Singapore Telecommunications Ltd - Re-opening and restructuring upside

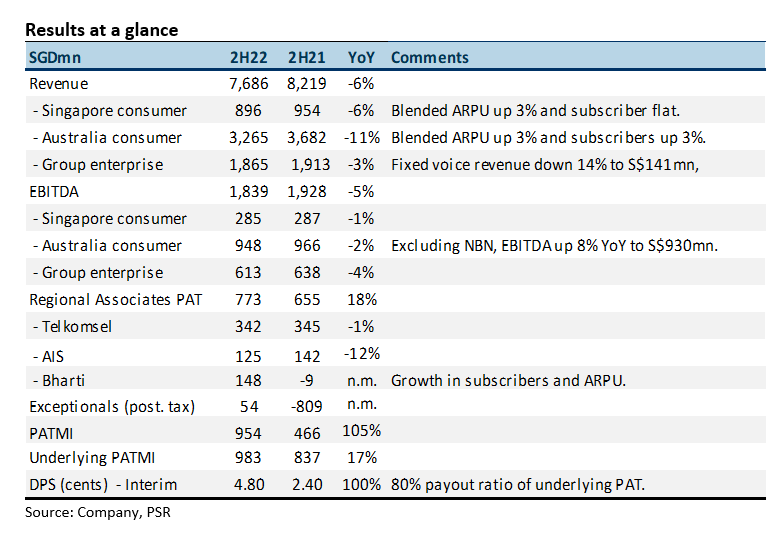

30 May 2022- FY22 revenue met our expectations at 101% of FY22e estimates. EBITDA was 93% of estimates due to lower-than-expected NBN migration earnings.

- 2H22 EBITDA was down 5% YoY, the largest drag from NCS and widening losses in Trustwave. Underlying PAT in 2H22 was up 15% excluding exceptional items, NBN and job support scheme.

- We lower our FY23e forecast by a modest 2% to account for weaker enterprise earnings. Our SOTP TP is raised from S$2.86 to $3.05 as we roll over our EV/EBITDA into FY23e and higher associate market valuations. Earnings in FY23e are expected to recover as roaming revenue creeps up and economic conditions improve in emerging countries post lock-down. The targeted monetization of around S$3bn assets will help narrow the valuation discounts for associates, strengthen the balance sheet and improve the capacity to raise dividends. Some of the assets identified for recycling of capital include disposal of Amobee, redevelopment of Comcentre and possibly part disposal of associate stakes. We maintain our ACCUMULATE recommendation.

The Positives

+ Improving earnings in Australia. Mobile service revenue rose 4% YoY to A$1.84bn, supported by both ARPU and subscriber growth. Optus mobile plans are gaining traction with customers for their more differentiated offering in terms of 5G speed, on-demand product features and improvement in customer service levels. Total consumer revenue in Australia declined due to a drop in NBN migration revenue (-83% YoY) and slower equipment sales (-25% YoY).

+ Huge reversal in Bharti earnings. The growth in earnings was driven by a 23% rise in ARPU and a 12% increase in 4G subscribers in India. Airtel Africa also delivered a 24% improvement in EBITDA through subscribers (+9%) and ARPU growth (+11%).

The Negative

– Sluggish enterprise and NCS earnings. EBITDA fell 4%, dragged down by a 14% drop in fixed voice revenue and 3% fall in leased circuits and broadband. Excluding JSS, NCS recorded a 4% rise in EBITDA. Margins were softer due to a 19% YoY rise in staff costs.

Outlook

Key drivers to earnings recovery in FY23e are 1) Roaming revenue in Singapore consumer and enterprise; 2) Organic and inorganic growth in NCS; 3) Economic recovery post-lockdown in emerging markets of Thailand, Philippines and Indonesia; 4) Improving ARPU in India and rising data traffic.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

Apr 25th - Things to Know Before the Opening Bell

Apr 25th - Things to Know Before the Opening Bell JPMorgan Chase & Co - NII continues to rise, guidance maintained

JPMorgan Chase & Co - NII continues to rise, guidance maintained Trade of the Day - NVIDIA Corporation (NASDAQ: NVDA)

Trade of the Day - NVIDIA Corporation (NASDAQ: NVDA) Trade of the Day - Applied Materials, Inc. (NASDAQ: AMAT)

Trade of the Day - Applied Materials, Inc. (NASDAQ: AMAT)