Sasseur Reit - Stock Analyst Research

| Target Price* | SGD 0.87 |

| Recommendation | BUY› BUY |

| Market Cap* | - |

| Publication Date | 22 Feb 2024 |

*At the time of publication

SASSEUR REIT - Resilient balance sheet and low onshore rate

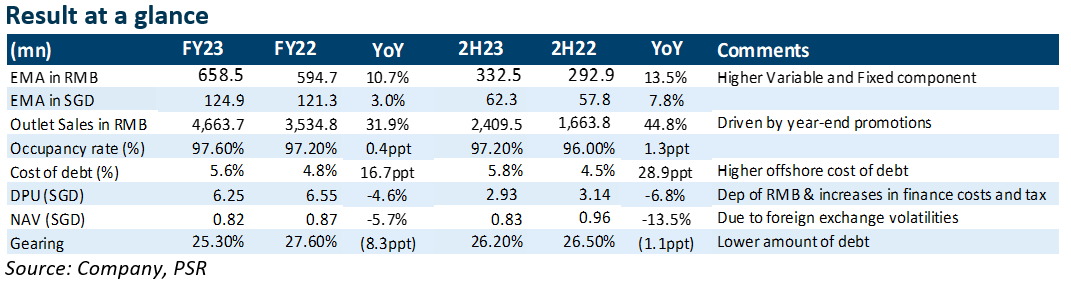

- FY23 rental income in SGD terms was within expectations (S$ 126.7mn, +0.6% YoY, +10.7% YoY in RMB. DPU was within our expectation at 6.25 Singapore cents for the whole year, representing a 4.6% decline YoY due to RMB depreciation of 7% in FY23. Keeping the exchange rate the same, DPU would have increased by c.4.1% YoY. SASSR retained 7% of distributable income mainly for the repayment of onshore RMB loans.

- Outlet sales in RMB were in line with our projection. It spiked 31.9% YoY to RMB4.6bn, leveraging on the consumption downtrading and various promotional events in FY23.

- We reiterate our BUY recommendation with a lower DDM TP of S$0.87 (prev. S$0.90) on the back of a fading recovery tailwind and weaker-for-longer exchange rate. FY24e- FY25e DPU forecasts have been lowered by 2-3% to 6.36-6.67 Singapore cents. SASSR is trading at 9% of FY24e forward dividend yield.

The Positives

+ FY23 outlet sales up 31.7% (RMB4.7bn). Tenant sales surged by 84.6% YoY in 4Q23 due to a low base in FY22 and various promotional events in December. The Chongqing outlet continues to lead the recovery, increasing by 35.5% YoY. Overall, sales reached 96.6% of their pre-COVID level. This trend is anticipated to continue, delivering a stronger FY24 performance. We expect FY24 sales to grow in the low teens amidst the ongoing retail sales recovery and ongoing consumption downgrade.

+ Healthy operating metric. The occupancy rate saw a 0.4% YoY improvement, with Chongqing remaining at 100% and all other sites exceeding 96%. SASSR actively replaces underperforming tenants. Notably, 97% of rental income is tied to tenant sales, resulting in healthy occupancy costs between 10% and 20% depending on the store size. Newly acquired tenant Yonghui has implemented smart technology in its supermarket, which is expected to attract consistent customer traffic from its catchment area of 150,000 residents. Their fixed rental agreement protects SASSR from potential structural changes in consumer behavior.

+ Resilient balance sheet and eyeing acquisition. SASSR, one of the least geared SREITs with a current gearing ratio of 25.3% and S$863mn in debt headroom (assuming a 50% cap) is eyeing potential acquisitions of sponsor-owned assets with ROFR. In the case of larger acquisitions, it considers utilizing EFR to maintain post-acquisition gearing below 40%. The Xi’an asset, valued at an estimated S$500mn-600mn with a stable cap rate of around 7%, is particularly attractive. We believe acquiring it would be DPU-accretive, generate a positive carry of 1.5%, and raise DPU by 4%, thanks to a projected 45% increase in EMA rental income.

The Negatives

– Depreciation of RMB. The Renminbi weakened by 7% YoY and may continue to impose a headwind on the DPU. We expect the SGD to remain strong against the Renminbi.

Outlook

We expect the strong tenant sales momentum to persist in FY24 but partially offset by strong SGD. A positive is onshore loan interest rates are trending downward, as evidenced by the LPR decrease from 4.2% to 3.95%. SASSR is already capitalizing on this by actively converting offshore loans to onshore (53.4% vs. 46.6%), resulting in less erosion of EMA rental income by interest expenses in FY24. However, the yearly S$5mn-6mn upfront fee associated with onshore loans necessitates maintaining a 93% payout rate, which will put some downward pressure on DPU.

Maintain BUY with a lower TP to S$0.87 (prev. S$0.90)

We expect a 13% YoY sales growth in FY24e, driven by SASSR’s strong value proposition targeting China’s growing middle-income population. However, the strengthening of the Singapore dollar against the renminbi is expected to reduce FY24e revenue by 1.2%. We have also lowered our FY24e interest rate assumptions by 0.6% in response to the lower interest rate in China. We reiterate the BUY recommendation with a revised DDM-TP of S$0.89 and projected FY24-25e DPUs of 6.36 to 6.67 Singapore cents. SASSR is trading at 9% of FY24e forward dividend yield.

About the author

Liu Miaomiao

Liu Miaomiao

PSR

Miaomiao mainly covers the Singapore REITs sector and graduated from Singapore Management University with a Bachelor’s degree in Business Management.

About the author

Liu Miaomiao

Liu Miaomiao

PSR

Miaomiao mainly covers the Singapore REITs sector and graduated from Singapore Management University with a Bachelor’s degree in Business Management.

Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY) Trade of the Day - Singapore Airlines (SGX: C6L)

Trade of the Day - Singapore Airlines (SGX: C6L) Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)

Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83) Trade of the Day - Microsoft Corp (NASDAQ: MSFT)

Trade of the Day - Microsoft Corp (NASDAQ: MSFT)