First Sponsor Group – China outlook turns cloudy

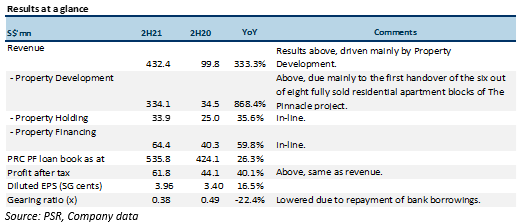

25 Feb 2022- 2H21 profit of $61.8mn was above our estimates, at 53.6%. The beat came from property development (PD) and property financing (PF).

- Revenue from hotel operations showed nascent recovery as improvements in its European hotel operations lifted earnings pared back by weakness from its China operations due to the resurgence of COVID-19 in China.

- China outlook turns cloudy as PF and PD business impacted by the slowing property market and recent loosening of monetary policy. Dongguan inventory turnover rose to 12.5 months from 3.2 months previously.

- Downgrade to NEUTRAL due to slower economic growth in China with reduced SOTP target price of S$1.39. Catalysts for upgrade are a recovery in the Chinese property market and its China hotel portfolio.

The Positives

+ 2H21 profit of $61.8mn above our estimates, at 53.6%. The beat came from property development and property financing. The Group made good progress with its various PRC property development projects with the handover of six out of eight fully sold residential apartment blocks of The Pinnacle project in Dongguan in December 2021. The average PRC PF loan book also hit a high of RMB2.7bn in 2021.

+ Revenue from hotel operations showed nascent recovery. Strong leisure demand led to better performance of its European hotel portfolio with revenue from hotel operations increasing 33% YoY in 2H21. Its European hotel portfolio also saw improvements in occupancy, average daily rate (ADR) and revenue per available room (RevPAR) following the easing of COVID-19 measures. According to management, January 2022 continues to be positive and is trending better than 2021.

The resurgence of COVID-19 cases in PRC, however, pared back gains. The implementation of restriction measures in Chengdu led to a weaker performance of its PRC hotels in 2H21 after it had to close the Holiday Inn Express Chengdu Wenjiang Hotspring Hotel for almost a month each in early August 2021 and early November 2021.

+ Revenue from property financing ahead of our expectations as PRC loan book exceeds. The PRC property financing business achieved a record full-year average loan book of RMB2.7bn for FY21.

|

The Negatives – Outlook for property financing disappoints. We believe the recent policy change in China will see clients repaying the loans in favour of bank loans. This, after the People’s Bank of China (PBOC) reduced the reserve requirement ratio for banks by 0.5% in December last year, in a bid to boost economic growth. This resulted in the release of an additional RMB1.2 tn (~$255bn) into the economy. To further ease the lack of liquidity in the property sector, PRC authorities are in the midst of drafting rules to allow developers to access funds from sales that are held in escrow accounts to meet obligations as well as payments.

– Dongguan’s property market slows, inventory rose to 12.5 months from 3.2 months. Curbs on debt and strict COVID-19 measures has negatively impacted property demand in China. According to Reuters’ calculations, property investment declined 13.9% in December 2021 from a year ago, dropping at the fastest rate since early 2020. Unsold housing stock in the PRC’s 100 biggest cities reached a five-year high in November last year. With the slowdown in the property sector, residential inventory in Dongguan rose to 12.5 months from 3.2 months as home buyers remain on the sidelines. |

|

Outlook Weak economic outlook in China clouds Group’s outlook. Falling property prices in China have resulted in a slowdown in demand. Unsold housing stock in the PRC’s 100 biggest cities reached a 5-year high in November last year. Some developers have also resorted to lowering prices to clear inventory, adding to the downward pressure in the property sector.

In January 2022, the PBOC cut the interest rate for the one-year medium-term lending facility from 2.95% to 2.85%. In the same month, the central bank reduced the one-year loan prime rate by another 10 basis points from 3.8% to 3.7% and the five-year loan prime rate by five basis points from 4.65% to 4.6%. To boost liquidity, the PBOC is also offering RMB700bn (S$148.7bn) of one-year medium-term lending facility loans in addition to RMB100bn (S$21.2bn) with seven-day reverse repurchase agreements. All these have culminated in a reduction in the Group’s PRC loan book, and is expected to add further pressure to its PRC loan book in the next two years.

In view of this, we have tweaked our model to account for the lower PRC loan book in the next two years. We lowered our expectations for the Group’s PRC loan book for FY22e-23e by 50% and 16% respectively as we expect customers to start repaying off its loans to refinance with the banks. Consequently, our earnings estimates for its PF business is reduced by 47% and 13% respectively for FY22e and 23e.

Strong balance sheet to capitalise on new opportunities. FSG is backed by a strong balance sheet, substantial unutilised committed credit facilities and potential equity infusion from the exercise of outstanding warrants. The Group is also expected to realise a substantial infusion of cash from the repayment of loans from its customers in the next two years. All of this will further strengthen the cash resources of the Group and to enable it to capitalise on any new business opportunities when they arise.

Downgrade to NEUTRAL from ACCUMULATE with reduced SOTP-TP of S$1.39. As the economic and property outlook in China turns more uncertain, we lowered our earnings expectations for its PD and PF business by 21% and 47% respectively for FY22e. Catalysts for an upgrade are a recovery in the Chinese property market and its China hotel portfolio. |

About the author

Terence Chua

Senior Research Analyst

Phillip Securities Research

Terence specialises in the consumer, conglomerate and industrials sector. He has over five years of experience as an analyst in the buy- and sell-side. As an institutional fund management analyst, he sat on the China-Hong Kong desk. Terence was ranked top 3 for Best Analyst under the small caps and energy category in the Asia Money poll 2018.

He graduated from the Singapore Management University with a major in Finance (Honours), and is the honoured recipient of the CFA scholarship.

About the author

Terence Chua

Senior Research Analyst

Phillip Securities Research

Terence specialises in the consumer, conglomerate and industrials sector. He has over five years of experience as an analyst in the buy- and sell-side. As an institutional fund management analyst, he sat on the China-Hong Kong desk. Terence was ranked top 3 for Best Analyst under the small caps and energy category in the Asia Money poll 2018.

He graduated from the Singapore Management University with a major in Finance (Honours), and is the honoured recipient of the CFA scholarship.

Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY) Trade of the Day - Singapore Airlines (SGX: C6L)

Trade of the Day - Singapore Airlines (SGX: C6L) Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)

Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83) Trade of the Day - Microsoft Corp (NASDAQ: MSFT)

Trade of the Day - Microsoft Corp (NASDAQ: MSFT)