PropNex Ltd - Surge in cash and dividends up 20%

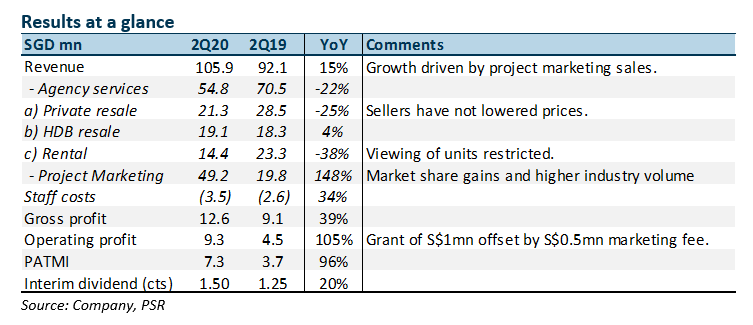

17 Aug 2020- 2Q20 PATMI rose 96% YoY to S$7.3mn. Earnings was within our estimates. The drop in transaction volumes during the lockdown will negatively impact 3Q20 earnings.

- Earnings this quarter was supported by a 150% jump in project marketing (new launches) revenue.

- Net cash is a record S$99.7mn (2Q19: S$73mn) due to S$11.9mn cash generated from operations during the quarter and a delay in paying S$8.3mn final and special dividend. Interim dividend per share was raised 20% YoY to 1.5 cents.

- We are maintaining our BUY recommendation and raising our target price to S$0.70 (prev. S$0.60). We made a modest increase to our FY20e earnings by 3% due to the JSS grant but raised our DCF growth assumptions. Near-term, the drop in transaction volumes due to the lockdown will negatively affect 3Q20 earnings. However, we believe transactions have bottomed and have started to recover July onwards. PROP pays a sustainable dividend yield of 7%, enjoys unlevered ROE of 25% and generates high cash-flow of around S$20mn p.a. with minimal capital expenditure and working capital requirements.

The Positives

+ Minimal capex and working capital. Net cash jumped to a record S$99.7mn due to the S$20.4mn generated in 1H20 and a delay in final and special dividend of S$8.3mn (or 2.25 cents). Worth noting that despite the 45% revenue jump in 1H20 to S$241mn, additional working capital required to support the growth was only S$300k and capital expenditure of S$110k.

+ Project marketing the revenue and margin driver. Revenue from project marketing jumped 148% YoY to S$49.2mn. Gross margins improve as new launches provide a higher share of commission for PROP.

+ Interim dividend raised by 20%. In-line with the jump in profits, PROP raised dividends by 20% to 1.5 cents. This interim payout of S$5.6mn is well supported by the 1H20 FCF of S$20.4mn.

The Negative

– Higher staff cost. Staff cost rose 34% due to higher provision of bonus and salary base. The increase in staff cost inline with gross profits means a loss in operating leverage, unlike the 1Q20. Unclear the split between the variable and fixed components of staff cost.

Outlook

The following are some of the outlook bullet points by segment:

- New launches: Mass market products in OCR and RCR will gain the most traction with the support of HDB upgraders. CCR is faced with larger enbloc supply and foreign buying slowing down. Transaction volumes have started to recover in July despite the absence of new launches. Another positive is the unsold units (excluding EC) that have been declining the past five quarters from 36.8k units in 1Q19 to currently 27.9k.

- Private resale: This segment will remain the weak spot. Unlike new launches where developers can lower prices, in the resale market, sellers are holding on to their asking prices leaving a large bid-ask gap.

- HDB resale: Transactions will be relatively stable between 21,000 to 22,000 units (2019: 23,714 units). The current HDB grants are an attractive incentive for buyers. Furthermore, the delay in construction activity may nudge buyers into resale rather than new BTOs.

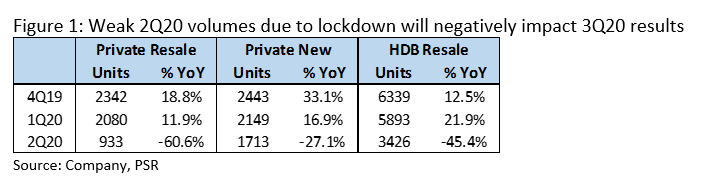

In 2Q20, transaction collapsed (Figure 1) as property viewing was restricted and showrooms closed. This will negatively impact PROP 3Q20 results. Nevertheless, we believe a bottom has formed and volumes will start to recover. July has seen private resale doubled to 928 units from prior month 383. New units sales are performing even better at 1,123 units in July and 992 units in June. August appears on track to reach the 1,000 units. Private resale transactions for August seem to be decelerating. PROP managed to capture 53% market share of new private units sold in 2Q20.

Maintain BUY with a higher target price of S$0.70 (previously S$0.60)

We are raising our target price as we increased our terminal growth rate assumption. With the lockdown restrictions being lifted in Singapore, a recovery in volumes is underway. PROP has a high cash generative asset-light business model with minimal capital expenditure and working capital required. The company is committed to paying attractive and sustainable dividends. The current 7% dividend yield amounts to S$14.8mn payout. This compares to their FCF that averaged S$23mn over the past three years. There is also the added buffer of S$99.7mn net cash on the balance sheet.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

Trade of the Day - NVIDIA Corporation (NASDAQ: NVDA)

Trade of the Day - NVIDIA Corporation (NASDAQ: NVDA) Trade of the Day - Applied Materials, Inc. (NASDAQ: AMAT)

Trade of the Day - Applied Materials, Inc. (NASDAQ: AMAT) CapitaLand Ascott Trust - Occupancy to improve with ADRs stabilising

CapitaLand Ascott Trust - Occupancy to improve with ADRs stabilising NikkoAM-StraitsTrading Asia ex Japan REIT ETF - Resilient dividends despite rate hikes

NikkoAM-StraitsTrading Asia ex Japan REIT ETF - Resilient dividends despite rate hikes