Block Inc - Booming Cash App business

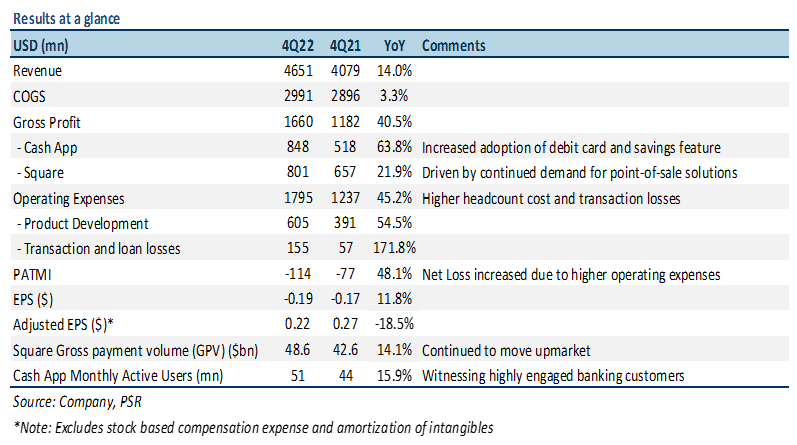

2 Mar 2023- FY22 revenue was in line with expectations at 100% of our forecasts, but net loss was worse than expected at 108% of our FY22 forecasts due to higher loan losses. 4Q22 revenue grew 14% YoY (33% YoY ex-bitcoin) to US$4.7bn driven by strong momentum across the Cash App division.

- Cash App division gross profit grew by 64% YoY reflecting a 16% YoY surge in monthly active users (MAUs) to 51mn. Spending per active user was driven by Cash App debit card and new savings feature. Square division gross profit and gross payment volume (GPV) increased by 22% YoY and 14% YoY, respectively, with continued demand for its point-of-sale solutions.

- We upgrade to ACCUMULATE with a raised DCF target price of US$91.00 (prev. US$70.00) using a WACC of 7.1% and terminal growth rate of 4%. We lower our FY23e revenue by 1% to reflect lower consumer discretionary spending, and we increase our net loss forecasts by 100% to reflect higher expenses. However, we model a net positive working capital position of US$66mn in FY23e that should help drive the company’s FCF generation. We believe Block is well-positioned to benefit from its robust platform of consumer banking services, resurgence of in-person activities, and ongoing shift to cashless payments.

The Positives

+ Cash App demand remained strong. In 4Q22, Block’s consumer-facing Cash App division reported revenue growth of 12% YoY to US$2.9bn (73% YoY ex-bitcoin) and gross profit growth of 64% YoY to US$848mn. This was mainly driven by strength in Cash App debit card, instant deposit activity, and new savings feature. Cash App’s monthly active users (MAUs) grew 16% YoY to 51mn, with two out of three of those active users transacting on a weekly basis.

+ Square segment remained resilient. In 4Q22, Square division (point-of-sale merchant business) revenue grew by 19% YoY to US$1.8bn and gross profit grew by 22% YoY to US$801mn. The growth was driven by a 14% YoY surge in Square Gross Payment Volume (GPV) to US$48.6bn and increased origination volumes of Square Loans. Mid-market sellers (merchants that generate annualized GPV of >US$500K) accounted for 39% of Square GPV and continued to remain the fastest-growing seller segment.

The Negative

– Operating expenses growth to slow, but still growing faster than revenue. Operating expenses for 4Q22 grew 45% YoY to US$1.8bn. Expenses growth was driven primarily due to higher headcount cost and loan losses. Losses increased due to the surge in volumes on Square loans and losses related to the buy-now-pay-later platform. However, total operating expenses growth did slow in 4Q22 compared with the first three quarters of FY22 (70% YoY growth in 1Q22, 66% in 2Q22, and 46% in 3Q22). Management remains committed to slowing expense growth in FY23e driven by measured hiring, real estate consolidation, and careful marketing spend across both Square and Cash App divisions. Net loss for 4Q22 was US$114mn, with FY22 net loss at US$541mn.

Apr 25th - Things to Know Before the Opening Bell

Apr 25th - Things to Know Before the Opening Bell JPMorgan Chase & Co - NII continues to rise, guidance maintained

JPMorgan Chase & Co - NII continues to rise, guidance maintained Trade of the Day - NVIDIA Corporation (NASDAQ: NVDA)

Trade of the Day - NVIDIA Corporation (NASDAQ: NVDA) Trade of the Day - Applied Materials, Inc. (NASDAQ: AMAT)

Trade of the Day - Applied Materials, Inc. (NASDAQ: AMAT)