Lendlease Global Commercial REIT - Room for organic and inorganic growth

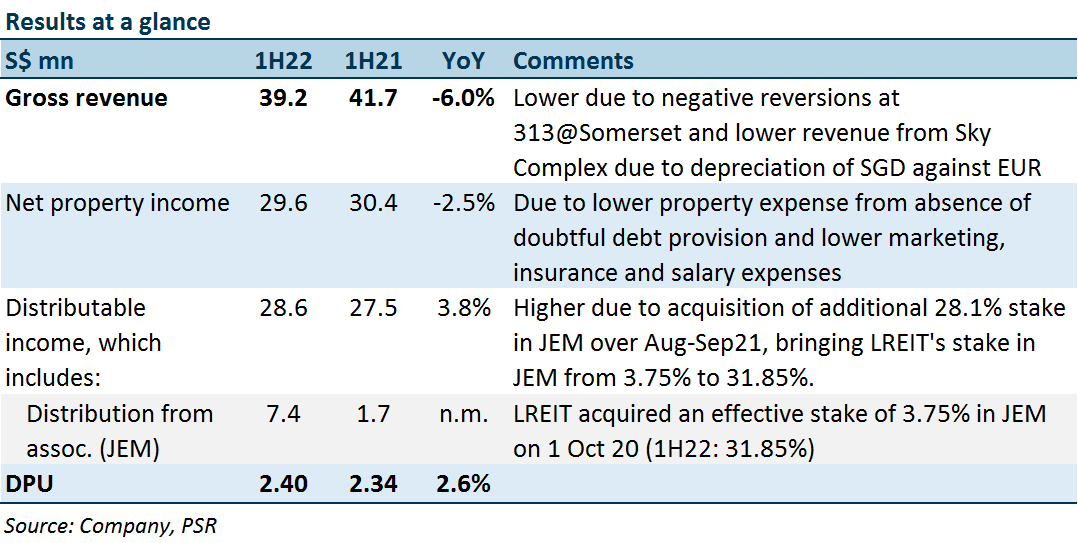

7 Feb 2022- 1H22 DPU of 2.40 Scts (+2.6% YoY) was in line, forming 48.4% of our FY22 forecast. DPU was lifted by the acquisition of an additional 28.1% stake in JEM over Aug-Sep21.

- 313@Somerset occupancy at an all-time high of 99.7%, 17% of GRI de-risked with weighted average reversions in high single-digits.

- Gradual deployment of c.11k sq ft from higher plot ratio could lift NPI by 2-3%.

- Maintain ACCUMULATE, DDM target price lowered from S$0.97 to S$0.94. FY22e-26e DPUs have been lowered by 1.4-1.9% on the anticipated rising cost of borrowing. Our DDM-based TP dips from S$0.97 to S$0.94 on lower DPU estimates and higher cost of equity of 7.72% assumption (previous 7.66%). Impending acquisition of remaining stake in JEM and deployment of additional GFA at 313@Somerset are catalysts for LREIT.

The Positive

+ Higher occupancy, positive reversions and unlocking of GFA at 313@Somerset. 99.7% occupancy at 313@Somerset is at an all-time high, up 1.0ppt YoY. Approximately 20K sq ft of NLA, or 17% of GRI signed in 1H22, reducing FY22 expiries by GRI from 24% to 7%. Leases signed in 1H22 yielded positive, high single-digit reversions, a sharp reversal from negative double-digit reversion seen in FY21. LREIT utilised 660 sq ft out of the 11k sq ft arising from the increase in permissible plot ratio from 4.9x to 5.6x. The unlocked space will be deployed to two stores, Puma and Ohayo Mama San, which are located at prime units on the ground floor. Remixing of tenant mix in earlier quarters has pulled in more shoppers, improving tenants’ sales for existing tenants. Tenants were more willing to renew their leases at higher rates given the improvement in tenant sales.

+ Robust portfolio metrics. Interest coverage ratio improved QOQ, from 8.8x to 9.7x (adjusted ICR: 5.0x) with cost of borrowing steady at 0.92%. 90% of borrowing have been hedged in 1H22, lower compared to the 100% hedge employed previously. We understand that this was due to revolving facilities in place, which are usually on floating rates. Gearing improved by 0.8ppts from 34.3% to 33.5%. The management shared that rent in arrears has reduced and is below pre-pandemic levels, crediting the improvement to the rebalancing of tenant mix in favour of tenants that are trading better and have stronger cash flows.

The Negative

– 1H22 revenue dragged down by lower GRI from negative reversions and lower GTO rent from 313@Somerset. YoY decline in turnover rent. 1H22 GRI was c.7% lower YoY due to negative double-digit reversions on 14k sq ft, or 17% of GRI signed at 313@Somerset in FY21. The negative reversions were inevitable given the tenants’ market in 2020 and 2021. However, we think that the strategy to prioritise occupancy and refresh 313’s tenant mix has paid off. LREIT retained and signed tenants that weathered the pandemic well or are expanding, lifting the vibrancy and positioning of 313@Somerset as a lifestyle and shopping destination. This ensured high occupancy and pricing power for positive reversions in 1H22. 2Q22 tenant sales grew 31.7% QoQ but were 5.1% lower YoY due to tighter restrictions during the Oct-Nov21 period. 1H22 tenants’ sales were 9.2% lower YoY, leading to a 30.7% YoY decline in GTO revenue.

Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY) Trade of the Day - Singapore Airlines (SGX: C6L)

Trade of the Day - Singapore Airlines (SGX: C6L) Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)

Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83) Trade of the Day - Microsoft Corp (NASDAQ: MSFT)

Trade of the Day - Microsoft Corp (NASDAQ: MSFT)