NETFLIX INC. - Membership growth boosted by hit series

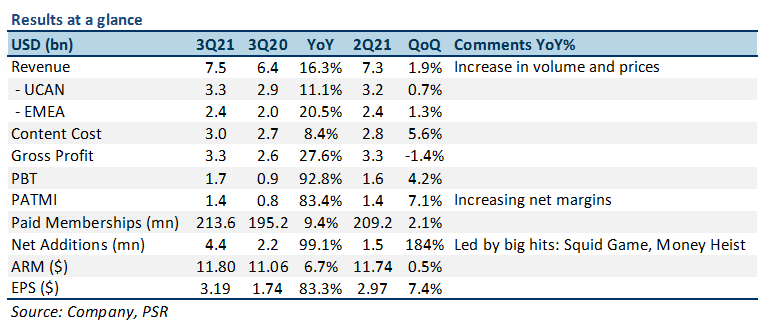

25 Oct 2021- 3Q21 results above expectations. YTD FY21 revenue/PATMI at 75/101% of our FY21e forecasts.

- Business metrics paid memberships and ARM boosted by hit series, “Squid Game” and “Money Heist”. Increase in prices across several regions is expected to drive ARM further.

- We estimate 4Q21 to be another strong quarter for NFLX due to low churn and quality produced content, which should help to support revenue growth.

- We raise our FY21e PATMI by 9% to US$4.9bn on lower than expected interest expense and effective tax rates YTD. We maintain our ACCUMULATE recommendation and unchanged DCF target price (WACC 9.0%) of US$724.00 as our FY22e assumptions remain unchanged.

The Positives

+ Paid membership additions above company estimates for 3Q21. 4.4mn paid net membership additions a 99% YoY increase compared to 3Q20, almost 1mn more than the company’s projection of 3.5mn, most of the net additions came from EMEA and APAC region. The uptick in membership growth was due mainly to big hits like “Squid Game” and “Money Heist”, which brought in record viewership numbers.

+ Subscription price hikes boosting revenue. Increasing membership base and price boosted 3Q21 revenue to US$7.5bn, a 16.3% YoY growth. Average Monthly Revenue per Membership (ARM) ended 3Q21 at US$11.80, representing an 8% growth YTD, on track to hit our estimates of 10% growth by end FY21e. Primarily due to price increases in the LATAM region.

+ Strategic acquisitions to boost content creation. We believe that selective acquisitions in the Roald Dahl Story Company and Night School Studio – video game developer, will boost its IP library for future content, as well as to improve its gaming capabilities to ramp up production of mobile video games.

The Negatives

– Softer QoQ guidance for EPS and PATMI in 4Q21. NFLX guided to a weak 4Q21 PATMI of US$365mn (-75% QoQ), led by a sharp increase in content costs due to a packed content release schedule. EPS is expected to be US$0.80 for the quarter. Nevertheless, guidance is above our estimates.

Average Monthly Revenue Per Membership (ARM) is defined as the total revenue for a given period divided by the average number of paid memberships at the beginning and end of that particular period.

Outlook

In terms of revenue, 4Q is seasonally the strongest quarter of the year, with strong growth in paid memberships and ARM. 4Q21 should be no different, especially with this season’s scheduled introduction of new quality content, and price hikes. We expect to see a relatively large content slate arriving in 4Q21, after lighter 1Q and 2Q content slates due to Covid related production rollovers in FY20.

Revenue is expected to be strong for 4Q21 at US$7.7bn, but PATMI for the quarter to be significantly lower than any other quarter in the year due to increased content cost, leading to lower net margins. 4Q EPS and PATMI is typically weaker than the rest of the year due to higher content costs associated with higher volume of content releases.

NFLX guided 4Q21 to YoY declines in PATMI from US$542mn in 4Q20 to US$365mn in 4Q21. The significant drop in guidance is due to a higher than usual expectation in content costs, causing net margins to decrease YoY as well.

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

JPMorgan Chase & Co - NII continues to rise, guidance maintained

JPMorgan Chase & Co - NII continues to rise, guidance maintained Trade of the Day - NVIDIA Corporation (NASDAQ: NVDA)

Trade of the Day - NVIDIA Corporation (NASDAQ: NVDA) Trade of the Day - Applied Materials, Inc. (NASDAQ: AMAT)

Trade of the Day - Applied Materials, Inc. (NASDAQ: AMAT) CapitaLand Ascott Trust - Occupancy to improve with ADRs stabilising

CapitaLand Ascott Trust - Occupancy to improve with ADRs stabilising