Del Monte Pacific Limited - Temporary de-stocking in channels

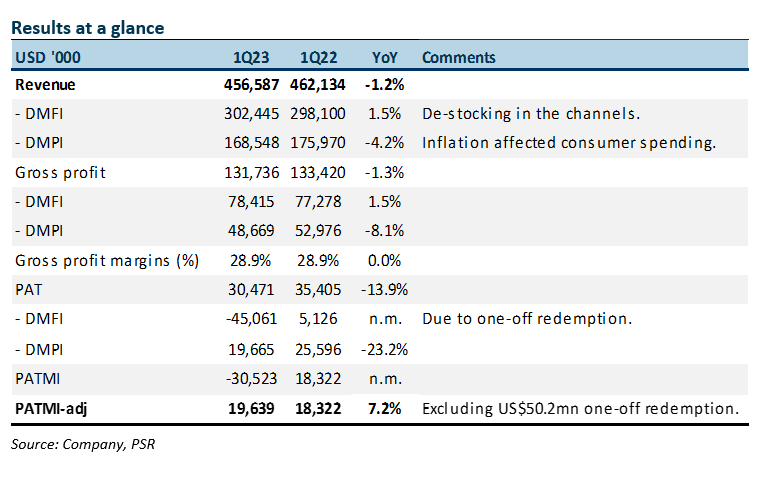

12 Sep 2022- 1Q23 results were within expectations. 1Q23 revenue and PATMI (excluding one-offs) were 20%/19% of our FY23e forecast. There was a US$50.2mn one-off redemption fee and deferred financing cost write-off (net of tax and minority interest). 1Q is seasonally the weakest. Currency impacted Philippine revenue by 8% points.

- Revenue growth decelerated to a 1% YoY rise in 1Q23 due to short-term destocking in the channel. We are modelling 8% revenue growth in FY23e.

- Our F23e earnings are unchanged. We maintain our BUY recommendation and unchanged target price of S$0.69, pegged to 10x FY22e P/E, a 30% discount to the industry valuation due to its smaller market cap and higher gearing. Del Monte valuations are attractive at 5x PE FY23e. As consumer wallets shrink due to inflation, consumers in the US are relying on more meals prepared at home. It benefits Del Monte canned vegetables, fruits and broth categories. The Philippines is gradually recovering from consumers prioritizing basic foodstuff away from canned fruit.

The Positives

+ Healthy gross margins. Gross margin was maintained at 28.9%, higher than our modelled 25.8% and 4Q22’s 25.9%. A combination of higher prices in June 2022 and packaging changes helped support margins. In early September, the US operations underwent their third round of phased price increases since May 2021.

+ Joint venture returning to profitability. The joint venture in India turned around from a US$0.6mn loss to a US$0.7mn profit. Earnings benefited from 19% YoY growth in revenue together with margin improvement. India has discontinued fresh business and a greater focus on B2B sales. There have also been management changes.

The Negatives

– One-off refinancing cost. In May 2022, Del Monte refinanced the US$500mn 11.875% p.a. 2025 high yield senior secured note with a US$600mn 7-year Term Loan facility. The interest on the loan is SOFR plus 4.25% or 6.45% currently. The early redemption incurred a US$71.9mn one-off cost (or US$50.2mn post-tax and minority interest). Current savings on the refinancing are around US$27mn p.a.

– Sluggish revenue. Revenue growth decelerated to a negative 1.2% YoY in 1Q23e to US$456mn. It is a major deceleration from the 14% YoY growth in 4Q22. The US growth rate slowed to 1.5% (4Q22: +25% YoY). We believe there was a general de-stocking exercise by US retailers in the quarter (Figure 3). The Philippines faced several hiccups during the quarter. There was a change in the distributor; de-loading of inventory in May and June; consumers shifting away from discretionary; and some market share loss in ready-to-drink juice to cheaper PET bottled juices. Another headwind was the 8% decline in the Philippine peso.

Outlook

We expect a healthy recovery in the coming quarters.

- US: Del Monte Food is riding on the increased dining and preparation of meals in homes. In addition, consumers are shifting to more value items in the centre store, away from fresh and frozen. Del Monte’s trusted brand and value image have allowed it to fend off even cheaper house brands. Around 75% of products cost less than US$2. Multi-pack offerings are also gaining traction as consumers pantry load with lower unit price points.

- Philippines: In August, volumes were up 33% YoY. The inventory de-loading and transitioning to the new distributor are complete. There is a planned price increase in October. Re-opening is supporting the food service and convenience store channel. To cope with the consumers’ shrinking wallet size, products are repacked to more value bundles. Del Monte will not lower its price point in beverages from the current P20 to P10, to compete with lower priced PET juices. The improving macro environment is another catalyst to support the recovery.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY) Trade of the Day - Singapore Airlines (SGX: C6L)

Trade of the Day - Singapore Airlines (SGX: C6L) Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)

Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83) Trade of the Day - Microsoft Corp (NASDAQ: MSFT)

Trade of the Day - Microsoft Corp (NASDAQ: MSFT)