Lendlease Reit - Stock Analyst Research

| Target Price* | 0.83 |

| Recommendation | BUY› BUY |

| Market Cap* | - |

| Publication Date | 5 Feb 2024 |

*At the time of publication

Lendlease Global Commercial REIT - High rental reversion and rental upside from Sky Complex

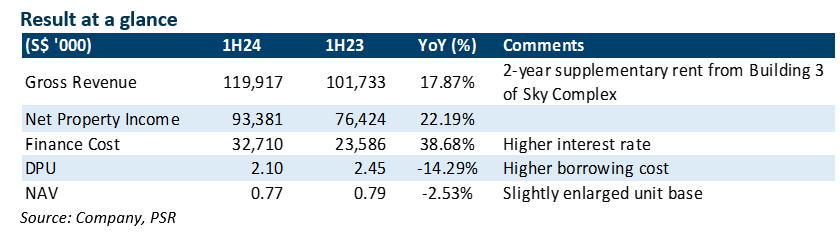

- Gross revenue increased by 17.9% to S$9mn with the 2-year supplementary rental from Building 3 of Sky Complex and form 55% of our FY24e forecast.

- NPI increased 22.2% YoY while DPU slid 14.5% YoY to 2.1 cents, and were 54%/52% of our FY24e estimates. High rental reversion was sustained with 313@somerset at c.20%, and Jem provided a stable contribution at c.10%.

- We reiterate our BUY recommendation with lower DDM-TP of S$0.83 and FY24e-25e DPU forecast of 4.16-4.59 Singapore cents. Erosion of DPU brought by higher-for-longer interest rates will still be apparent. We expect FY24e earnings will be supported by strong rental reversion.

The Positives

+ Resilient rental reversion of 15.7%, with 313@somerset contributing c.20%, and Jem delivering stable support of c.10%. Due to the lingering effects of COVID-19 base rents, we expect a rental reversion in the high teens for 313@somerset and in the low teens for Jem in 2025, as 20.3% of the lease by GRI is set to expire.

+ Stable operating metrics. Tenant sales continue to trend above pre-COVID levels and increased 0.6% YoY in 1H24. F&B, entertainment, and necessities outperformed. Despite lower contributions from GTO, we expect sales to benefit the top line with the influx of Chinese tourists, facilitated by the 30-day visa-free policy.

The Negative

– Borrowing cost inched up. There was no indication of a near-term reversal in the interest rate trajectory. LREIT having hedged 61% of its borrowings, will not experience much benefit from a potential interest rate cut in the future. With the implementation of the new rate, the expected interest rate for FY24e is c.3.5% (1H24: 3.37%).

About the author

Liu Miaomiao

Liu Miaomiao

PSR

Miaomiao mainly covers the Singapore REITs sector and graduated from Singapore Management University with a Bachelor’s degree in Business Management.

About the author

Liu Miaomiao

Liu Miaomiao

PSR

Miaomiao mainly covers the Singapore REITs sector and graduated from Singapore Management University with a Bachelor’s degree in Business Management.

NikkoAM-StraitsTrading Asia ex Japan REIT ETF - Resilient dividends despite rate hikes

NikkoAM-StraitsTrading Asia ex Japan REIT ETF - Resilient dividends despite rate hikes Netflix Inc. - Pricing power on display

Netflix Inc. - Pricing power on display Keppel DC REIT - DXC settlement offers partial relief from uncollected rents

Keppel DC REIT - DXC settlement offers partial relief from uncollected rents Apr 19th - Things to Know Before the Opening Bell

Apr 19th - Things to Know Before the Opening Bell