SGX - Stock Analyst Research

| Target Price* | 10.53 |

| Recommendation | ACCUMULATE› ACCUMULATE |

| Market Cap* | - |

| Publication Date | 5 Feb 2024 |

*At the time of publication

Singapore Exchange Limited - FICC revenue support growth

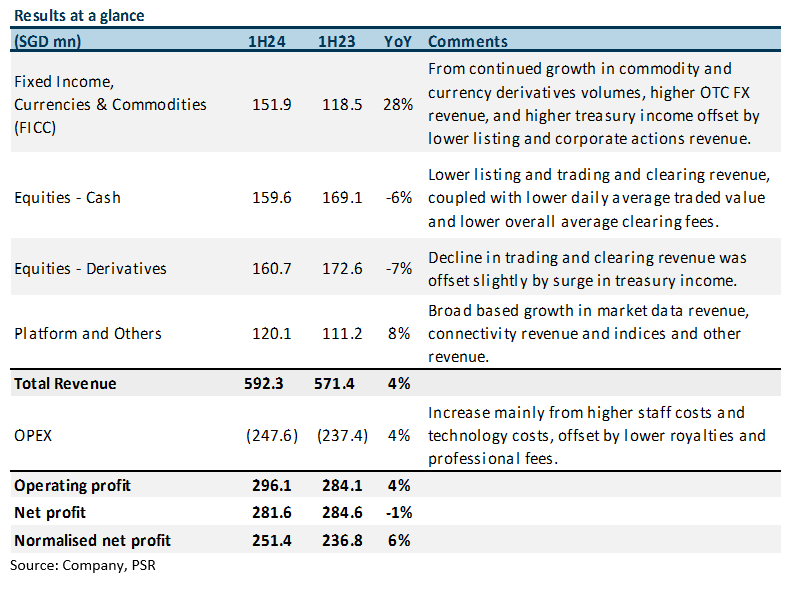

- 1HFY24 revenue of S$592mn was slightly below our estimates, at 45% of FY24e, while adjusted PATMI of S$251mn was below our estimates, at 42% of FY24e. The variance came from higher-than-expected FICC revenue offset by lower Equities – Cash and Equities – Derivatives revenue. 1HFY24 DPS increased by 6% to 17 cents (1HFY23: 16 cents).

- Treasury income surged 47% YoY to S$67mn for 1H24, mainly due to higher average yields on margin deposits, partially offset by a decrease in margin balances.

- FICC grew 28% YoY, led by continued growth in commodity and currency derivatives volumes, higher OTC FX revenue, and higher treasury income. Equities revenue fell due to a decline in trading and clearing, and listing revenue, offset slightly by higher treasury income.

- We downgrade to ACCUMULATE with a lower target price of S$10.53 (prev. S$11.71). We lower FY24e earnings by 3% as we lower Equities – Cash and Derivatives revenue estimates and lower total OPEX estimates for FY24e. Our target price is pegged to -1SD of its 5-year mean or 19.4x P/E (Figure 1). Catalysts include continued growth from OTC FX business pillars, and continued high treasury income due to the higher-for-longer interest rates.

The Positives

+ Treasury income continues to climb. 1H24 total treasury income on collateral balances held in trust surged 47% YoY to S$67mn from 1H23’s treasury income of S$47mn. The increase was mainly due to higher average yields on margin deposits, partially offset by a decrease in margin balances. However, this was lower than the record high of S$90mn reached in 2H23. Notably, 1H24’s treasury income contributed 20% to PBT, similar to the contribution in full-year FY23.

+ FICC – Currency and commodities surges. FICC – Currency and commodities trading and clearing revenue surged 30% YoY to S$148mn in 1H24, as volumes increased in commodity and currency derivatives, primarily from iron ore futures (up 49% YoY in 1H24) and USD/CNH FX futures; as well as higher contribution from OTC FX. SGX’s OTC FX business average daily volume spiked 46% YoY to US$100.1bn, on target to reach SGX’s FY25 target of US$100bn, and contributed S$40.9mn, or 7%, to 1H24 revenue. The increase was primarily due to higher volumes in currency swaps from clients managing interest rate risks.

+ Platform and Others revenue rose 8% YoY. Platform and Others revenue accounted for 20.3% (1H23: 19.5%) of total revenue and grew 8% YoY to S$120mn in 1H24. Market data revenue rose 10% YoY, driven by higher revenue realised from Securities and Derivatives Market Direct Feed subscribers, as well as growth in distribution of Commodities data, while connectivity revenue grew 9% YoY, mainly due to higher revenue from co-location subscribers. Indices and other revenue increased 7% YoY mainly from higher revenue contribution from Energy Market Company and Indices.

The Negatives

– Listing revenue continues decline. FICC – Fixed Income revenue fell 8% YoY in 1H24, dragged down by lower listing revenue. There were 489 bond listings raising S$132bn in 1H24 (2H22: 449 bond listings raised S$104bn). On Cash equities, revenue was 6% lower YoY in 1H24 mainly due to listing revenue declining 3% YoY and trading and clearing revenue falling 14% YoY as daily average traded value, total traded value, and overall average clearing fees fell. Overall, equities revenue accounted for 54% (1H23: 60%) of revenue and fell 6% YoY to S$320mn in 1H24.

– Derivatives volume and fees dip. Total equity derivatives volumes dipped 14% YoY in 1H24, as volumes of GIFT Nifty and FTSE China A50 index futures contracts declined. The average fee per contract for Equity, Currency, and Commodity derivatives was lower at $1.54 in 1H24 (1H23: $1.58) mainly driven by a decline in the average fee of Nifty 50 index futures, due to the reclassification of National Stock Exchange of India fee arrangement from expense to revenue as part of GIFT Connect. Nonetheless, on a pro forma basis, the 1H24 average fee per contract rose slightly to $1.54 (1H23: $1.53).

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

Apr 19th - Things to Know Before the Opening Bell

Apr 19th - Things to Know Before the Opening Bell Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY) Trade of the Day - Singapore Airlines (SGX: C6L)

Trade of the Day - Singapore Airlines (SGX: C6L) Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)

Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)