Singapore Telecommunications Ltd-Some bright spots

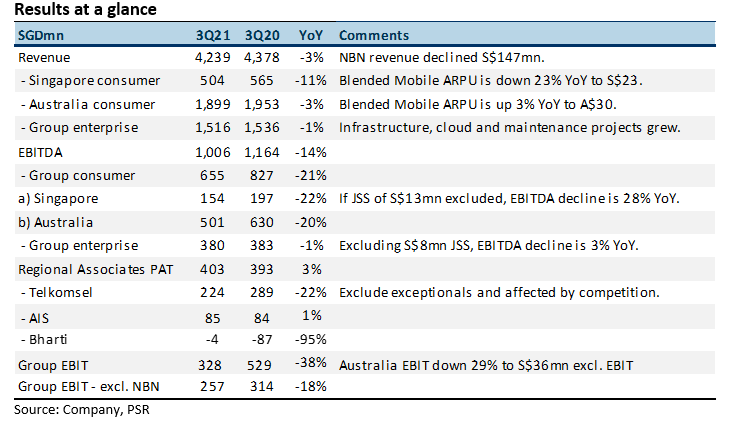

15 Feb 2021- 3Q21 revenue and EBITDA met expectation, with 9M21 numbers at 78%/70% of our FY21e forecasts. EBITDA declined 14% YoY to S$1bn. Singapore consumers were its weakest link, with mobile ARPU down 23%

- After-tax exceptional gains were S$116mn, from Bharti Infratel’s merger (S$72mn) (BHARTI IN, Not Rated) and Telkomsel’s sale of towers (S$60mn).

- Australia still grappling with high costs. 3Q21 EBIT declined 29% YoY to S$36mn, excluding NBN. This was despite A$ appreciation of 5.7%.

- Maintain NEUTRAL and SOTP TP of S$2.44. Underlying weakness in Singapore consumer from loss of roaming revenue and cost burden in Australian could persist. However, there were some bright spots, including stable mobile revenue in Australia, resilient enterprise operations and Bharti’s continued turnaround.

The Positives

+ Enterprise earnings resilient. EBITDA at group enterprise was flat YoY. This was commendable, given macro weakness. Demand was driven by system infrastructure services, cloud and maintenance projects led by NCS and Australia Enterprise. NCS bookings in 3Q21 were S$809mn from public service, financial and commercial. 1H21 bookings for the whole enterprise division had only totalled S$755mn.

+ Australia consumer stable. Revenue from Australia consumers was up 5.4% YoY to S$4.16bn, ex-NBN. Singtel’s strength in Australia came from mobile revenue, which was flat YoY at A$1.5bn. Despite a 5% YoY fall in mobile subscribers, blended ARPU managed to creep up 3% to A$30. A 41% YoY surge in data usage to 17GB per month likely helped.

+ Turnaround at Bharti continued. Net loss at Bharti shrank 95% YoY to S$4mn. Higher mobile ARPUs and strong 4G additions were behind this.

The Negatives

– Singapore consumer still contracting. Roaming revenue from the Singapore consumer continued to recede. Revenue contracted 11% YoY while postpaid ARPU collapsed 26% YoY. EBITDA was down 22% YoY. Excluding S$13mn from the Job Support Scheme, EBITDA contracted 28% YoY to S$141mn.

– High fixed costs in Australia. Australia’s 3Q21 EBIT was down 29% YoY to S$36mn, excluding NBN. We believe high fixed costs from its on-net broadband business continued to weigh on it. EBITDA fared better with an increase of 4.4%, excluding NBN.

Outlook

Singtel remains in the grip of roaming losses, high costs in Australia and competition in Indonesian mobile. That said, it had some bright spots in 3Q21, such as its enterprise resilience, mobile revenue stability in Australia and Bharti’s recovery.

Maintain NEUTRAL with unchanged TP of S$2.44

We keep our target price and FY21e earnings largely unchanged. We continue to value Singtel’s core Singapore and Australia businesses at 6x EV/EBITDA and mark its associates to market with a 20% discount to account for their share-price variability.

# Note – Management does not provide analysts’ briefings for quarterly business updates.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

Netflix Inc. - Pricing power on display

Netflix Inc. - Pricing power on display Keppel DC REIT - DXC settlement offers partial relief from uncollected rents

Keppel DC REIT - DXC settlement offers partial relief from uncollected rents Apr 19th - Things to Know Before the Opening Bell

Apr 19th - Things to Know Before the Opening Bell Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY)