Singapore Exchange Limited - Competition for SGX’s FTSE China A50 contract

24 Aug 2021- Hong Kong Exchanges and Clearing Limited (0388 HK, Not Rated) (HKEX) will be launching the MSCI China A50 Connect Index in October this year, filling a gap in cross-border finance.

- This new derivative would plug a gap in financial instruments and regulations linking Mainland China with Hong Kong, potentially diverting volumes from SGX.

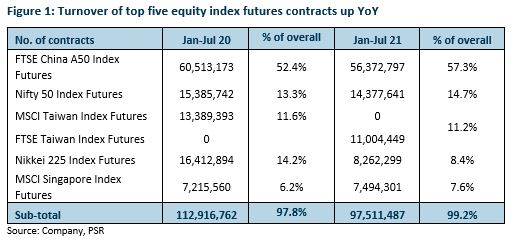

- FTSE China A50 Index Futures has the largest turnover of equity index futures for the SGX, accounting for 57.3% of its total equity index futures. We estimate that it contributed 20% to its overall derivatives revenue and 10% to its overall revenue in FY21.

- Maintain NEUTRAL with lower TP of S$10.78, from S$11.54. FY22e earnings reduced by 6.1% as we factor in lower volumes for FTSE China A50 contracts. Our TP remain pegged to 25x FY22e P/E, +2SD of its 5-year mean.

The news

HKEX has announced that it will launch a financial derivative in October this year for investors to hedge their risks of investments in China’s A-share market following green light from Hong Kong’s Securities and Futures Commission. HKEX has agreed with the MSCI to launch a US-dollar futures contract based on the MSCI China A50 Connect Index. This index tracks the performance of the 50 key Shanghai and Shenzhen stocks available via the Stock Connect.

The new derivative would help to plug a gap in the financial instruments and regulations that link China with Hong Kong, where the Shanghai-Hong Kong Stock Connect handles about HK$5bn a day in cross-border transactions. The A-share futures will enable offshore investors to hedge risks by taking contrarian positions to their underlying assets.

The Negatives

– Direct competition with FTSE China A50 Index Futures. The MSCI China A50 Connect Index Futures could divert trading volume away from the FTSE China A50 Index Futures on the SGX. This is the only A share futures available for offshore investors to date. The FTSE China A50 Index Futures has the largest turnover of equity index futures for the SGX, accounting for 57.3% of total equity index futures traded, up from 52.4% last year (Figure 1). Even though SGX does not provide a revenue for its China A50 contract, we estimate it contributed about 20% to its overall derivatives revenue and 10% to its overall revenue in FY21.

China’s importance in the global investment market is growing. The country’s weighting in the MSCI Emerging Markets Index increased from 18% at the end of December 2009 to 34% in August 2021. We believe growing demand for A-share futures will help to compensate for some of the volume that could be diverted to the HKEX’s MSCI China contract.

Moreover, SGX’s transition away from the MSCI to FTSE’s suite of products could potentially enhance client’s stickiness. We have seen this for its Taiwan index futures. The previous launch of a non-China related equity derivatives product by HKEX had a limited impact on SGX’s derivatives volume, as it was able to migrate to the FTSE product suite and maintain its leadership in Taiwan index contracts.

Outlook

Continued development of multi-assets to anchor long-term growth. SGX remains committed to expanding its suite of products through strategic partnerships and new product development for newly-acquired businesses.

Investing for medium term. SGX has guided for FY22 expenses of S$565-575mn, an 8.6% increase from FY21 at the mid-point. More than 50% of the increase will be for near-term investments. These include setting up FX ECN, climate-related initiatives and continued investments in BidFX and Scientific Beta.

Investment Actions

Maintain NEUTRAL with lower TP of S$10.78, from S$11.54. Our TP is still pegged to +2SD of its 5-year mean or 25x P/E (Figure 3). FY22e earnings have been reduced by 6.1% as we factor in lower volumes for its FTSE China A50 contracts. We believe the near-term impact could be cushioned by the usual adoption time of 3-5 years by global investors for the new MSCI China

About the author

Terence Chua

Senior Research Analyst

Phillip Securities Research

Terence specialises in the consumer, conglomerate and industrials sector. He has over five years of experience as an analyst in the buy- and sell-side. As an institutional fund management analyst, he sat on the China-Hong Kong desk. Terence was ranked top 3 for Best Analyst under the small caps and energy category in the Asia Money poll 2018.

He graduated from the Singapore Management University with a major in Finance (Honours), and is the honoured recipient of the CFA scholarship.

About the author

Terence Chua

Senior Research Analyst

Phillip Securities Research

Terence specialises in the consumer, conglomerate and industrials sector. He has over five years of experience as an analyst in the buy- and sell-side. As an institutional fund management analyst, he sat on the China-Hong Kong desk. Terence was ranked top 3 for Best Analyst under the small caps and energy category in the Asia Money poll 2018.

He graduated from the Singapore Management University with a major in Finance (Honours), and is the honoured recipient of the CFA scholarship.

NikkoAM-StraitsTrading Asia ex Japan REIT ETF - Resilient dividends despite rate hikes

NikkoAM-StraitsTrading Asia ex Japan REIT ETF - Resilient dividends despite rate hikes Netflix Inc. - Pricing power on display

Netflix Inc. - Pricing power on display Keppel DC REIT - DXC settlement offers partial relief from uncollected rents

Keppel DC REIT - DXC settlement offers partial relief from uncollected rents Apr 19th - Things to Know Before the Opening Bell

Apr 19th - Things to Know Before the Opening Bell