Singapore Exchange Limited - Growth led by newly acquired businesses

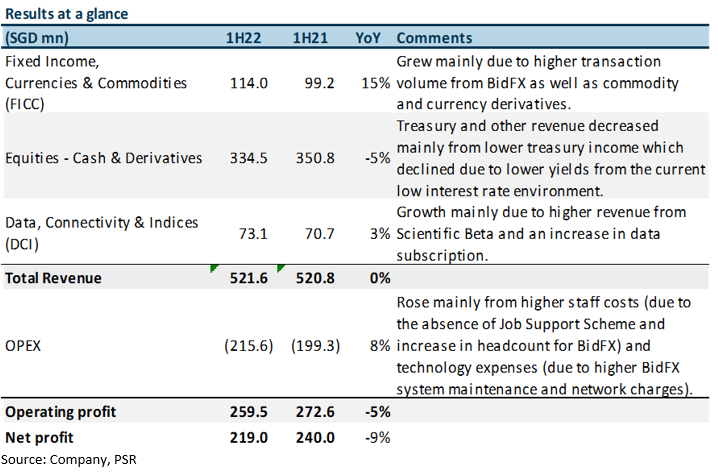

14 Feb 2022- 1HFY22 revenue was slightly below our estimates, at 44% of FY22e, while earnings met our estimates, at 50% of our FY22e. Variance came from lower-than-expected equity and FICC revenue.

- FICC and DCI grew 15%/3% YoY, led by newly acquired businesses, BidFX and Scientific Beta, respectively.

- Excluding treasury income, revenue was up 6% YoY, lifted by higher trading and clearing revenues from equity derivatives, currencies, and commodities.

- Lower yields dragged down equity derivatives treasury income. Equities – Cash & Derivatives was 5% lower YoY as equity derivatives volume declined 4%.

- Maintain NEUTRAL with unchanged target price of S$10.78. Our TP is pegged to 25x FY22e P/E, +2SD of its 5-year mean. Catalysts include continued growth from new acquisitions and higher treasury income as economic conditions improve.

The Positives

+ New businesses accelerated growth. Newly acquired BidFX and Scientific Beta contributed S$40mn, or 8%, to 1H22 revenue, which is 20% higher YoY. Consequently, FICC and DCI grew 15% and 3% YoY respectively to mitigate Equities – Cash & Derivatives revenue decline. Both businesses are expected to remain growth engines for SGX, with opportunities from cross-selling and new client acquisitions on the back of customer access to an enlarged trading network.

+ Underlying business resilient. Excluding treasury income, revenue grew 6% YoY, lifted by higher trading and clearing revenues from equity derivatives, currencies, and commodities. Treasury and other revenue income dropped as treasury income was affected by lower yields from low interest rates.

+ FTSE China A50 contract showed growth. Despite the introduction of HKEX’s MSCI China A50 Connect Index in Oct 2021, SGX’s FTSE China A50 contract saw increased volume, with open interest growing at more than 10% between Oct and Dec 2021. SGX expects trading activity and open interest of the FTSE China A50 contract to continue growing as the international A-share market expands.

The Negatives

– Lower yields drag equity derivatives treasury income. Equities – Cash & Derivatives was 5% lower YoY as equity derivatives volume declined 4%. This was mitigated by higher fees per contract of S$1.50 in 1H22, 18% higher YoY and in line with our expectations as introductory fees in 1H21 tapered off. 1H22 treasury and other revenue declined 46% YoY mainly from lower treasury income, which declined primarily due to lower yield. Nonetheless, this is expected to recover with rising interest rates, with SGX’s management mentioning that the low treasury income is to remain for the following months, with only an uptick expected later in the year.

Outlook

Continued development of multi-assets to anchor long-term growth. SGX remains committed to expanding its suite of products through strategic partnerships and new product development for newly acquired businesses.

Investing for medium term. SGX has guided FY22 expenses of S$565m-575mn, an 8.6% increase from FY21 at the mid-point. More than 50% of the increase will be for near-term investments. These include setting up FX ECN, climate-related initiatives and continued investments in BidFX and Scientific Beta. However, this guidance includes expenses for Maxxtrader, which was previously not included in their earlier guidance. With that, SGX expects FY22 expenses to remain flat or marginally higher compared with FY20’s pre-acquisition expense of S$475mn.

Rising interest rates. Apart from the banks, SGX is another beneficiary of higher interest rates. As at 2H21, SGX reported a S$12bn float from collateral and S$72mn of interest income which represents 13% of FY21 operating profit. Based on our calculations, a 25 basis point rate hike would mean an increase of S$30mn in operating profit (or a 6% uplift).

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

Apr 25th - Things to Know Before the Opening Bell

Apr 25th - Things to Know Before the Opening Bell JPMorgan Chase & Co - NII continues to rise, guidance maintained

JPMorgan Chase & Co - NII continues to rise, guidance maintained Trade of the Day - NVIDIA Corporation (NASDAQ: NVDA)

Trade of the Day - NVIDIA Corporation (NASDAQ: NVDA) Trade of the Day - Applied Materials, Inc. (NASDAQ: AMAT)

Trade of the Day - Applied Materials, Inc. (NASDAQ: AMAT)