META PLATFORMS INC. - Reels drives positive user growth

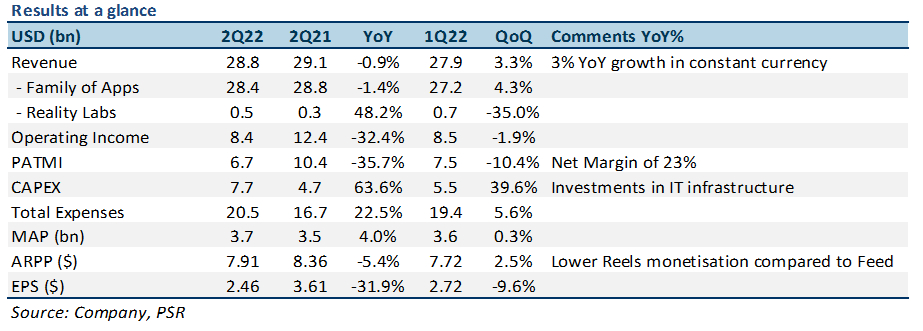

1 Aug 2022- 2Q22 revenue in line with expectations, with earnings missing target slightly. 1H22 revenue/PATMI at 43/42% of our FY22e forecasts.

- Reels driving positive user growth across all metrics for 2Q22, with 15% YoY increase in ad impressions. Business messaging potential additional revenue driver because of its growing popularity amongst SME business owners.

- Soft revenue guidance for 3Q22 from slowing advertising demand and 600 basis points YoY revenue headwind from strengthening US dollar.

- We lower our FY22e revenue/PATMI forecast by 5/10% to account for slower revenue growth, slightly higher-than-expected R&D expenses, and increasing FX headwinds. We maintain a BUY recommendation with a lowered DCF target price of US$221.00 (prev. US$231.00).

The Positive

+ Reels driving positive user growth, increasing ad impressions. META recorded 3.65bn Family Monthly Active People (MAP) for 2Q22, increasing 4% YoY, with ad impressions also increasing 15% YoY. User growth and engagement continues to be driven by strong 30% QoQ Reels growth, particularly in the APAC and Rest of World regions. This is good news for META especially as it shifts its focus into short-form video formats like Reels.

+ Business messaging a potential lever of revenue growth. Once clicked, Click-to-Message opens a chat between the user and a business, connecting both parties instantly, and is proving to be particularly popular amongst SMEs in Brazil and Mexico. Business messaging products like Click-to-Message are already a multi-billion dollar business for the company – with strong double-digit YoY growth and more than 1bn users, which we believe should unlock an additional lever of revenue growth for META moving forward.

The Negatives

– Earnings miss due to higher than expected expenses. META recorded 2Q22 EPS of US$2.46, missing estimates of US$2.61, largely due to higher-than-expected expenses, which increased 22% YoY. Headcount increased by 32% YoY, mainly in tech functions, above expectations. However, META also mentioned that it expects headcount growth to slow for the rest of the year as they reduce hiring.

– Soft 3Q22 revenue guidance due to continuing weakness in advertising, and 6% FX headwinds. META issued very soft revenue guidance for 3Q22, in the range of US$26bn-28.5bn – representing a 6% YoY decline. Broader macroeconomic uncertainty, softening demand for advertising, and an approximate 6% YoY headwind from a strengthening US dollar, were cited as the main reasons for the expected weakness.

Outlook

META guided 3Q22 revenue to be US$26bn-28.5bn, a 6% YoY decline, and relatively flat compared with 2Q22, with this guidance reflecting weakening revenue trends that are expected to continue. Meta also lowered its FY22e guidance on total expenses from US$87bn-92bn, to US$85bn-88bn, as it slows hiring and overall expenses to account for a more challenging macro environment.

META’s transition from Feed/Stories to Reels seems to be ahead of schedule, with management seemingly optimistic about its results so far. As advertisers shift more spending on Reels, average price per ad declined 14% YoY. In the long-run, this should be a positive for META as it continues to compete with other short-form video players like TikTok for advertising dollars.

Management reiterated its focus on investing more into its Artificial Intelligence (AI) and Machine Learning capabilities to drive better user experiences on its platforms and grow video monetization. The increasing capabilities in AI will also help to deliver better personalized ads using less data, helping to combat the negative effects from Apple’s third-party privacy changes.

META is no doubt in a transition period, with margins contracting and revenue slowing in the near-term. However, we believe in its ability to get through this transition period, especially with its long-term investments in AI. Free Cash Flow (FCF) for the quarter was US$4.5bn, with the company also repurchasing US$5.1bn of shares.

We reduce our FY22e revenue/PATMI forecasts by 5/10% on the back of slowing revenue growth as a result of weakness in consumer advertising, and increasing FX headwinds.

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

Apr 19th - Things to Know Before the Opening Bell

Apr 19th - Things to Know Before the Opening Bell Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY) Trade of the Day - Singapore Airlines (SGX: C6L)

Trade of the Day - Singapore Airlines (SGX: C6L) Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)

Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)