Lendlease Global Commercial REIT - Organic and inorganic growth opportunities

24 Apr 2023- Organic growth of an additional 10,200 sft NLA, retail footfall to benefit from upcoming tenant Live Nation, c.3% annual rental escalation from 313@somerset and c.5.7% rental escalation tied to CPI growth from Milan commercial property.

- Inorganic growth opportunities from the sponsor’s stabilised asset pipeline, of up to c.$5bn.

- Resume coverage with a BUY recommendation and DDM TP (cost of equity 7.6%) of S$0.91. Valuations are attractive at FY23e yields of 6.6%.

Key Investment Merits

Organic growth to support valuation and DPU:

- Lendlease Global Commercial REIT (LREIT) is expecting its new tenant Live Nation to be fully renovated at the end of 2024. With a capacity of more than 2,000 concertgoers per event, four events per day translate to generate additional footfall of 1mn per year which is 2.5% of the total 313@somerset footfall. We expect more than 90% of the tenants (except money changers, gadget stores, etc) to benefit from the concerts.

- LREIT is also gradually deploying its additional plot ratio of 10,200 sft, 3.4% of the total NLA of 313@somerset. If LREIT is to deploy the entire 10,200 sft, we believe the plan is to convert Level 7/ Level 6 (currently a car park) into retail and expand higher-yielding floors such as Level 1. With the additional plot ratio and the presence of Live Nation, we expect the NPI of 313@somerset to increase by 2%.

- We expect an annual rental escalation in Sky Complex Milan of 5.7% based on 75% of March 2023 CPI growth.

Potential Inorganic growth opportunities: After capping gearing at 45%, LREIT is estimated to have a debt headroom of c.$207m which allows for piecemeal acquisitions of a small stake in PLQ Mall or Parkway Parade (PP) as Singapore remains its focus. We believe LREIT can acquire c.6.2% of PLQ Mall or c.14.7% of PP, assuming the cap rate for PLQ Mall and PP is c.4.5%.

Attractive Valuation: Based on the 2% terminal growth rate, we reinitiate with a BUY recommendation, and the DDM-backed target price is $0.91. We increased the COE to 7.6% to reflect the higher interest rates. We expect FY23-24e DPUs of $4.63 – 4.78 cents.

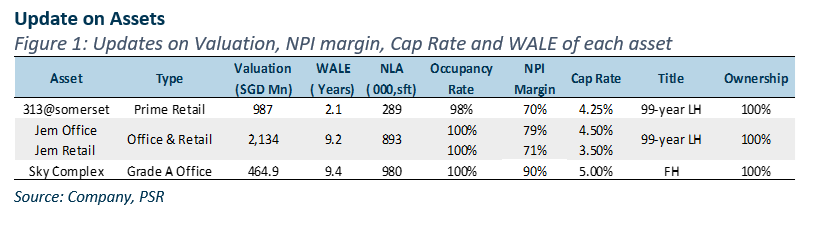

313@somerset

- 313@somerset has now positioned itself to be the incubator of new brands and businesses, a platform for business diversification from onshore to offshore. Famous brands such as TanYu and Chicha San Chen have chosen 313@somerset to initiate their pilot

- We expect a 30% decrease in CAPEX due to Live Nation taking most of the space on Grange LREIT is also actively managing its operating expenses by switching the utility contract to a lower-cost government contract.

Jem

- Office occupancy stays at 100% and it is fully leased to the Ministry of National Development.

- Tenant sales in Jem were up for c.20% YoY due to the resiliency from necessity spending and an increased footfall. We expect higher rental reversion due to the current low occupancy cost (rental charge/ tenant sales).

Sky Complex Milan

- Master tenant, Sky Italia’s lease ends in May 2032 with a physical occupancy rate at c.70% currently. The current market rental rate is c.€300-320/sqm per month, however, Sky Italia is renting at €188 / sqm. As such, we believe there is an upside in rental reversion upon lease expir

About the author

Liu Miaomiao

Liu Miaomiao

PSR

Miaomiao mainly covers the Singapore REITs sector and graduated from Singapore Management University with a Bachelor’s degree in Business Management.

About the author

Liu Miaomiao

Liu Miaomiao

PSR

Miaomiao mainly covers the Singapore REITs sector and graduated from Singapore Management University with a Bachelor’s degree in Business Management.

Netflix Inc. - Pricing power on display

Netflix Inc. - Pricing power on display Keppel DC REIT - DXC settlement offers partial relief from uncollected rents

Keppel DC REIT - DXC settlement offers partial relief from uncollected rents Apr 19th - Things to Know Before the Opening Bell

Apr 19th - Things to Know Before the Opening Bell Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY)