First Reit - Stock Analyst Research

| Target Price* | - |

| Recommendation | NON-RATED› NON-RATED |

| Market Cap* | - |

| Publication Date | 25 Mar 2024 |

*At the time of publication

First REIT - Virtuous cycle in Indonesia healthcare

- We visited First REIT’s four hospitals in Jakarta operated by Indonesia-listed Siloam International Hospitals [Rp2,270, Not Rated]. The hospitals were bustling with activity, well equipped, nicely furbished and offered advanced specialist care including neurology, oncology, gastropathy, urology and fertility.

- Indonesia faces an acute shortage of specialists. Specialists are drawn to modern healthcare equipment and patients. Investing early in private hospitals allowed Siloam to establish a reputation and location that draws patients. It has around 20 hospitals that are a decade old. With the patient flow, it can invest in more sophisticated equipment, which in turn attracts more specialists and patients. A perpetuating loop of specialists, equipment and patients is created.

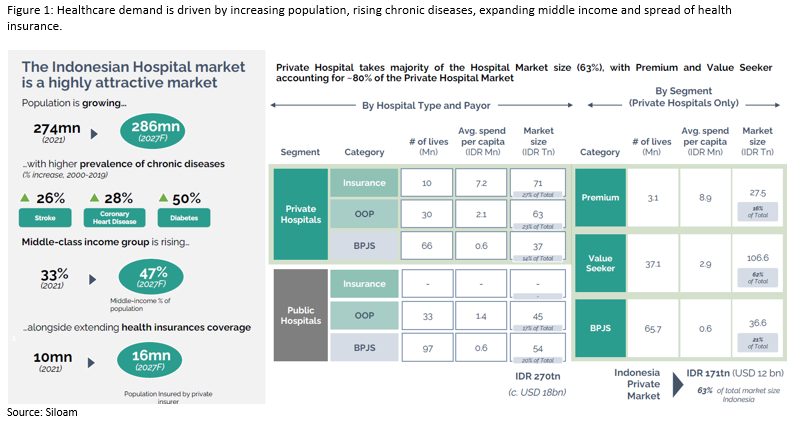

- First REIT collects rent from Indonesia hospitals in rupiah from the higher of 4.5% annual or performance rent which is 8% of gross operating revenue in the preceding year. In FY23, rental growth in rupiah terms rose 7.6%, of which three hospitals were at performance rent. Rental income from Indonesia could grow faster in FY24 as Siloam revenue expands 18% YoY in 9M23. The four macro drivers for healthcare demand are the growing population, the rising rate of chronic diseases, expanding middle income and the spread of health insurance.

Company Background

First REIT (FIRT) is Singapore’s first healthcare REIT that focuses on investing in income-producing real estate assets that are primarily used for healthcare-related purposes. Its S$1.14bn portfolio consists of 32 properties comprising 15 in Indonesia (74% of assets under management), 14 in Japan (23%), and 3 in Singapore (3%). FIRT’s sponsors are OUE Limited and OUE Lippo Healthcare Limited (OUELH). FIRT has the right-of-first-refusal (ROFR) from OUELH, and a ROFR to a pipeline of hospitals from Lippo Karawachi (LPKR), a majority shareholder of Siloam. Siloam International Hospitals (39%) and LPKR (35%) are major tenants.

VISIT HIGHLIGHTS

Day 1 – 18Mar24: Siloam International / Siloam Hospital Simatupang / Mochtar Riady Comprehensive Cancer

