FIRST SPONSOR GROUP LIMITED - Property Development outlook turns positive

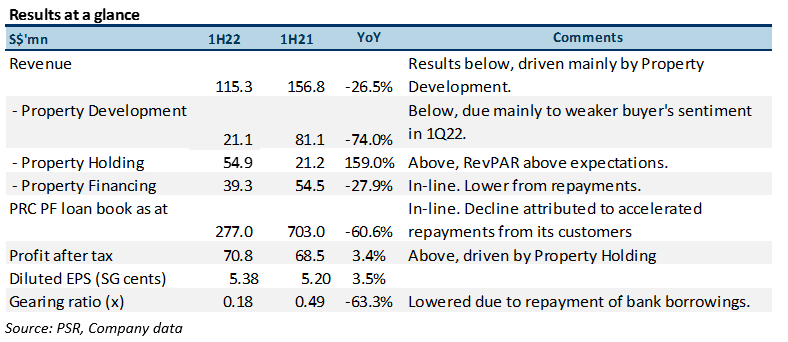

4 Aug 2022- 1H22 profit of $71.3mn was above our estimates, at 60.5%. The beat came from Property Holding (PH).

- Housing policy relaxation measures in Dongguan drove sales higher. Sales accelerated in the 1.5 months after the implementation of the relaxation measures.

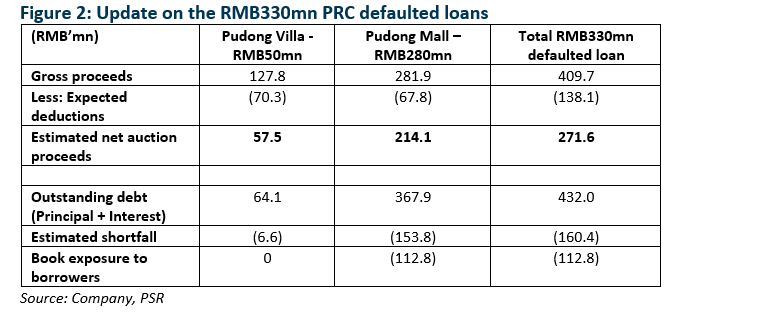

- 6mn (S$55mn) in net auction proceeds recovered from RMB330mn in defaulted loans. The potential disposal of Pudong Mall, which we estimate in FY23 could see a further recovery of the defaulted loans.

- Upgrade to ACCUMULATE from NEUTRAL with unchanged SOTP target price of S$1.39. Catalysts for a TP upgrade are a recovery in the Chinese property market and its China hotel portfolio.

The Positives

+ 1H22 profit of $71.3mn above our estimates, at 60.5%. The beat came from PH. PH’s profit was driven by the acquisition of the Dutch Bilderberg hotel portfolio it acquired on 2 May 2022 and the overall improvement in RevPAR of its hotel portfolio due to fewer Covid-19 restrictions. All of its hotel properties reported positive profits for 1H22. Interim dividend of 1.1 Singapore cents was in-line with our forecasts.

+ Housing policy relaxation measures in Dongguan drove sales higher. Buyer sentiment in the Dongguan residential market improved after two rounds of housing policy relaxation by the local municipal authorities in May 2022. 190 residential units of its project in Time Zone were sold in 1.5 months after relaxation measures were announced. This was significantly higher than the 139 residential units sold in the first 4.5 months of 2022. We believe this bodes well for the two residential projects it has targeted to launch in 2H22, the Hefu project and Phase 1.2 of its Time Zone development, both in Dongguan.

+ RMB271.6mn in net auction proceeds recovered from RMB330mn in defaulted loans. The Group recovered a portion of the proceeds in April 2022 from the mortgaged properties (Figure 2). The estimated net proceeds of RMB271.6mn however, is insufficient to cover the outstanding loan principal, default and penalty interest and other fees, resulting in an estimated shortfall of RMB160.4mn, with a book exposure of RMB112.8mn left to be collected. The Group will continue to pursue the shortfall via the court process. In other words, if the Group fails to recover such an amount, the negative P&L impact on the Group would be RMB112.8mn.

|

Potential recovery from the disposal of Pudong Mall. The legal title of the Pudong Mall as well as net auction proceeds of the Pudong Villa are expected to be transferred to the Group in 3Q22. As the Group managed to win the title of the mall through an auction process, we believe there is upside to the valuation of the mall at the end of the year when a valuation is done. We believe the Group will attempt to divest the mall to recover the shortfall, which we estimate to be in FY23e.

The Negatives – Primus Bay residential apartment blocks receive muted response at launch. The pre-sales for the three residential blocks in Panyu, Guangzhou, with 177 units was launched on 26 May this year, with only 11% of the units sold as the weak macro backdrop weighed on sales. ASP of RMB26,200sqm is on the lower end of the spectrum, but we expect pricing to remain stable as the Group will launch the smaller units in 2H22, which should support pricing.

|

– Potential impairment of hotels in 2H22 as rates soar. With inflation rates in Netherlands (+8.6% YoY) and Germany (+7.5% YoY) soaring in June and July respectively, management has guided for potential impairments arising from higher rates. The ECB recently raised rates for the first time in 11 years, with a larger than expected rise of 50bps. That said, we expect the impairments, if any, to be offset partially by the continued recovery of RevPAR and occupancy in Europe.

About the author

Terence Chua

Senior Research Analyst

Phillip Securities Research

Terence specialises in the consumer, conglomerate and industrials sector. He has over five years of experience as an analyst in the buy- and sell-side. As an institutional fund management analyst, he sat on the China-Hong Kong desk. Terence was ranked top 3 for Best Analyst under the small caps and energy category in the Asia Money poll 2018.

He graduated from the Singapore Management University with a major in Finance (Honours), and is the honoured recipient of the CFA scholarship.

About the author

Terence Chua

Senior Research Analyst

Phillip Securities Research

Terence specialises in the consumer, conglomerate and industrials sector. He has over five years of experience as an analyst in the buy- and sell-side. As an institutional fund management analyst, he sat on the China-Hong Kong desk. Terence was ranked top 3 for Best Analyst under the small caps and energy category in the Asia Money poll 2018.

He graduated from the Singapore Management University with a major in Finance (Honours), and is the honoured recipient of the CFA scholarship.

Apr 25th - Things to Know Before the Opening Bell

Apr 25th - Things to Know Before the Opening Bell JPMorgan Chase & Co - NII continues to rise, guidance maintained

JPMorgan Chase & Co - NII continues to rise, guidance maintained Trade of the Day - NVIDIA Corporation (NASDAQ: NVDA)

Trade of the Day - NVIDIA Corporation (NASDAQ: NVDA) Trade of the Day - Applied Materials, Inc. (NASDAQ: AMAT)

Trade of the Day - Applied Materials, Inc. (NASDAQ: AMAT)