PropNex Ltd A new altitude

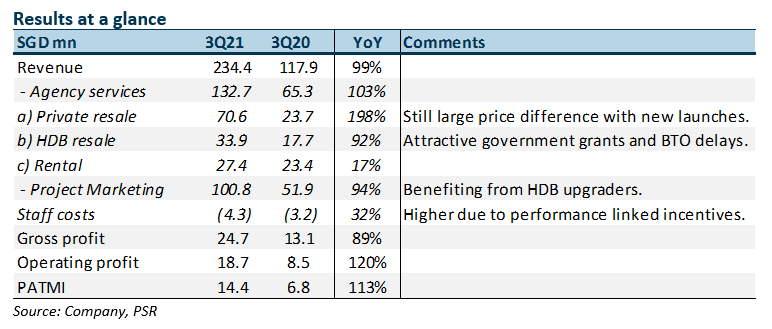

15 Nov 2021- 3Q21 PATMI spiked 113% YoY to S$16.5mn. 9M21 revenue and PATMI were within expectation at 73%/72% of FY21e forecast.

- The fastest growing segment was private resale, revenue tripled to S$70.6mn.

- The company aims to pay out 75%-80% of FY21 PATMI as dividends. We raise our FY21e DPS by 17% from 11.5 cents to 13.5 cents per share. This implies FY21e dividend yield of 7%.

- Our FY21e forecast and DCF target price (WACC 9.8%) of S$2.08 is unchanged. Our ACCUMULATE recommendation is maintained. PropNex’s revenue run rate is at a new level of around S$200mn per quarter, up from S$100mn in the prior years. Supporting this new altitude of revenue will be the record growth in agents, maiden revenues from collective sales and healthy property transactions aided by a recovering economy, low interest rates and rising replacement costs.

The Positives

+ Broad based growth. The doubling of revenue was supported by growth in all segments. Revenue generated from the private resale and project marketing segments posted the highest YoY growth at 198% and 94% respectively. The buoyant resale market bolstered equity values for HDB owners and investors. HDB volumes were perked up by government grants and delays in BTO construction. Private resale demand was supported by the price differential between new and resale units and rising land and construction costs.

+ Full-year DPS guidance raised. PropNex guided FY21e dividends to be 75% to 80% of PATMI. This compares with the 70% payout in FY20. We raise our FY21e DPS by 17% to 13.5 cents per share, implying final dividends of 8 cents Our forecasted annual dividend payout of around S$50mn is well supported by operating cash-flows. 9M21 FCF was around S$57mn.

+ Net cash bulks up to S$123mn. Net cash stood at a record S$123mn as at Sep21. Cash generated from operations was S$23.9mn during the quarter (3Q20: S$9.6mn). Capital expenditure was a paltry S$25,000. The bulk of the cash generated in the quarter was to pay the interim dividend of S$20.3mn.

The Negative

– Nil.

Outlook

We expect the momentum in real estate transactions to sustain. Key drivers include low interest rates, BTO delays, rising land prices and construction costs and an expanding agency force.

Agency force. PropNex onboarded 2,000 new agents year-to-November, double the 924 new agents in 2020. This brings the number of agents to 10,324, one-third the market share of agents in Singapore. PropNex can tap on the network of the new sales force and enhance their outreach efforts. A large number of agents can further raise the company’s transaction market share.

Private new homes. PropNex raised its 2021 new home sales projection from 11k to 12-13k units. HDB upgraders form less than one-third of demand, with the bulk of the demand coming from upgrading of private property owners and investment-driven purchases. However, depleting developer landbanks may cause transactions to taper down next year to 11-12k units.

Private resales. PropNex raised its resale transactions guidance for the second time to 19k units, up from 16k and 18k previously. Resale prices, which can be 25% lower than new homes prices, are an important driver for demand. The price gap is likely to persist given the rising land prices. The lower price points are more palatable for HDB upgraders who prefer larger units.

HDB resales. FY21 transaction volumes are expected to come in at 30k units, up from 24.7k units in the prior year. Demand is driven by first-time home buyers looking to tap attractive government grants to circumvent BTO delays, as well as HDB owners looking to upsize or downsize their existing units.

New collective sales division. PropNex established this new division in 2021. Collective sales transactions are largely handled by property consultants. PropNex’s advantage is its intimate understanding of the market demand at various locations. This provides developers with the confidence that the en-bloc site can garner demand post redevelopment. So far, two en-bloc projects worth around $42mn have been completed. Another S$3bn of collective sales projects are at various stages of completion.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

NikkoAM-StraitsTrading Asia ex Japan REIT ETF - Resilient dividends despite rate hikes

NikkoAM-StraitsTrading Asia ex Japan REIT ETF - Resilient dividends despite rate hikes Netflix Inc. - Pricing power on display

Netflix Inc. - Pricing power on display Keppel DC REIT - DXC settlement offers partial relief from uncollected rents

Keppel DC REIT - DXC settlement offers partial relief from uncollected rents Apr 19th - Things to Know Before the Opening Bell

Apr 19th - Things to Know Before the Opening Bell