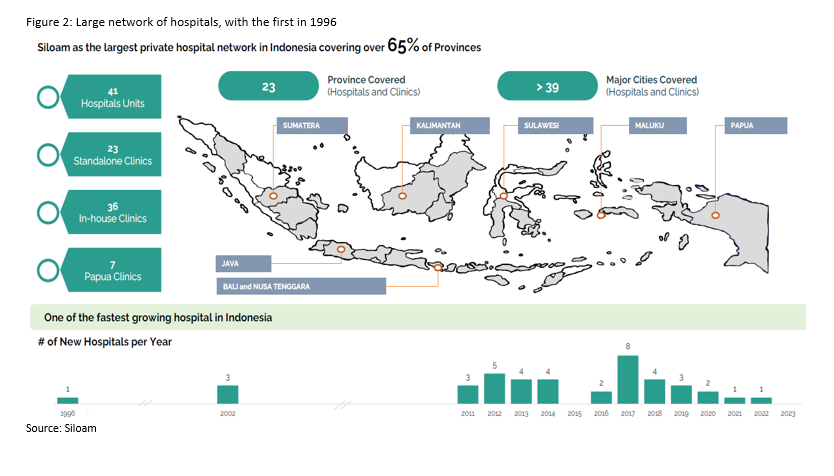

- PT Siloam International Hospitals Tbk (Figures 1 and 2)

Siloam operates 41 hospitals and 3,800 operational beds across Indonesia, serviced by 3,600 plus general practitioners, specialists, and dentists. It has around 9% market share in the private hospital sector. Siloam started investing in private hospitals in 1996. But only ramped up its expansion in 2011. The general practitioners are employees of Siloam. Other doctors collect 100% of the consultation fees in outpatient and inpatient treatment. In general, 20-35% of hospital bills go to the doctor. The annual price increase ranges from 3 to 4%. Rental is 6% to 6.5% of revenue. The new law for foreign doctors to practise in Indonesia, it will require several years. The new government needs to be set up and implementation law passed.

- Siloam Hospitals TB Simatupang (Figures 3 to 6): Established in 2013, it is a 26-storey 100 operational bed hospital. Centers of excellence include Cardiology, Neuroscience, and Oncology. It is the largest hospital in South Jakarta. We visited the basement floor used for chemotherapy and oncology. The equipment we saw included a linear acceleration machine (LINAC) by Varian used in the treatment of cancer. High-energy beams are used to destroy cancer cells. It was a general hospital that included many other services including health screening, orthopaedics, paediatrics, pulmonology, dental, psychiatry and emergency.

- Mochtar Riady Comprehensive Cancer Centre (Figures 7 to 10): Established in 2010, this hospital in Central Jakarta specialises in Gastroenterology and Oncology. It treats multiple forms of cancer, including liver, pancreatic, breast, stomach, blood, lung, and bone. There are four PET CT scans (imaging tests of organs and tissue) in Indonesia, two of which are located in this hospital.

Day 2 – 19Mar24: Siloam Hospitals Kebon Jeruk / Siloam Hospitals Lippo Village

- Siloam Hospitals Kebon Jeruk (Figures 11 to 14): Established in 1991, it is the oldest private hospital in West Jakarta and is surrounded by a large residential population. It is the hub in Orthopaedic, Urology, Cardiology and Radiology for the Siloam network of hospitals. There are around 200 specialists and sub-specialists. It no longer takes in National Health Insurance (BPJS) patients since 2020. In our discussion with management, raising prices is not the focus, it is raising the level of complex and advanced treatments and procedures. When the pandemic occurred, and patients could not travel abroad for treatment, it was a “golden period” for Siloam to showcase the quality and sophistication of their services.

- Siloam Hospitals Lippo Village (Figure 15 to 18): Established in 1995, it is one of the largest hospitals in the region with a 274-bed capacity. It was the busiest hospital that we visited. There is a waitlist for the hospital beds. The hospital attracts patients outside Jakarta, which can account for 20-30% of advanced cases. The hospital can provide 600 surgeries per month with 1,000 outpatients on weekends. It is housed by around 200 specialists and sub-specialists, of which 30% are visiting specialists. Specialists in Indonesia are allowed to practise in three hospitals. Resident specialists will enjoy higher fees and better premises.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

Apr 19th - Things to Know Before the Opening Bell

Apr 19th - Things to Know Before the Opening Bell Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY) Trade of the Day - Singapore Airlines (SGX: C6L)

Trade of the Day - Singapore Airlines (SGX: C6L) Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)

Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)