First Sponsor - Stock Analyst Research

| Target Price* | 1.390 |

| Recommendation | ACCUMULATE› ACCUMULATE |

| Market Cap* | - |

| Publication Date | 2 Nov 2022 |

*At the time of publication

FIRST SPONSOR GROUP LIMITED - Dongguan projects see better sales

- No financials provided in a voluntary 3Q22 business update.

- Housing policy relaxation measures in Dongguan drove sales higher. Time Zone saw faster sales in 3Q22 vs. 1H22.

- The Group’s European property holdings (PH) segment saw stronger performances for both its office and hotel portfolio.

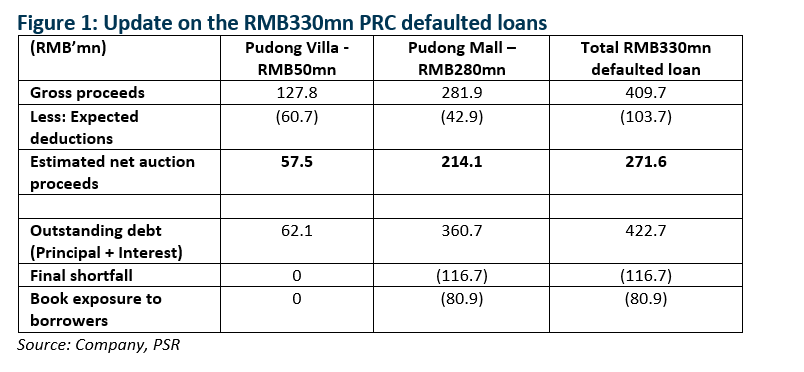

- Lower tax liabilities saw a higher recovery of Group’s RMB330mn PRC defaulted loan. The Group’s total tax liabilities for its Pudong Villa and Pudong Mall were settled at about RMB35mn lower than expected.

- Maintain ACCUMULATE with unchanged SOTP target price of S$1.39. Catalysts for a TP upgrade are a recovery in the Chinese property market and its China hotel portfolio.

The Positives

+ Time Zone saw faster sales in 3Q22 vs. 1H22. Residential sales of its 17.3%-owned Humen development saw sales accelerate in 3Q22 to 306 units vs. 329 units sold in 1H22. The better sales reflect the recent ease in housing policy restrictions in Dongguan as the Group released another 255 units during the quarter. Housing policy restrictions in Dongguan have been mostly lifted except for the five core districts, where some degree of restrictions are still in place.

+ European PH saw stronger performances for both its office and hotel portfolio. The Group’s operating results in this segment came in at 77% of FY22e. Its Bilderberg hotel portfolio saw a strong recovery with occupancy increasing to 73.2% vs. 64% in the same period last year. The recovery in its hotel properties was driven by a combination of fewer Covid-19 restrictions and strong leisure and meeting business.

+ Group’s PRC PF loanbook decline less than expected. During the quarter, the Group’s PRC PF loan book stood at RMB1.2bn (-9% YoY) as at 30 Sept 2022, above our estimate of RMB1.09bn. The repayment came from the repayment from the S$97mn and S$89mn junior and senior convertible bonds which it hold for the purpose of financing the acquisition and conversion of the land parcel, and the development of Oasis Mansion.

+ Lower tax liabilities see higher recovery of Group’s RMB330mn PRC defaulted loans. The Group’s total tax liabilities for its Pudong Villa and Pudong Mall were settled at about RMB35mn lower than was initially projected. The net effect of this is an overall improvement in its overall net auction proceeds to RMB306mn from RMB271.6mn previously and an improvement to the overall book exposure to RMB80.9mn from RMB112.8mn

|

Potential recovery from the disposal of Pudong Mall. The legal title of the Pudong Mall as well as net auction proceeds of the Pudong Villa are expected to be transferred to the Group in 3Q22. As the Group managed to win the title of the mall through an auction process, we believe there is upside to the valuation of the mall at the end of the year when a valuation is done. We believe the Group will attempt to divest the mall to recover the shortfall, which we estimate to be in FY23e.

The Negatives – Primus Bay residential apartment blocks continue to see slower sales. The pre-sales for the three residential blocks in Panyu, Guangzhou, with 177 units was launched on 26 May this year, with only 13% of the units sold as the weak macro backdrop weighed on sales. ASP of RMB26,200sqm is on the lower end of the spectrum, but we expect pricing to remain stable as the Group will launch the smaller units in 2H22, which should support pricing. |

About the author

Terence Chua

Senior Research Analyst

Phillip Securities Research

Terence specialises in the consumer, conglomerate and industrials sector. He has over five years of experience as an analyst in the buy- and sell-side. As an institutional fund management analyst, he sat on the China-Hong Kong desk. Terence was ranked top 3 for Best Analyst under the small caps and energy category in the Asia Money poll 2018.

He graduated from the Singapore Management University with a major in Finance (Honours), and is the honoured recipient of the CFA scholarship.

About the author

Terence Chua

Senior Research Analyst

Phillip Securities Research

Terence specialises in the consumer, conglomerate and industrials sector. He has over five years of experience as an analyst in the buy- and sell-side. As an institutional fund management analyst, he sat on the China-Hong Kong desk. Terence was ranked top 3 for Best Analyst under the small caps and energy category in the Asia Money poll 2018.

He graduated from the Singapore Management University with a major in Finance (Honours), and is the honoured recipient of the CFA scholarship.

Apr 19th - Things to Know Before the Opening Bell

Apr 19th - Things to Know Before the Opening Bell Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY) Trade of the Day - Singapore Airlines (SGX: C6L)

Trade of the Day - Singapore Airlines (SGX: C6L) Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)

Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)