Oversea-Chinese Banking Corp Ltd-Outlook stable along with lower allowances

8 Nov 2021- 3Q21 earnings PATMI of S$1.22bn in line with our estimate. 9M21 PATMI is 80% of our FY21e forecast on lower-than-expected allowances.

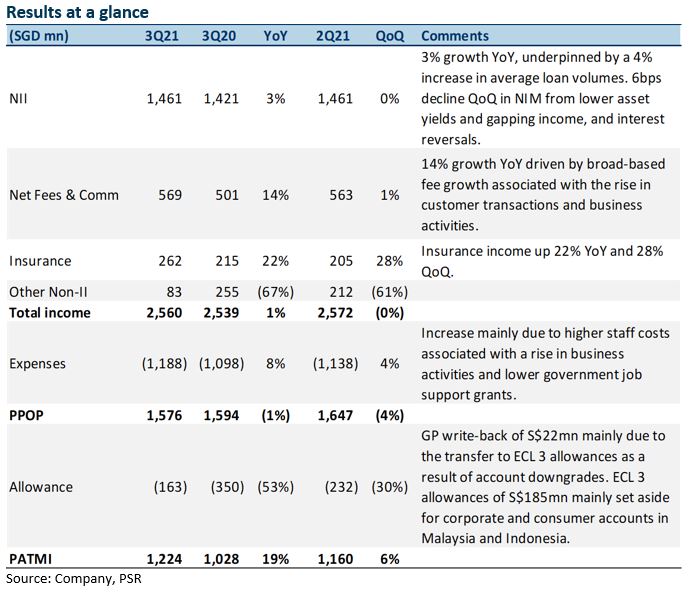

- NIM fell 6bps QoQ, though NII remained flat in the same period and grew 3% YoY.

- Provisions were 53% YoY lower to S$163mn due to lower SPs and GP write-back. Asset quality suffered due to an increase in loans under relief in Malaysia.

- Maintain BUY with an unchanged target price of S$14.22. We raise FY21e earnings by 1.8% as we increase profits of associates. Our TP remains unchanged at 1.24x P/BV and 9.3% FY21e ROE. Catalyst includes lower provisions and higher interest income as economic conditions improve.

The Positives

+ Fee income grew 14% YoY. Fee and commission income grew 14% YoY and 1% QoQ, particularly from wealth management income which made up 35% (S$897mn) of the Group’s income in 3Q21. The Group’s assets under management (AUM) fell to S$123bn, matching 1Q21, mainly due to the decline in market valuations which offset net new money inflows.

+ GP write-backs of S$22mn. OCBC was able to write back GPs of S$22mn during the quarter as the credit environment improved while SPs of S$185mn were made. Total NPAs rose by 4% QoQ to S$4.2bn, mostly attributed to downgrades of secured consumer loans in Malaysia. Nonetheless, OCBC has set aside S$185mn of SPs this quarter mainly for corporate and consumer accounts in Malaysia and Indonesia. Group NPLs were stable at 1.5% in 2Q21.

The Negatives

– NIM fell 6bps QoQ to 1.52%. NIM declined by 6bps QoQ mainly due to the classification of loans to NPL (mostly from downgrades of secured consumer loans in Malaysia) and more competitive corporate loans which resulted in lower asset yields. As such, management expects NIM to maintain at 1.5%-1.52% until 1H22. Nonetheless, NII grew 3% YoY and remained flat QoQ, underpinned by loans growth of 4% QoQ and 6% YoY, backed by demand from Greater China, Singapore and the United Kingdom. Loan growth this quarter was led by higher loans to the building and construction sector.

– Loans under moratorium unchanged at 2%. Loans under moratorium remained at 2% of the total, unchanged from the last quarter. The portfolio of relief loans, however, increased to S$6.3bn in 3Q21 from S$4.5bn. The increase was due to an increase in Malaysia’s relief loans to S$4bn in 3Q21 from $1.5bn, representing 19% of Malaysia’s total loans. Nonetheless, management has mentioned that the majority of loans under moratorium are performing loans, with all loans under moratorium in Singapore performing and about 20% of Malaysia’s loans under moratorium non-performing. Management expects the non-performing loans under moratorium to drop with the improving economic situation. 89% of all loans under moratorium remain secured.

Outlook

Loan growth: Loans grew 6% YoY in 3Q21, trailing the bank’s guidance of a high single-digit increase for FY21e. Management, however, believes its target is achievable. It sees lending opportunities in the wholesale segment and sustainable financing. Green and sustainable finance was up 12% QoQ to S$19.5bn and now forms 7% of its loan book. Mortgage pipelines in Singapore and Hong Kong are also healthy, with drawdowns expected in 2H21.

China: OCBC’s total exposure to mainland China remains at 11% of Group loans, with onshore exposure at S$6bn and offshore exposure at S$26bn. Nonetheless, customers include mainly top state-owned enterprises, large local corporates, as well as OCBC’s network customers. Less than one-third of the Group’s Mainland China onshore exposure (S$2bn) are corporate real estate loans, largely lending to the bank’s network customer. NPL ratio for non-bank Mainland China loans dipped to 0.3% from 0.5% in the previous quarter.

NPL: Non-performing assets rose 4% QoQ, due to new NPA formation of S$804mn mainly from the downgrades of secured consumer loans in Malaysia offset by recoveries and upgrades of S$359mn mainly from several corporate accounts in the oil and gas support vessels and services sector. We expect loans under relief to nudge higher as the COVID situation recovers gradually in Malaysia and Indonesia. In anticipation of this, management set aside S$185mn of SPs this quarter mainly for corporate and consumer accounts in Malaysia and Indonesia.

Investment Action

Maintain BUY with an unchanged target price of S$14.22

We maintain our BUY recommendation with an unchanged GGM target price of S$14.22. We raise FY21e earnings by 1.8% as we increase profits of associates. Our TP remains unchanged at 1.24x P/BV and 9.3% FY21e ROE. Catalyst includes lower provisions and higher interest income as economic conditions improve.

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

Apr 25th - Things to Know Before the Opening Bell

Apr 25th - Things to Know Before the Opening Bell JPMorgan Chase & Co - NII continues to rise, guidance maintained

JPMorgan Chase & Co - NII continues to rise, guidance maintained Trade of the Day - NVIDIA Corporation (NASDAQ: NVDA)

Trade of the Day - NVIDIA Corporation (NASDAQ: NVDA) Trade of the Day - Applied Materials, Inc. (NASDAQ: AMAT)

Trade of the Day - Applied Materials, Inc. (NASDAQ: AMAT)