ManulifeReit USD - Stock Analyst Research

| Target Price* | USD 0.86 |

| Recommendation | BUY› BUY |

| Market Cap* | - |

| Publication Date | 11 May 2022 |

*At the time of publication

Manulife US REIT – Stepping up leasing and portfolio rebalancing initiatives

- No financials provided in this operational update.

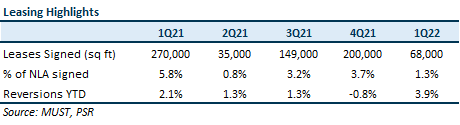

- Softer leasing quarter with only 68k sq ft of leases signed. Reversions positive at 3.9%. Portfolio occupancy slid 0.6ppt from 92.3% to 91.7% due to downsizing and non-renewals at five of MUST’s properties.

- Maintain BUY and DDM-based TP (COE 9.1%) of US$0.86. No change in our estimates. The US office market continues to improve – projected 12-month rent growth in MUST’s markets has improved to +3.8% as of Apr22 compared with +2.3% as of Jan22. Catalysts include stronger-than-expected leasing and portfolio reconstitution. Current share price implies FY22e/FY23e DPU yield of 9.4%/9.8%.

The Positive

+ 68k sq ft signed with 3.9% reversions (FY21: -0.8%). Leases signed accounted for 1.3% of portfolio NLA, 54% of which were new leases. Demand came from accounting, and finance & insurance tenants. MUST signed a couple of large 20k sq ft leases, as well as a seven-year lease with a real estate real estate company, which took 11k sq ft of space at Michelson, lifting Michelson’s occupancy from 97.2% to 89.2%. 1Q22 was a softer leasing quarter due to Omicron wave in end-2021, which only receded in mid-1Q22. However, we understand that physical tours picked up towards the end of 1Q22, ending the quarter 13% higher QoQ.

The Negative

– Occupancy hurt by non-renewals and downsizing. Portfolio occupancy slid 0.6ppt from 92.3% to 91.7%, due to lower occupancy at Exchange (-2.1ppts), Peachtree (-1.7ppts), Figueroa (1.2ppts), Centerspointe (-1.0ppts) and Capitol (-0.9ppts). Notable occupancy losses were the result of a non-renewal and downsizing by a legal tenant at Peachtree and a tenant in the information sector at Exchange, both occupying 20k sq ft of space. Passing rents on both leases are below market and present positive reversionary potential. We understand from the management that over the last 12 months, out of 371 sq ft of leases expiring, 272k sq ft of space was renewed and 99k sq ft of space was returned due to downsizing, implying a c.27% reduction in space requirement.

Outlook

The US office market continues to improve – projected 12-month rent growth in MUST’s markets has improved to +3.8% as of Apr22 compared with +2.3% as of Jan22. Increasing occupancy remains a key focus for MUST. The management is evaluating several strategies including building spec suites, leasing to co-working operators, offering more flexible/shorter leases, increasing touring and offering higher commissions to leasing agents.

Two of MUST’s top 10 tenants, TCW Group and Quinn Emanuel Trial, have lease expires in Dec23 and Aug23 respectively. These two tenants are located in Michelson and occupy 26.1% and 19.3% of NLA in the building. TCW group has decided to reduce its space requirements and indicated that it will be relocating instead of undertaking renovations to accommodate a smaller footprint. Passing rents for TCW Group’s lease are c.9% below market, providing positive reversionary potential. MUST has started marketing the space and is considering building some pre-fitted office space, also known as spec suites, to enable tenants to move in more quickly and reduce vacancy period. We may see gearing creep up as MUST funds tenant incentives and spec suites. MUST’s gearing as at end-1Q stands at 42.8%, implying a US$89mn headroom to its internal gearing limit of 45%.

Future acquisition is still focused on markets with high representation of tech, healthcare and life science tenants. MUST is eyeing assets with cap rates ranging between 6.5% and 7.5% in sunbelt and magnet cities — Seattle, Portland, Austin, Nashville and Raleigh. Due to the volatility in the capital markets, MUST is reassessing its portfolio for divestment candidates as a possible alternative to fund acquisitions.

Maintain BUY and DDM TP of US$0.86

No change in our estimates. Catalysts include stronger-than-expected leasing and portfolio reconstitution. Current share price implies FY22e/FY23e DPU yield of 9.4%/9.8%.

Apr 19th - Things to Know Before the Opening Bell

Apr 19th - Things to Know Before the Opening Bell Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY) Trade of the Day - Singapore Airlines (SGX: C6L)

Trade of the Day - Singapore Airlines (SGX: C6L) Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)

Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)