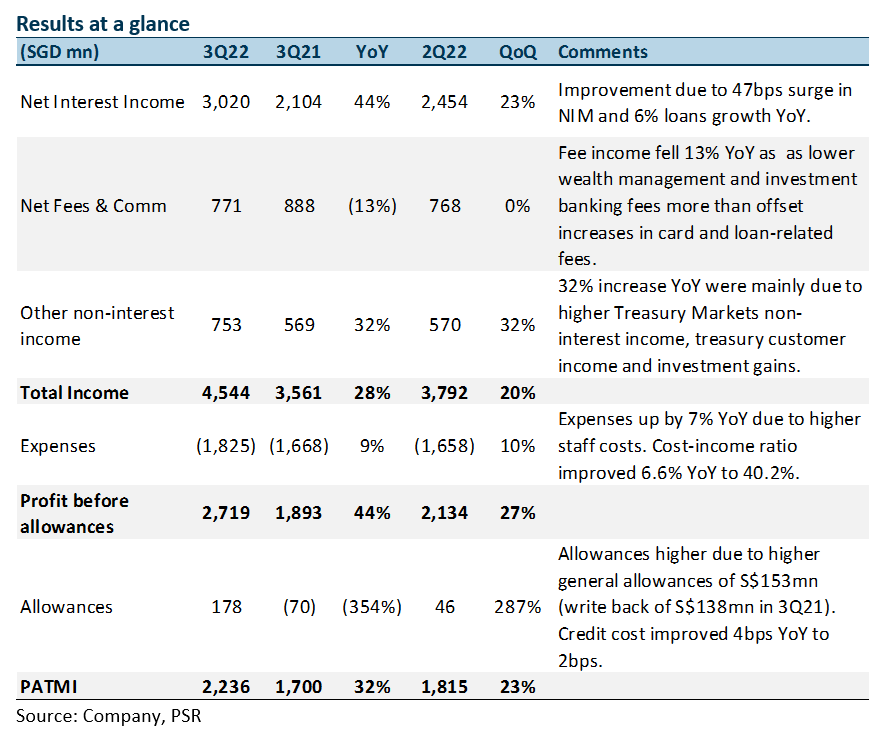

4 Nov 2022- 3Q22 earnings of S$2.24bn in line with our estimates due to higher net interest income (NII) and net interest margins (NIM) slightly offset by lower fee income and higher allowances. 9M22 PATMI is 77% of our FY22e forecast. 3Q22 DPS up 9% YoY at 36 cents.

- NII surged 44% YoY to S$3bn on NIM expansion of 47bps to 1.90% and loan growth of 6% YoY. Fee income fell 13% YoY due to weaker market sentiment while other non-interest income increased 32% YoY. 3Q22 ROE increased 4.2% points YoY to 16.3%.

- Maintain BUY with an unchanged target price of S$41.60. We raise FY22e earnings by 3% as we increase NII estimates for FY22e. We assume 1.77x FY22e P/BV and ROE estimate of 13.6% in our GGM valuation. We raised FY23e earnings by 6% as we increase NII estimates for FY23e. Our ROE estimate for FY23e is raised from 14.7% to 14.9%. A 50bps move in interest can raise earnings by 13%.

The Positives

+ NIM and NII surge. NII grew 44% YoY to S$3.02bn due to NIM increase of 47bps YoY to 1.90% (1Q22: +3bps, 2Q22: +12bps, 3Q22: +32bps) and continued loan growth of 6% YoY. Loan growth was driven by housing and non-trade corporate loans offset by lower trade loans as maturing exposures were not replaced due to unattractive pricing. Management has maintained NIM guidance of 1.75% for FY22e and targets to reach 2% by 4Q22.

+ Other non-interest income up 32% YoY. Other non-interest income was up 32% YoY and QoQ mainly due to higher Treasury Markets non-interest income, treasury customer income and investment gains.

+ Asset quality stable; 3Q22 allowances at S$178mn. 3Q22 total allowances were higher YoY and QoQ due to higher GPs of S$153mn for the quarter (write back of S$23mn in 2Q22). Nonetheless, credit costs improved by 4bps YoY to 2bps as SPs were lower YoY and QoQ at S$25mn. GP reserves rose to S$3.9bn, with NPA reserves at 120% and unsecured NPA reserves at 216%. The NPL ratio declined to 1.2% (3Q21: 1.5%) as new NPA formation remained low and was more than offset by higher upgrades and repayments.

The Negatives

– Fee income fell 13% YoY. The fee income decline YoY was mainly due to weaker market sentiment affecting wealth management and investment banking which more than offset increases in card and loan-related fees. WM fees fell 30% YoY to S$323mn as market conditions further weakened during the quarter. Investment banking fees fell by 38% YoY to S$25mn alongside a slowdown in capital market activities. Nonetheless, card fees improved 24% YoY to S$223mn as borders start to reopen and spending increased, while loan-related fees increased 15% to S$122mn.

– CASA ratio declined YoY. The Current Account Savings Accounts (CASA) ratio fell 8.9% YoY to 60.3% mainly due to the high interest rate environment and a move towards fixed deposits (FD). Nonetheless, total customer deposits increased 9% YoY to S$533bn. Management said that the drop in CASA was expected and that the increase in FDs was higher than the drop in CASA, hence a net increase in deposits.

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

Trade of the Day - Microsoft Corp (NASDAQ: MSFT)

Trade of the Day - Microsoft Corp (NASDAQ: MSFT) Apr 15th - Things to Know Before the Opening Bell

Apr 15th - Things to Know Before the Opening Bell Singapore REITs Monthly – Waiting for interest rate cuts

Singapore REITs Monthly – Waiting for interest rate cuts Apr 12th - Things to Know Before the Opening Bell

Apr 12th - Things to Know Before the Opening Bell