StarHub - Stock Analyst Research

| Target Price* | 1.29 |

| Recommendation | ACCUMULATE› ACCUMULATE |

| Market Cap* | - |

| Publication Date | 14 Feb 2024 |

*At the time of publication

StarHub Limited - Pop in dividends

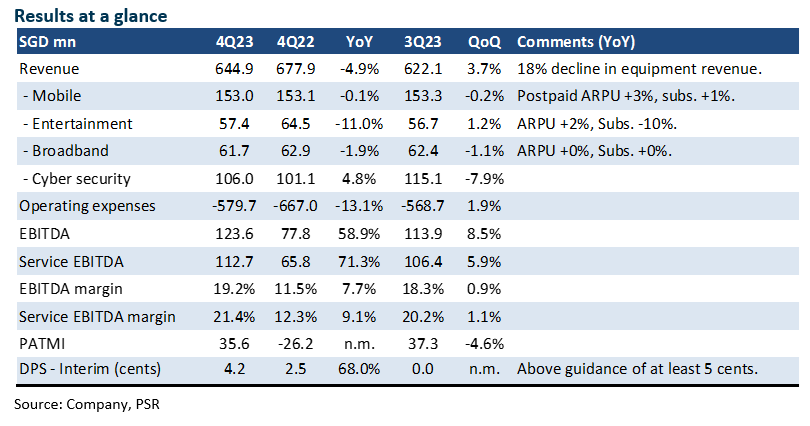

- 4Q23 results were within expectations. FY23 revenue and EBITDA were 99%/101% of our FY23 estimates. The full-year dividend was 6.7 cents, a 34% YoY rise and ahead of our 5 cents estimate.

- Revenue guidance for FY24e was for weaker growth of 1-3% (FY23: +5.5%). We believe mobile revenue faces stiffer competition from lower-end price plans, thus impeding ARPU growth despite contributions from higher-margin roaming revenue.

- The increase in FY24e dividend guidance from 5 cents to at least 6 cents has placed a minimum yield of at least 5% at the current price. Our target price is raised from S$1.21 to S$1.29 as we roll over our earnings to FY24e. We peg valuation to 6.5x FY24e EV/EBITDA, in line with other mobile peers. It will be another year of investment and slow growth for StarHub with its DARE+ initiative. The expected spend is S$80mn in FY24e, of which S$32mn is opex and S$48mn capex. Any premium valuations (or re-rating) for StarHub will depend on the efficiency and revenue gains from DARE+. This is elusive so far. Another catalyst will be monetisation or operating leverage at Ensign, the cybersecurity operations.

The Positives

+ Jump in dividends supported by FCF. The final dividend was 4.2 cents, up 68% YoY. Full-year dividend payout was 80%. It aligns with management guidance to distribute at least 80% of earnings or 5 cents, whichever is higher. The company mentioned it generated a free cash flow (FCF) of S$186mn, sufficient to cover the S$115mn in dividends. However, we believe lease payments of S$37mn should be deducted from FCF as it is operating in nature.

The Negative

– Slower services revenue. Service revenue declined 1.4% YoY in 4Q23 to S$527mn, the first decline in two years. Most segments were weak. Despite roaming revenue, mobile ARPU only rose 3% YoY to S$33. Entertainment revenue declined due to the absence of World Cup 4Q22. ARPU for broadband was flat YoY at S$34 as competition is accelerating ahead of the entry of Simba, the fourth mobile operator.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

NikkoAM-StraitsTrading Asia ex Japan REIT ETF - Resilient dividends despite rate hikes

NikkoAM-StraitsTrading Asia ex Japan REIT ETF - Resilient dividends despite rate hikes Netflix Inc. - Pricing power on display

Netflix Inc. - Pricing power on display Keppel DC REIT - DXC settlement offers partial relief from uncollected rents

Keppel DC REIT - DXC settlement offers partial relief from uncollected rents Apr 19th - Things to Know Before the Opening Bell

Apr 19th - Things to Know Before the Opening Bell