Lendlease Global Commercial REIT – Reopening tailwinds to lift tenant sales

9 May 2022- No financials provided in this operational update. Portfolio occupancy was stable at 99.9%.

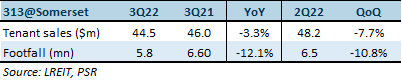

- 313@Somerset delivered positive reversions for the third consecutive quarter, but tenant sales, which are at 90% of pre-pandemic levels, dipped 3.3% YoY due to dine-in cap of five pax in 3Q22 (3Q21: 8 pax).

- Acquisition of remaining stake in JEM was completed on 22 April 2022. We understand that reversions have been positive and tenant sales are at 110% of pre-pandemic levels.

- Upgrade to BUY from ACCUMULATE; DDM target price raised from S$0.94 to S$1.05. FY22e-26e DPUs lowered by 0.6-3.8% to factor in the issuance of perpetual securities. We lower our COE from 7.7% to 7.0% to reflect the lower risk associated with a predominantly Singapore-focused portfolio post-acquisition of JEM. Return to office and tourist visits are immediate catalyst for LREIT.

Operating metrics at a glance

The Positive

+ Rental growth on the back of positive reversions and impending annual inflation-linked escalation. LREIT delivered its third quarter of positive reversions at 313@Somerset, although signing rents are still c.3% below pre-pandemic levels. We understand that reversions at JEM, are also positive. LREIT’s only Italian asset, Sky Complex, which is on a long lease that expires in May 2032, is subject to annual inflation-linked escalation every April. Using Mar22’s CPI growth as in indication, we could see c. 5% of escalation on Sky Complex’s rent in Apr22. Portfolio occupancy remained stable QoQ at 99.9% with only 3% of GRI to be de-risked in 4Q22.

The Negative

– Tenant sales still below pre-pandemic levels due to absence of tourists. Tenant sales at 313@Somerset dipped 3.3% YoY due to dine-in cap of five pax in 3Q22 (3Q21: 8 pax). 3Q22 tenant sales were at 90% of pre-pandemic levels as tourists, who typically accounts for 20-25% of 313@Ochard’s tenant sale, have yet to return to pre-pandemic levels. Meanwhile, footfall and tenant sales at JEM have surpassed pre-pandemic levels, the latter coming in at 110% of 2019’s levels. The lifting of workplace capacity to 100% should bring more footfall to both JEM and 313@Somerset, which are located near offices, and could further uplift tenant sales.

Outlook

LREIT has c.10k sq ft of additional GFA to unlock at 313@Somerset and intends to deploy it at the basement and ground floors of the mall, which command higher rents, timing AEIs to coincide with lease renewals to minimise disruption. Once fully deployed, the additional GFA could increase NPI by 2-3%. Acquisition remains a lever of growth for LREIT. Among its two pipeline assets, Paya Lebar Quarters (PLQ) and Parkway Parade, the former will likely be the priority as Parkway Parade has not yet stabilised. Due to PLQ’s size, LREIT may acquire PLQ in tranches via the respective strata titles.

Upgrade from ACCUMULATE to BUY, DDM target price raised from S$0.94 to S$1.05

FY22e-26e DPUs lowered by 0.6-3.8% to factor in the issuance of perpetual securities. We lower our COE from 7.7% to 7.0% to reflect the lower risk associated with its predominantly Singapore-focused portfolio post-acquisition of JEM. As such, our DDM-TP is increased from S$0.94 to S$1.05. LREIT’s portfolio is anchored by JEM and 313@Somerset, which are dominant malls in their respective catchments and will benefit from return to office and tourist visits.

Apr 19th - Things to Know Before the Opening Bell

Apr 19th - Things to Know Before the Opening Bell Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY) Trade of the Day - Singapore Airlines (SGX: C6L)

Trade of the Day - Singapore Airlines (SGX: C6L) Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)

Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)