HRnetGroup Limited - Another record year expected

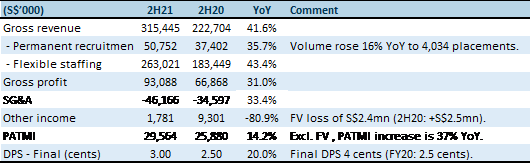

2 Mar 2022- Results beat our estimates. FY21 revenue and PATMI was 114%/108% of our forecast. 2H21 PATMI grew 14% YoY to S$29.6mn. Excluding fair value losses, PATMI would have jumped 37%.

- 2H21 growth was from both permanent recruitment (+36% YoY) and flexible staffing (+43% YoY). FY21 DPS increased 60% to 4 cents, including a 1 cent special dividend.

- We expect another record year in FY22e. Volume growth in permanent hires will come from recovering economic conditions and clients working more with recruiters due to the tight labour market. Rising salaries will be the driver for higher margins. Flexible staffing remains healthy as others sectors start to re-open. We maintain BUY. Our target price is raised to S$1.18 (previous S$1.05) as we raise FY22e earnings by 20%. The valuation metric is lowered from 14x to 12x PE FY22e ex-cash. We tag to the mid-range of the historical 5-year range as the labour recovery has moved past the peak cycle. HRnet pays a dividend yield of 5%, net cash of S$327mn and unlevered ROEs of 16% (or above 100% ex-cash).

The Positives

+ Growth in both segments. Both permanent and flexible staffing enjoyed growth in 2H21. Permanent staffing recorded 16% volume growth at 4,034 placements and 16% improvement in margins per placement. Flexible staffing volumes grew an estimated 36% YoY. Sectors that performed the best in 2H21 were healthcare (+182% YoY), manufacturing (+65%) and IT and Tech (+49%). Consumer (-1%) and financials (+7%) were the weak spots. Healthcare was driven by COVID-19 vaccinations and testing work in Singapore, while IT and tech hires came from North Asia.

+ Jump in dividends. Full-year dividend was raised 60% to 4 cents (includes 1 cent special). This represents a payout of S$40mn. Cash flow from operations of S$53mn and a net cash hoard of S$327mn will support the dividends. CAPEX for the year was a modest S$1.3mn.

The Negative

– Volatility from investments. There is S$30mn of listed equities and debt on the balance sheet which will be marked to market. Changes in value will be reflected through the income statement. In 2H21 there was a S$2.4mn net fair value loss. In contrast, 2H20 saw a S$2.5mn gain. This swing in fair value will create some volatility in reported net earnings.

