Sembcorp Ind - Stock Analyst Research

| Target Price* | SDG 6 |

| Recommendation | ACCUMULATE› ACCUMULATE |

| Market Cap* | - |

| Publication Date | 22 Feb 2024 |

*At the time of publication

Sembcorp Industries - Renewables to be the key earnings driver

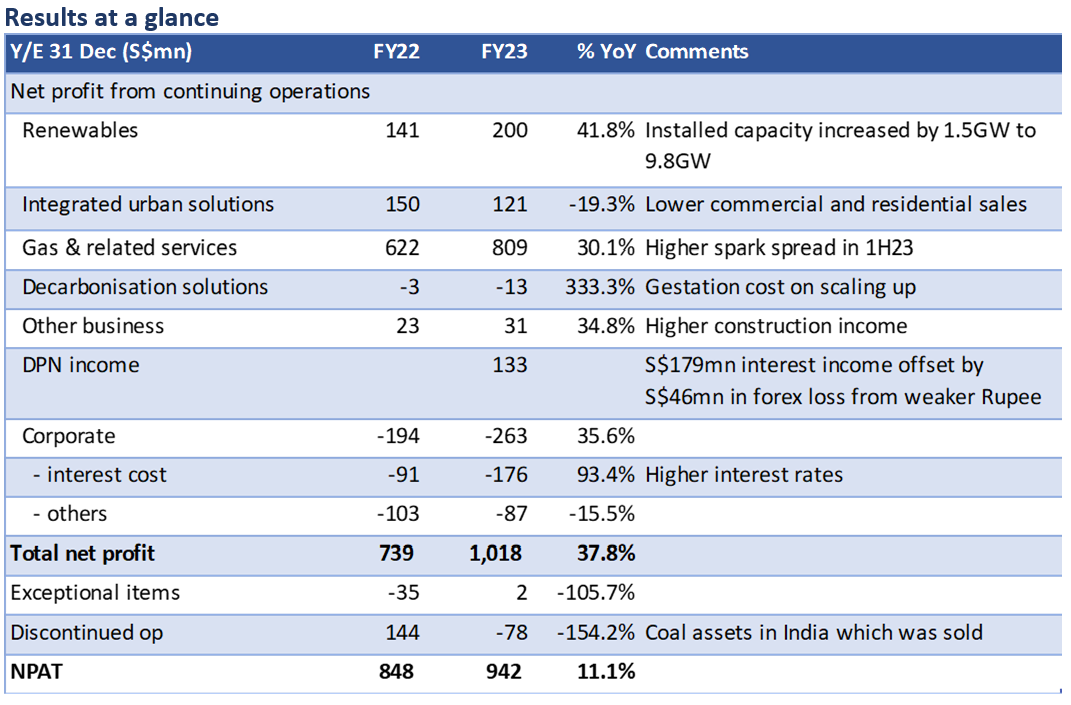

- FY23 net profit was 3.3% higher than our estimates. Growth was driven by renewables (+41.8%), gas and related services (+30.1%) and maiden interest income from deferred payment note (DPN) in exchange for the sale of the Indian coal power plant. 2H23 net profit, at S$412mn, was 22.3% lower than 1H.

- FY24e net profit is expected to fall due to major maintenance for 60 days at the Singapore power plant (we estimate S$66mn impact) and the handover of the Vietnam Phu My 3 power plant in Feb 2024.

- Maintain ACCUMULATE and TP of S$6.00. We are also maintaining our FY24e net profit estimate. Energy sales and infrastructure services form a stable and visible income stream for the group. Renewable energy will drive earnings growth in FY25e, whose share of net profit could grow to 31.8% in FY25e, from 21% in FY23.

The Positives

+ Singapore gas energy portfolio has locked in 99% of its capacity on contracts with average tenure of 12 years. These contracts are on a pre-determined dollar margin, with cost passed through to the customers. This provides visibility and stability to about 65% of earnings, making them highly visible and stable. The small spot market suggests that this is a sellers’ market, as customers are keen to lock in to ensure supply. SCI’s 600MW hydrogen-ready cogen plant will be completed in early 2026.

+ Renewable capacity increased by 4GW to 13.8 GW, of which 9.8 GW (+18.1% YoY) is operational. These are achieved through acquisitions as well as organic growth with key partners in China, India, and Southeast Asia. The power is sold to the grid and billed to the energy authority on a timely basis, cutting down on merchant risks and minimize collection risks. However, subsidy payments from the government are slower as the projects undergo audit assessments.

+ About S$355mn was received from the deferred payment note. About S$133mn was interest accrued, and the rest went towards principal repayment. A negative was the weak Rupee, which knocked off S$46mn. Management has not hedged its Rupee exposure, as the cost outweighs the forex loss. The DPN, which bears an interest rate of about 9%, will mature in 15 years with an option to extend for 9 more years. The outstanding amount of these notes is S$1.8bn as at Dec 2023.

The Negatives

– Land sales for commercial and residential land banks were lower due to the weak market sentiment in Vietnam. However, industrial land sales in Indonesia and Vietnam grew as manufacturers built supply chain networks in these two countries.

– Net debt has risen to S$6.5bn, and net gearing rose to 1.33x due to a bigger renewable portfolio. Still, EBITDA/interest improved from 4.2x to 4.4x.

Outlook

We maintain our earnings estimates for FY24e, which are expected to fall 11.9% YoY due to the maintenance shutdown at its power plant for two months and the absence of contributions from the Vietnam power plant. Contributions from renewables are expected to account for a larger share of net profit, from 21.2% in FY23 to 31.8% in FY25e. We expect integrated urban solutions to remain muted, but there is no risk of writedown in the value of the property assets.

Maintain ACCUMULATE and TP of S$6.00. Our TP is based on 11x of FY24e EV/EBITDA.

About the author

Peggy Mak

Research Manager

PSR

Peggy has been a sell-side equity analyst for 22 years and a fund manager for 15 years.

About the author

Peggy Mak

Research Manager

PSR

Peggy has been a sell-side equity analyst for 22 years and a fund manager for 15 years.

Apr 19th - Things to Know Before the Opening Bell

Apr 19th - Things to Know Before the Opening Bell Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY) Trade of the Day - Singapore Airlines (SGX: C6L)

Trade of the Day - Singapore Airlines (SGX: C6L) Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)

Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)