PRIME US REIT - To thrive and not just weather

11 Aug 2020- We still favor Prime US REIT for its diversified portfolio and organic growth potential derived from rental reversions and escalations. Prime US REIT remains resilient.

- Overall occupancy dipped slightly QoQ to 93.0%. Nevertheless, portfolio WALE remains at 4.8 years. Only 3.3% and 7.4% of the leases by GRI are due to expire in FY20 and FY21.

- FY20e yield remains attractive at 8.6%; Maintain BUY at a higher target price of US$0.94.

The Positives

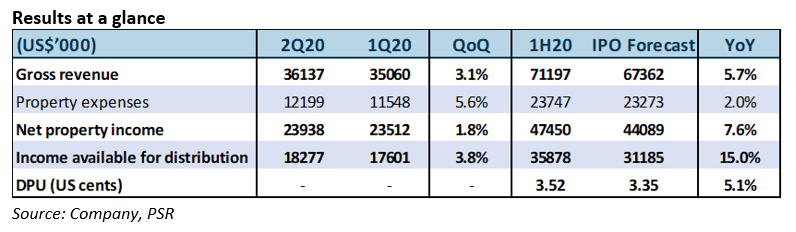

+ NPI and DPU slightly surpassed expectations; minimal impact amidst COVID-19. Gross revenue and NPI is up 5.7% and 7.6% YoY in 1H20, attributable to its accretive acquisition of Park Tower acquired in 1Q20. NPI and DPU slightly surpassed our expectations, forming 50.6% and 51.5% of our estimates for FY20e. Income stream for 1H20 remained stable as 99% of the rents are collected for each month in 2Q. While rent deferrals for 8 small retail tenants (comprising 0.2% of CRI) are provided, no rent abatements are given. Rent collections in July continued the same trend in Q2. Built-in rental escalations of c.2% in leases contributing to 99.8% of the CRI provides a clear organic growth outlook for the REIT.

+ Stable lease expiry profile; Strong leasing activity in 1H20. Portfolio WALE remains at 4.8 years. Only 3.3% and 7.4% of the leases by GRI are due to expire in FY20 and FY21. Strong leasing activity was observed in 1H20 as Prime reaped 82k sqft in new leases and renewals (of which 30k sqft was secured in 2Q) at an average positive rental reversion of 8.5%. Over 60% of 1H20’s leases were renewals and expansions. The portfolio’s reversion potential is underpinned by leases that are rented at an average of 7.5% below market.

+ Healthy gearing levels and ample debt headroom. Prime’s gearing and interest coverage ratio improved from 33.7% to 33% and 5.1x to 5.4x respectively, with $91.4mn available undrawn facility to tap on for future growth opportunities. Effective interest rate for the portfolio has been reduced to 2.6% from 3.3%. 90% of the debt is locked into fixed interest rates.

The Negatives

– Overall portfolio occupancy dipped QoQ from 94.9% to 93.0%. Decline in portfolio occupancy in Q2 is mainly due to the expiring leases in Village Center I and 171 17th Street. A property developer and Holland and Hart exited Village Center post-development of Village Center III. The market is still active and there has been interest from the financial and technology industry over the past 2 months. Also, Wells Fargo returned some of their space in 171 17th street post expiry of the previous lease extension. The management is confident in leasing out the vacant space as 171 17th street is the strongest submarket in Atlanta. This is supported by Microsoft’s decision to lease 100% of Atlantic Station, a property across the street from Prime’s property.

Outlook

Upcoming commercial supply into the markets that Prime has presence in continues to be minimal as majority of the buildings under construction are pre-leased. Markets with notable supply includes Midtown Atlanta (c.700k sqft), Salt Lake City (590k sqft) and St.Louis (457k sqft). Midtown Atlanta continues to attract large corporations and has benefited from a wave of tech-oriented companies; Microsoft recently leased 523k sqft in Atlantic Station (post-COVID), which brings preleased space in Atlanta to 2.8mn sqft (c.80% of available space). For the supply in Salt Lake City, it is a single building which saw pre-leasing activity from UBS and a technology firm.

We remain positive on Prime’s outlook due to its income stability supported by long WALE of 4.8 years, minimal expiries of 3.3% and 7.4% in FY20 and FY21 and high levels of asset and trade sector diversification. No property contributes more than 15.3% to net property income. Office using sectors like finance (1H20: 14.3%) and communication (13.5%) remains the largest income contributor to the portfolio. Despite heightened level of cautiousness surrounding new leases and expansions amidst uncertainty, Prime saw robust leasing activity in 1H20 which spilled over to 3Q20. Post 1H20, an additional 36k sqft of renewals and expansion leases were executed by existing tenants at positive reversions. This is testament of Prime’s asset quality and tenant stickiness, which we believe will allow Prime to thrive and not just weather through COVID-19.

Maintain BUY with a higher TP of US$0.94.

Our target price translates to a FY20e distribution yield of 8.6% and a total upside of 24.0%. We adjusted our revenue and NPI forecasts upwards to reflect the new leases and renewals signed in 1H19, resulting in an increase in FY20’s distributable income and DPU by 3.7% and 3.1% respectively. Our higher TP is mainly attributable to a lower cost of equity assumption of 9.50% (prev. 9.96%) to reflect the relative resilience of US office asset class.

The report is produced by Phillip Securities Research under the ‘Research Talent Development Grant Scheme’ (administered by SGX).

Apr 19th - Things to Know Before the Opening Bell

Apr 19th - Things to Know Before the Opening Bell Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY) Trade of the Day - Singapore Airlines (SGX: C6L)

Trade of the Day - Singapore Airlines (SGX: C6L) Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)

Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)