Outlook

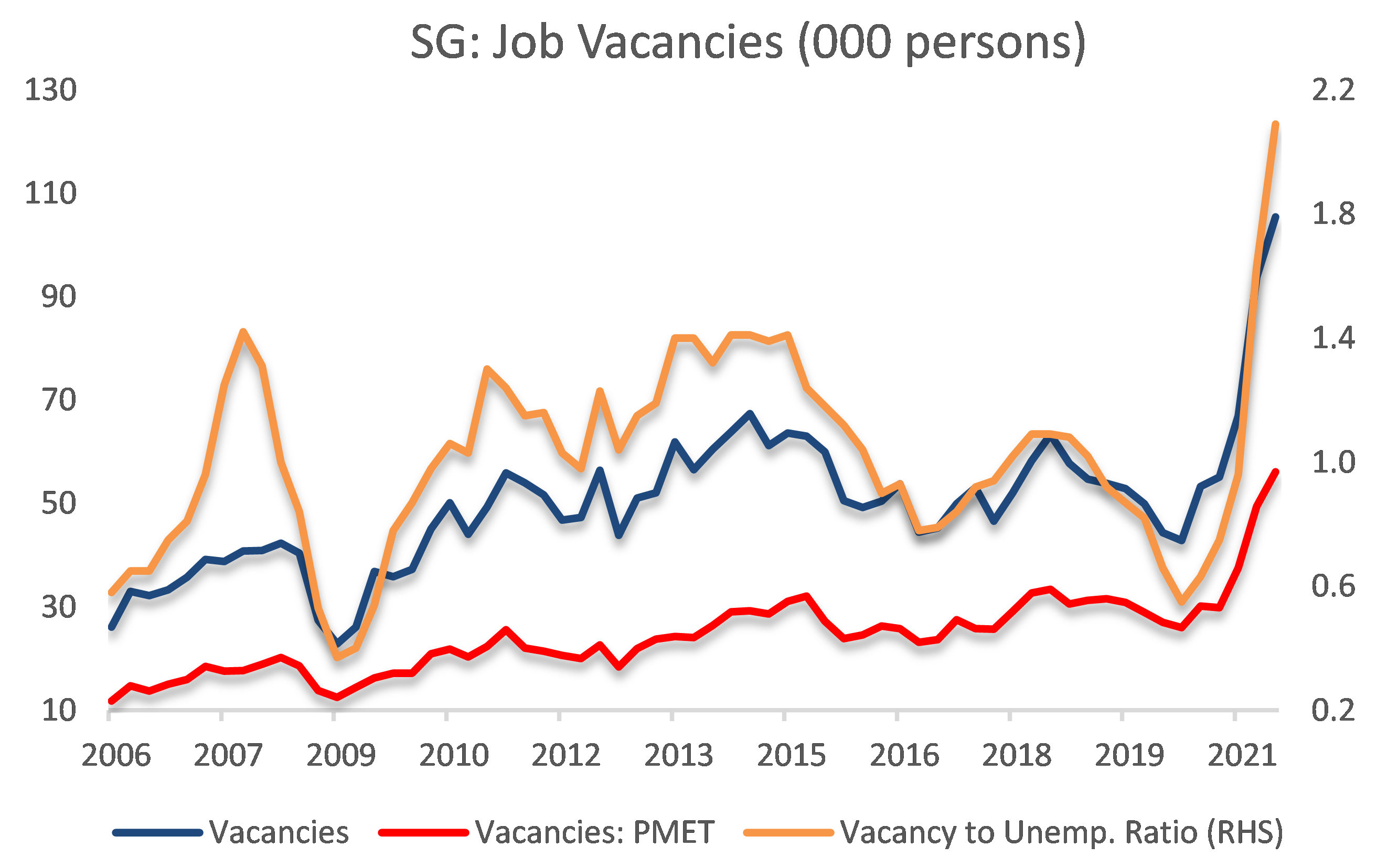

We expect another healthy year of growth in FY22e. Economies are recovering and vacancies are at record levels, especially in Singapore (Figure 1). Labour challenges have led to companies working closer with recruiters. The pivot towards local hires is another demand driver for recruiters. North Asia demand is driven by semiconductors roles such as IC design and wafer fabs in Taiwan and China. We expect growth in flexible hiring to soften as healthcare hires slow down. The pick up will come from sectors most affected by border closures such as retail and consumer.

Figure 1: Record vacancies in Singapore including PMET

Source: PSR, Company; PMET = professionals, managers, executives and technicians

Maintain BUY with a higher TP of $1.18 from S$1.05. We raised our FY22e revenue and PATMI by 13% and 20% respectively. The employment market is stronger than expected. Our margins are also raised from higher margin per placement due to improvement in salaries and pricing. Our valuation metric is lowered from 14x to 12x PE FY22e ex-cash. We tag to the mid-range of the historical 5-year range as the labour recovery has moved past the peak cycle.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

Apr 19th - Things to Know Before the Opening Bell

Apr 19th - Things to Know Before the Opening Bell Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY) Trade of the Day - Singapore Airlines (SGX: C6L)

Trade of the Day - Singapore Airlines (SGX: C6L) Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)

Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)